Emerging insurer, Integrity Life, has highlighted its Care Support Package initiative as an example of the way in which it is seeking to disrupt and advance the Australian life insurance sector.

Designed to ‘walk the talk’ of its customer focus mantra, this package provides policy holders access to nine ancillary benefits, one of which is a Terminal Illness Care benefit.

“What this means is we will pay a benefit for up to 30 days where palliative care is required to prevent, reduce, manage or ease pain and we will pay this benefit whether palliative care is provided in home, hospice or other location that provides palliative care,” said Integrity Life’s General Manager Distribution, Suzie Brown.

The insurer also pointed out that while the federal, state and territory governments fund a range of palliative care services, sometimes individuals may need to contribute to their own costs of care, where some examples include:

- Hiring specialised equipment for use at home

- Paying for medicines

- Paying for your own nursing staff if you choose to stay at home and require 24-hour assistance

- Paying an excess if you have health insurance that covers palliative care and you go to a private hospital

- Using respite services that charge a fee

- Paying the fee of a private allied health professional, such as a psychologist, that isn’t fully covered by Medicare

- Paying for complementary therapies, such as massage therapy and acupuncture

Brown maintains the industry has largely addressed situations where an insured person has been on a long-term income protection claim by continuing to pay IP benefits until the person needs to move into palliative care, at which point they switch to a ‘bed-confinement benefit’ and the income protection benefits cease:

…Our benefit has been designed to pay both IP and the Terminal Illness Care benefit at the same time

“Our benefit has been designed to pay both IP and the Terminal Illness Care benefit at the same time,” said Brown, who emphasised the insurer’s Terminal Illness Care benefit is designed to assist in these circumstances as well as to assist family members in visiting the insured person, the costs of which may not be covered under other typical insurance benefits, such as accommodation benefits.

“This benefit is paid due to the circumstance and not based on a particular ‘financial loss’,” she said, who noted this means the benefit can be used in any way that will help the individual in their unique personal circumstance.

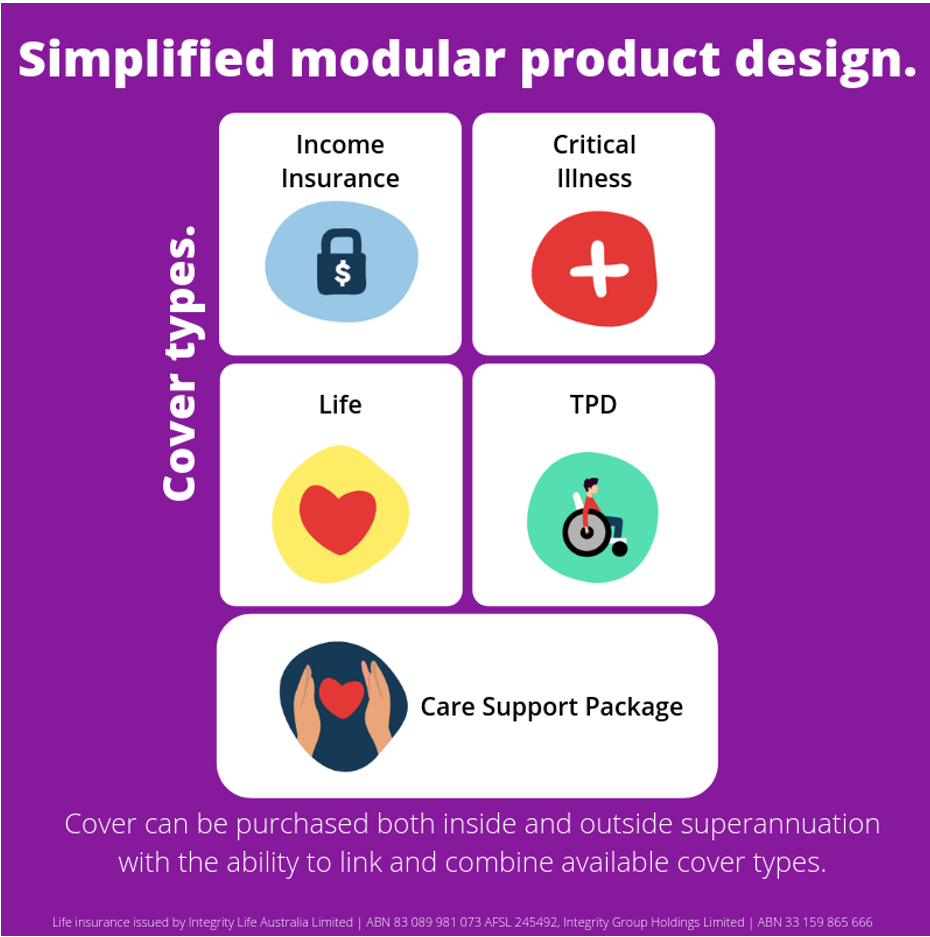

In emphasising the very real impact that a terminal illness has on an individual and their family and how its care support package is intended to provide benefits which support death in a way that empowers and provides choice, the insurer produced this simplified modular design representation of its offer: