Industry contraction experienced over the past year has slowed, according to the Adviser Ratings Adviser Musical Chairs Report for the first quarter of 2020.

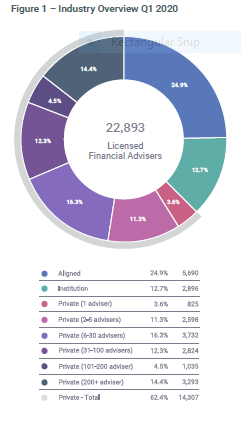

The report, which looks at financial adviser movements, says that by the end of Q1 2020, the adviser population had reduced to 22,893. This represents a net decline of 678 advisers (2.9 percent) from end 2019 but on a pro-rated basis, this is 25 percent below the overall adviser reduction (16 percent) experienced last year.

“With the economic impacts from the pandemic mostly post March, it will be interesting to see how this affects adviser intentions in coming months,” the report says.

The report notes that “the pain and suffering of small advice businesses” already struggling with several factors may prompt higher attrition from the industry. It says these include:

- Commercial pressures in part from regulatory overload

- Compounded by work-from-home inefficiencies

- Client financial distress brought on by Covid-19.

…a huge spike in demand for guidance …could become the saviour of some advice businesses…

“Balancing that, the industry including super funds are reporting a huge spike in demand for guidance around issues like early release of superannuation that could become the saviour of some advice businesses.

“Whether this Covid-19 inspired demand can postpone, or reverse, adviser decisions around exiting or switching licensees remains to be seen,” the report says.

It adds that the preliminary results from the first few weeks in April points to a further marked slow-down in adviser movements, “although we caution reading too much into this because ASIC as-reported data for this period still needs conditioning”.

Another point highlighted is that 81 percent of the 197 licensees shut down in last 12 months had only one financial adviser.

Adviser Ratings says the adviser exits from the industry, and the continued long-run trend of the radical mass privatisation of the licensee market “…ensures that the institutionally owned and aligned sectors have shrunk even further in absolute terms, falling by a combined 595 advisers over the last quarter, now representing only 8,586 advisers or 37.6 percent of the total market (down from 39 percent at end 2019)”.

“The privately owned sector has also shrunk in absolute terms by 1,452 advisers and nine percent over the past 15 months since the industry peak in December 2018, although at a considerably slower rate than for the overall industry (reduced by 5,128 advisers and 18 percent).

“Nevertheless, considerable activity is occurring here as advisers continue their merry-go-around of movement between privately owned licensees,” it states.

Flight To Safety

Adviser Ratings also notes that in these economically challenging times “…we are likely to see a flight-to-safety as advisers favour licensees with greater scale and stronger balance sheets.

“For many, this ‘safe haven’ may be quite appealing for those from institutional backgrounds who have since experienced the white-knuckle ride of their own self-licensed boutique. Having said that, these same licensees will be judged by how they leverage that scale to support advisers with services that help them grow their business and manage compliance.”

The report adds that arguably, this flight-to-safety theme was already emerging through the worst of the regulatory-driven disruption in 2019.

“While too early to tell from the Q1 2020 numbers, we anticipate a growth over time in the volume of advisers gravitating to the largest privately owned licensees.

“Of course, the stronger licensees must be prepared to accept more advisers; there are reports that some licensees have reached a self-determined capacity, or are being extremely selective in any incremental growth,” the report says.

The slow down is only temporary.

It gives the appearance that the foot has been taken off the accelerator.

Nothing could be further than the truth.

No one is buying unless they can dictate the price after picking and choosing.

No one is selling because the obvious market forces of supply and demand are dictating lower values than sellers think their book is worth.

As soon as it’s known how many survive the adviser exam and 16,000 are still out there, watch the exodus of advisers wanting out.

The next tranche to leave will come at around 2024- 2025.

Deakin University is touting for business which would suggest not many are committed to doing the bridging courses or doing another degree.

Comments are closed.