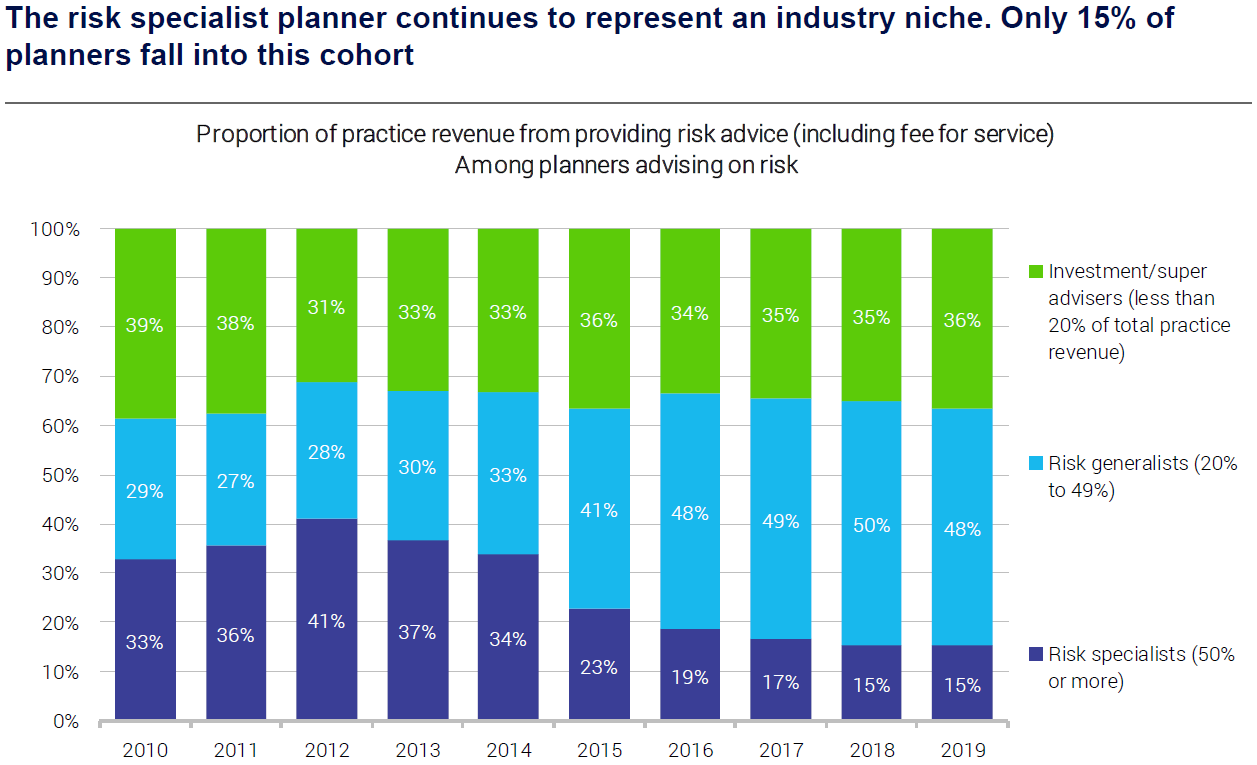

Risk specialist advisers are becoming an ‘industry niche’, according to latest research released by Investment Trends.

This is one of the key findings published in the research firm’s comprehensive 2019 Planner Risk Report, released this week.

According to Investment Trends Senior Analyst, King Loong Choi, only 15% of planners derive over 50% of their total practice revenue from providing risk advice, down significantly from 34% five years ago. He maintains that financial planners continue to regard life insurance advice as a key component of their proposition but many are looking to broaden their advice services – as reflected in the dwindling number of those who he categorises as ‘risk specialists’:

“As more planners seek to diversify their advice proposition, the risk specialist planner has become an industry niche,” he said.

He also noted that the top two challenges that prevent financial planners from growing their insurance advice services are:

- The admin burden of compliance and paperwork

- An uncertain regulatory landscape

Emergence of New Insurers

Another key finding coming out of the 2019 Planner Risk Report is what Investment Trends characterises as strong interest by advisers in new, less established insurers.

In reporting that non-bank propositions TAL, AIA Australia, Zurich and MLC Life Insurance have been the most successful at extending their planner relationships over the last year, the 2019 report also noted 28% of advisers say they intend to start using a new insurer in the next 12 months, with the new, less established insurer brands such as NEOS Life, Integrity Life and MetLife leading in planner perceptions.

