Adviser Ratings has reported a 70 percent increase in the number of advisers moving between licensees in the last quarter, as overall adviser numbers fell by another three percent. However, the research also revealed a new trend of advisers returning to the sector.

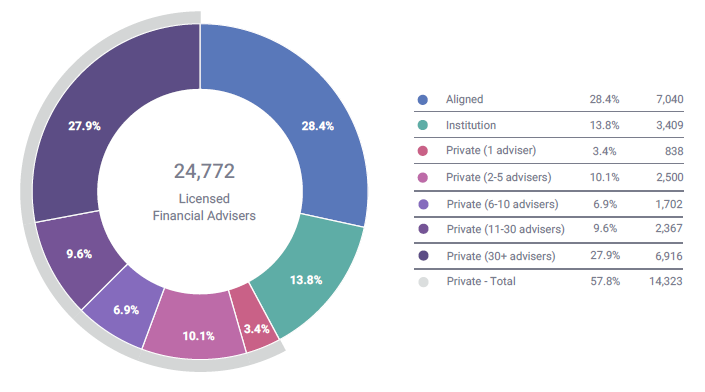

These are some of the key findings in the research firm’s ‘Musical Chairs Report‘ for the September quarter 2019, which revealed the number of ASIC-registered advisers dropped to 24,772 during the quarter, down from 25,470 at the end of June.

Reflecting the growth of private licensee firms, the research also found:

- For the first time, more than 20 percent of the industry (5,040 individuals) is represented by advisers in licensees with ten or less authorised representatives

- Nearly ten percent of advisers are in private licensees with 11-30 authorised representatives

- Private licensees with 30 or more advisers grew further and remains the largest segment of private licensees, with almost 28 percent (6,916) of all advisers in the industry

- Though the largest single segment of advisers is still nominally the aligned adviser segment, with 28.4 percent (7,040) advisers, its numbers have decreased by over 30 percent since the start of the year

The research firm noted that, while advisers have maintained their preference for private licensees as a destination of choice over institutional and aligned licensees, they have a somewhat restricted choice, given the extent of institutional restructuring at present.

New Trend of ‘Returning Advisers’

While this detailed research confirmed what many would assume to be the outcome of the rationalisation currently taking place in the institutional and aligned advice space, the research has also revealed a new trend – that of ‘ceased advisers’ renewing their licence in the last quarter.

The difference …is accounted for by hundreds of advisers transitioning back into advice land after being previously ceased

The financial advice data and rating agency reported there were 949 ceased advisers in the September quarter, and while still a high number, this was well down on the 1,750 advisers who ceased during the June quarter:

“The difference between the 949 ceased adviser number and the overall reduction …of 698 is accounted for by hundreds of advisers transitioning back into advice land after being previously ceased,” noted the report, which added that many of the advisers who ceased their authorisations in Q2 were re-licensed in Q3, which helped reduce the overall drain of advisers from the industry.

Interestingly, the agency also highlighted there were only ten ‘brand new’ advisers who registered during the third quarter this year.

Advisers can click here to access the full Q3 Musical Chairs Report summary released by Adviser Ratings, which details a broad array of key industry trends and other information.

The fact there were only 10 new advisers is predictable.

It is too restrictive employing new advisers and all the pressure, cost and risk is on practice owners who are already struggling with declining revenues and increasing red tape.

The exodus of advisers has slowed with the extension of the FASEA time frames, though the issues are still there and the decline of existing advisers will continue unless there is an overhaul of the LIF fiasco.

I understand the numbers exiting will further increase at potentially, like a hockey stick. All going through look back etc incurring delays. Some dealer groups are making it so hard. Also AMP writing to hundreds but now giving them a month extension.

And don’t believe the jargon from the Private Licensees that – unlike the aligned ones – they ‘won’t stand in your way’ if you want to leave them & join another [in my case] boutique Licensee. My Licensee of over 15 years made it near on impossible for me to move to the new Licensee. Although ASIC only requires them to hold soft copies of client files for the immediate past 7 years – mine demanded soft copies of all my client files going back to 1987!

The extension of the FASEA timeline enabled me to look for a longer exit strategy [from the industry – by end of 2021] that helped me financially. But only the boutique Licensee could facilitate this process, yet my long standing association with my current Licensee meant nothing to them!

It’s. number game for the big Licensees and be damned if they’re going to let ARs go easily, thus diminishing their ‘head count’ and weakening their ‘position’ in the market place.

Have to use a pseudonym here to avoid any backlash.

Comments are closed.