- Agree (85%)

- Disagree (9%)

- Not sure (6%)

At the end of a sometimes bruising year for risk-focussed advisers and advice businesses, we’re keen to establish your outlook as you enter the New Year.

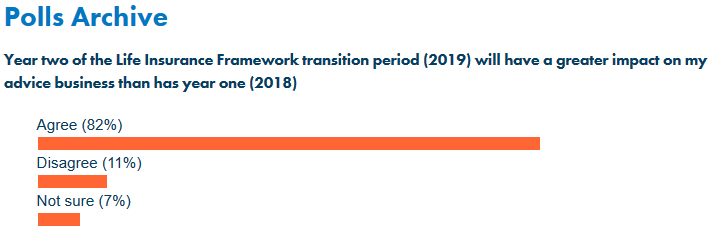

Twelve months ago, the prospect of moving from 88 percent to a new cap of 77 percent upfront commissions for life insurance advice solutions under the Life Insurance Framework remuneration reforms saw 82 percent of advisers indicate they felt they were in for a tougher year:

Does the same outlook apply twelve months on, as advisers now move into the capped 66 percent upfront commission era?

We appreciate there are a host of other issues impacting the future outlook for many advisers, including the prospect of sitting and passing the FASEA adviser exam, the end to grandfathered investment and super commissions, the implementation of the FASEA Code of Ethics and the roll-out of the new minimum adviser education standards.

In isolation, however, will the move from 77 percent upfront to a maximum 66 percent upfront commission be the straw that will break the camel’s back? Or if you’ve come this far, will you be in a position to accommodate the extra ten percent upfront cap reduction within your advice business model?

To reflect that the financial advice community is facing challenging times is an understatement, as the winds of regulatory change continue to circle around the sector.

So, where are you right now, when it comes to maintaining a sustainable life insurance advice proposition?

Tell us what you think and we’ll report back to you on the other side of the festive season…

The industry is dying and they are just hammering in the last nail, when will they wake up and see that the decline in life new business and increase in cancellations are directly linked to the fact that advisers that SOLD risk insurance just can’t afford to write it anymore and are leaving the industry.

Agree Mark. One other problem is that the govt and the regulators see the number of advisers not exiting the industry and foolishly believe they will keep the industry (life industry in particular) moving ahead. What they don’t realise is that of those who remain as advisers, most will not write new business for all of the reasons stated, they will simply live off their trail. Life companies are now showing their support for maintaining commissions following the reduction in new business over the last two years. Because new business will further reduce significantly in 2020 – and we all know it will – I believe the Life companies will make an even greater effort in their support of commissions. I am going to repeat what I’ve said in a number of past editions of Riskinfo – all Life companies, the AFA, FPA and dealer groups, must go to the govt collectively and make them understand what has happened – even pointing out that this mess began with ASIC’s flawed audit in October 2014 – and what must happen if the Life insurance industry is to survive, i.e. reinstate comissions to at least 80/20, rid the industry of this evil 2 year clawback and abolish this ridiculous FASEA imposition of a degree on all advisers. NOTHING less will be accepted by advisers!

It isn’t solely the LIF that is making life impossible for risk writers. It is compliance and regulation that is the big killer. I have never yet had a client on claim or their survivors tell me that the claimant held too much insurance, yet I now have to justify every dollar of a sum insured. With many primary producers as clients, I am yet to find a single person who can tell me how these would ever pass the ASIC affordability test, yet they have millions of dollars of assets to protect should they die or be seriously disabled.

2020 will see further decreases in New Business.

2021 will see a greater exodus of advisers.

2022 will see the complete collapse of the Retail Life Insurance Industry.

OR;

The Life Companies and the Associations will finally get their act together and in the New Year start taking on what Advice Practices have been telling them for years and start properly relaying to the Government, that what Australia is facing is unprecedented and unless there is immediate change, then the Industry will collapse.

It is ironic that like magic, a Government entity can bring about immediate change that will be a major detriment to all Australians, yet the Government is incapable of making positive changes that will reverse the chaos and absolute disgraceful position we face now.

Government are supposed to represent all Australians.

What we have seen, is the complete opposite.

FACT – No-one cares what happens to us advisers anymore! The Government, ASIC, FASEA or life insurance insurance company’s….none of them.

I can’t work out why they can’t see what’s going to happen or why they aren’t smart enough to see how all these changes completely stuffed life insurance industries in other countries – but they obviously aren’t.

I’m not smart enough to work out what ‘end-game’ it is that they’re all conspiring towards but what I do know is I can’t stick it out much longer. It’s just not viable.

I’m saddened because I love helping clients at their worst times in life. That’s being taken away from me and my clients by people who quite clearly, only care about themselves and their own filthy greed. It’s disgustingly wrong on so many levels but I’ve lost the fight now.

I can’t survive on 66% (less GST, less Licensee costs) with all the compliance BS, 2-year responsibility periods, further education requirements and increasing fees for this and that. There’s 12 years down the drain.

Comments are closed.