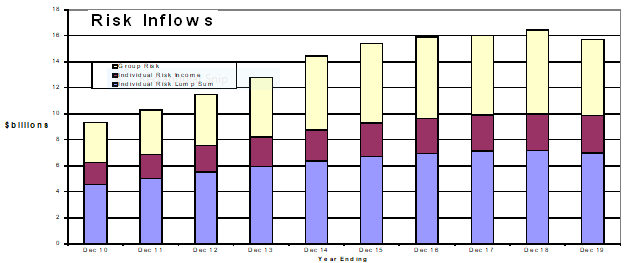

After a decades-long history of increases, overall risk inflows declined slightly in 2019 dropping by 4.5 percent year on year, according to Plan for Life’s Life Insurance Risk Premium Inflows and Sales for the year ended December 2019 report.

Plan for Life says during 2019 life insurance risk market inflows fell from $16.5 billion to $15.7 billion.

(Also see Retail Risk Sales Continue to Head South covering the September 2019 year.)

In the individual risk lump sum market (term life, total and permanent disablement and trauma insurance) PFL says premium inflows decreased slightly in 2019, down 2 percent.

“Market leader TAL (0.5 percent) reported little change while most of the rest were lower although MLC (2.5 percent) and … ClearView (5.2 percent) managed to report a couple of modest increases.”

It says reported individual risk lump sum sales dropped significantly by 20.2 percent compared to 2018.

“Virtually all the participants active in this sub-market experienced substantial double digit percentage falls however going against this general trend MLC (11.6 percent) managed to record higher annual sales.”

PFL says the individual risk lump sum insurance market has for many years been impacted by activity in the housing market which remains a significant source of new business.

In the individual risk income market (income protection or sickness and accident and business expenses insurance) PFL says year on year inflows were flat “… increasing by just a marginal 0.3 percent. ClearView (15.1 percent), MLC (4.8 percent), Zurich (2.0 percent) reported higher individual risk income inflows in 2019 while most of the rest were little changed”.

The report says too that new premium sales fell 14.6 percent in 2019.

But year on year MLC reported significantly increased sales of 68.3 percent while BT/Westpac (-1.1 percent) was fairly flat. “On the other hand individual risk income sales of all of the other companies were lower with some down very substantially.”

PFL says the individual risk income insurance market is affected by both price and the profitability of the small business sector. This market supports small businesses and professionals by providing income replacement insurance in the event of sickness or accident.

This would be a shock to no one, if anything I’m surprised they didn’t decrease last year.

It will get worse There is too much time required for very minimal income compared to effort required to chase up new clients. Not to mention that minimal income you have used to pay your rent and staff is still at “ jeopardy “ or being lost for the next two years

The landlords not going to give you the rent back or your staff their wages if it is lost ! Even if it’s due to no fault of yours !

Advisers provide the “lions” share of new business and if they keep leaving at the rate they are that just complicates it even more

The only reason why Clearview has seen an increase is because they keep jacking up IP premiums ( a lot more than other insurers)

Comments are closed.