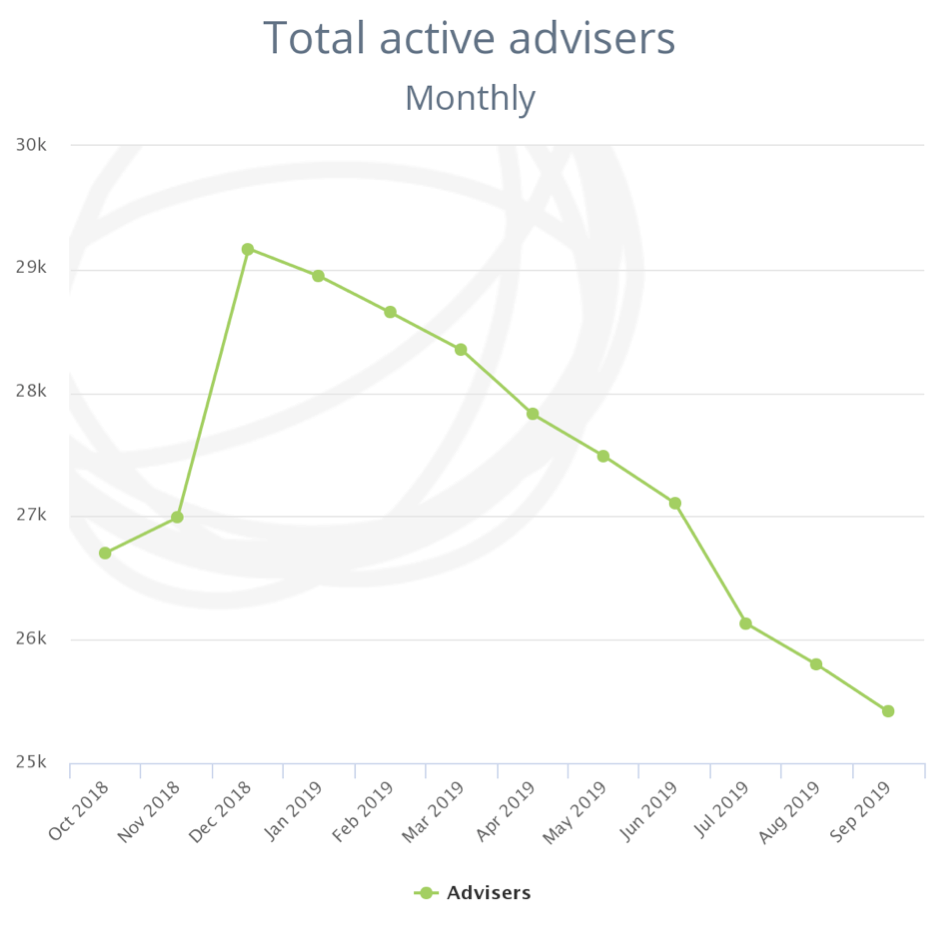

Recent findings by Beddoes Institute indicate that whilst the decline in adviser numbers throughout 2017/18 was mainly among non-life insurance advisers, 2019 has seen the exit rate of both life and non-life advisers reach similar levels.

These findings stem from new analysis by Beddoes* which has revealed adviser numbers are declining by approximately 15 per day in 2019.

Compounding these findings, according to Beddoes, is the fact that there are few new entrants into the industry, and just as concerning is the discovery that 64 per cent of advisers exiting possess over a decade of industry experience.

According to Dr Rebecca Sheils, Director at Beddoes Institute, the sheer rate of exits, which far surpass the number of industry entrants, has the potential to create a substantial memory gap: “This memory gap has the potential to result in a loss of expertise and revenue that may take the industry years to recover from,” warned Dr Sheils.

The Beddoes research suggested much of the adviser exodus this year can be attributed to the new ASIC requirements of an approved degree, a professional year, an exam and the requirement to adhere to a code of ethics.

“Based on the data and general rhetoric surrounding the new professional standards, it seems that advisers who’ve built their livelihoods in this industry might be slightly wary – perhaps not only of re-treading old pathways with regards to training, but also of feeling like they have to metaphorically rebuild themselves to be able to remain in the same professional space they’ve embodied for years,” says Dr Sheils.

Whilst creation of continuous learning will benefit the advice industry moving forward, Dr Sheils questions whether there is a better way forward than making well-established and experienced advisers reinvent their professional standards wheel.

Have your say on how insurers can best support you by completing the Beddoes’ Adviser Experience Study. This Study has been in the market for 10 years and has supported insurers by providing adviser feedback on the services they offer to support you as a business, as well as your clients throughout the life of their policy. It also underpins the Client Service Team Awards (Claims, BDM and Underwriting Teams of the Year) that are part of the AFA Life Company of the Year Awards suite, as well as the inaugural Most Valued BDM of the Year Award. Simply complete the survey to receive access to over $3000 worth of business resources and potential eligibility to join Beddoes’ Most Trusted Advisers (MTA) Network. Click here to learn more and register:

https://tess.beddoes.com.au/adviser_registrations/new?source=risk_info

The data is clear and is screaming out, thank you to Dr Sheils for drawing attention to the facts and explaining the very troubling but potentially avoidable consequences. The question is can we get Anyone to really listen – before it is too late?

its too late for so so many

That research should send a pretty clear message!

Unfortunately those now making the rules don’t care. Josh Frydenburgh wants to make a name for himself as treasurer and doesn’t care what harm it will do to consumers and those working in the financial services industry.

Many if not most who have built relationships over a lifetime and their businesses will be cast on the scrap heap like a pair of old shoes., for what purpose ?

Apart from destroying of the value of many businesses,… was it too sensitive an issue to include the suggested 17 suicides as a result of this governments agenda ?

Dr Shiels, despite your obvious findings, do you think ANYONE will take notice of your research ?

I know from experience a good number of advisers could be described as either members of, donators to, or just plain camp followers of the Liberal Party. Its a natural for small businessmen.

Before the last election many of those folks told me that Mr Shorten would be worse for advisers than Mr Frydenberg, in terms of regulation and “reform”. Yet it is the latter who dismissed the Crown Solicitors advice accepted by Shorten on GC. When pressed for the basis of that support, the union super funds came up for mention by most advisers I quizzed.

We have now had a former Minister and a current Treasurer, both with past employment connections to NAB, who have let the dogs in into the yard to maul advisers. I no longer believe the ALP, if it ever returns to power, will be any worse than the self-proclaimed “party of small business”

I challenge those advisers to look at the benefits of being attached by umbilical cord to a party and to a Government that is blowing up our industry, and once again, favoring the banks over small business independent advisers and the people employed in those businesses

I wrote to Josh by email 3 times and no response. he wont respond unless you are in electorate

Comments are closed.