ClearView Tops Satisfaction Ratings

Investment Trends reports overall adviser satisfaction with retail life insurers has improved markedly over the last 12 months, with 57% of financial planners rating their main insurer as ‘very good’, compared to 48% in 2018.

Of the retail insurers, ClearView emerged on top in the 2019 report for overall adviser satisfaction – the third consecutive year it has done so.

According to the Investment Trends data, ClearView led satisfaction rankings in 18 out of the 31 categories measured. The top three life insurers in 2019 by overall planner satisfaction are:

- ClearView

- OnePath

- Zurich

so why is this any surprise? This was always going to happen.. just another example of unintended consequences of relentless reform!

George you are correct, but it never was “reform”. The bank dominated FSC proposed LIF as a “consumer benefit” when it was really about helping the banks dress up their “old mutton”( Comminsure, MLC, One Path) as “new lamb” for the Japanese market, with a government backed lessening of distribution costs.

If you want to know why O’Dwyer speared us with FASEA, read the list of bank sponsors. FASEA is designed to squash small independent advice firms, and suits ASIC’s long held desire to reduce the number of licencees to facilitate less expensive regulation.

Mat Comyn is already talking about robo advice, and anyone who thinks the banks have totally departed from insurance and investment advice are just blind idiots.

All of this endorsed by a “small business friendly” Coalition government.

A way that the numbers of specialist risk writers will increase, is to make the Retail Life Industry viable and allow Financial Planning firms to split their Business model and be able to employ risk advisers as a stand alone Business within the practice.

The only way this will work, is to throw FASEA requirements onto the scrap heap for risk advisers and allow them to focus on Insurance studies without the noose that is currently strangling Risk advisers to the point where they cannot operate their Businesses profitably or effectively.

The other noose, is the Life Companies have seemed to forget that they promised to pay commission on premiums paid.

That promise has been reneged, as the Life Companies are not going to pay commission on Policy fees which can be up to $100 a year, modal loadings which are up to 8% and stamp duty which in states like Victoria are 10%.

The Government said advisers would get 60%, so as an Industry, we must demand we get it, or as we have said many times, it becomes unviable to operate in the Insurance field.

Last but not least, the 2 year responsibility against advisers, with nil responsibility against Insurers who continue to jack up premiums at higher than 10% pa, based on age increases, is not acceptable.

The Government and the Life Companies keep saying ALL AUSTRALIANS require help and advise, so put your money and actions where your mouths are and start doing the right thing, so the Retail Life Industry can survive and all Australians can be given the right to attain advice.

Given the high number of practices that continue to charge for advice with a % of FUA model, and the massive rise in share markets over the last 5 years, no wonder the % of total practice revenue from risk has fallen. The basis for the claim by Investment trends that the number of risks specialists has more than halved is flawed. I suspect its true that there are less ‘risk specialists’ but this is an exaggeration. A true ‘risk specialist’ must surely get at least 75% of their revenue from risk??

Specialist risk writers have looked at the numbers and they don’t add up to the fable being bandied around.

If we take a closer look at the commission effective 1/1/2020, supposedly, advise practices will be paid 60% in year one for all the work.

WRONG.

Assuming a $1,000 premium, the guru’s are telling the world the commission is $600.

The real truth is that the commission is way less than 60%.

$1,000 – $90 policy fee – $80 modal loading – $50 stamp duty = $780 x 60% = $468

By magic the stated 60% has shrunk to 46.8%.

Considering that the cost to do Business in the insane over regulated, red tape world we live in today, is a minimum $3,000, this means the minimum premium a client would need to pay to cover a risk practices costs would be around $5,800.

What are we supposed to tell a person who desperately needs advice, though can only afford $50 a week to cover Insurance premiums?

The end result of all the Government intervention, is a much worse position for all Australians when it comes to their Life and disability needs.

So much for Best Interest Duty.

you are spot on.. what hope do we have when ASIC and media simply do not understand what is involved in providing advice. Our industry has let us down in explaining this to the general public

As an ‘old’ 100% risk adviser what constantly bemuses me is the FPs out there charging thousands in fees and NOT rebating risk commissions. Saw one last month where FP charged over $5k in fees and earned $7k in risk commissions. Didn’t even disclose the monthly premium costs in his SoA. I worked it out from his commission disclosure what the premiums must’ve been. Client had no idea!! Blind leading the blind.

Comments are closed.