The AFA says legal firm, Maurice Blackburn, has jumped to a range of conclusions in relation to the data contained in the most recent release of APRA’s life insurance claims and disputes statistics (click here).

In offering an alternative view, AFA GM, Policy and Professionalism, Phil Anderson, took aim at the Maurice Blackburn statement (attributed to the firm’s Superannuation and Insurance Principal, Josh Mennen), for drawing a conclusion about the relative value of life insurance advice delivered by financial advisers, by relying on and interpreting a single statistic as the determining factor in its argument.

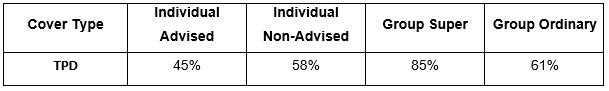

The key statistic cited in the Maurice Blackburn statement relates to the claims paid ratio for TPD cover. This ratio represents the dollar amount of claims paid out in the reporting period as a percentage of the annual premiums receivable during the same period. The TPD data referred to by Mennen is taken from the report’s Table 2:

According to Mennen, the APRA report “…has some very compelling data that makes clear that group insurance through super remains a crucial product that delivers significantly greater value for consumers than other policies, including those supposedly tailored by financial advisors.”

Mennen references the TPD data from Table 2 in support of his argument, which he reinforces by highlighting the dispute rate differential between group super and individually advised disability income insurance claims. He states:

“This reinforces that while advisor-sold policies are often marketed as a bespoke product, too often they are compromised by conflicts of interest, including insurers paying trailing commissions that result in poor product selection and claim disputes caused by underwriting complications.”

Characterising these and other statements in the legal firm’s release as uninformed, Anderson says the statement is directly at odds with a comment made by APRA in its report, in which it urges caution in interpreting the information presented in Table 2 as a measure of consumer value.

Countering the Maurice Blackburn line, Anderson points to other data such as the average benefit paid statistics, also sourced from the APRA data, according to Anderson, which paints another picture:

Anderson: “In our view, the most meaningful measure of value for clients in life insurance is what the client or their family receives in the event of a life insurance event and how this aligns with their actual needs.”

He continues, “The average claim benefits demonstrate very clearly that those clients who receive specific tailored life insurance advice from a financial adviser receive a benefit far more relevant to their circumstances and their household debt and living costs. This clearly demonstrates significantly more value for financial advice clients,” says Anderson.

Anderson adds that Maurice Blackburn has sought to utilise the claims paid ratio (Table2) as the sole determining factor of value. While he concedes this is certainly a useful measure for all product types, he says it is not a complete measure in two important ways:

- It does not include all costs that clients experience

- It does not take into account the [relative] complexity of the product

Adviser response

Also supporting the argument for the value of advice and financial advisers, Australian Financial Risk Management’s Victorian Director, Rob Vitnell, has released a response in which he says he is astounded by the lack of evidence used by Mennen to justify his statements.

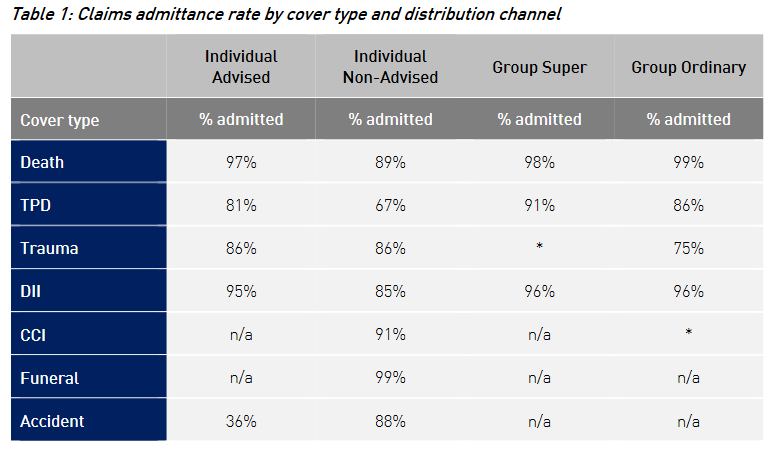

Vitnell points to other data in APRA’s claims reporting dating back to the first half of 2017, which reveals only a very small variance between individually-advised and group claims outcomes across all product types except TPD:

He says what the Maurice Blackburn statement holds out to be compelling data, therefore, is utterly baseless:

“Put simply, good advice leads to good claims outcomes,” concludes Vitnell.

Click here to read the statement released last week by Maurice Blackburn.

…And click here for the full AFA statement made by Anderson, as your measured comments are welcome.

It is very easy for Lawyers, plus other vested interest groups, to interpret data and the direction they wish the conversation to head.

This is especially so when percentages are used as the benchmark.

For instance, there is an argument that 50% of income protection claims are not paid, if the basis of the research was calculated on 2 claims and one was paid.

The AFA have looked past mere percentages and focused on the most important part of any claim, which is, how much does the claimant receive.

There has always been a major problem with the actual amount of money claimants receive and of course if the person receives $123,191 after being Totally and Permanently Disabled in a Group policy, compared to $482,271 from an advised policy, it would be an interesting survey to ask every person who is now uninsurable and desperate for money, if they are happier with the lower amount.

How data is collated, can determine interpretation, which leads to fanciful tales.

I’ve come across one case where a lawyer was looking into commuting a long-term IP claim, just so they could have their fee paid. Others where IP claims were ignored for an individual, choosing to work on the claim for their TPD benefit alone, because fees are easier collected from lump sum payments. That’s right, they did nothing on the IP claim!!! Sorry, and the financial planning industry has an ethics problem???

It is really important as an industry we value insurance (group & retail) – so that more Australians are protected.

Stakeholders involved in claims – customers, financial advisers, trustees and insurers can all share examples where lawyer involvement in the claim process has added little value.

Surely, they can’t all be wrong!

Lawyers……what would they know about the value of advice??? Their so call advice and service model are based entirely on monetary exchange, where a client has more money (than those less fortunate) than their likely chance of winning a case is absolute certain (either rightly or wrongly) regardless of the law system.

Why did God invent lawyers? So used car salesmen had something to look down on! Having been forced into utilising the services of a criminal [for my son], then contract [for me] & finally family lawyer [my son] I can categorically state as follows –

Any lawyer that states we have a conflict of interest is calling the kettle black! $45,000 in total lawyer fees paid between 2018 and 2020 for a total estimate of 40 hours worked or one week. That’s $1200 an hour! What benefits were derived – I lost $200,000 I’d loaned in good faith to my son & his now ex-wife. The contracts lawyer was probably the least monetarily invasive. She likely earned her money.

[Name deleted – Editor] are the bottom of the pile – the original ambulance chasers before the likes of [Name deleted – Editor] came along. I trust them as far as I could throw one – that’s 35,000 feet out of a plane without a parachute.

The reason 2 of my clients got paid their IP benefits this year was solely due to MY involvement.

Comments are closed.