Some SMEs in financial and insurance services may be struggling with significant cash flow issues as payment times blow out, data from CreditorWatch indicates.

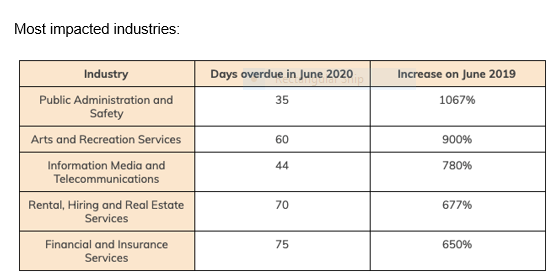

A media release from the digital credit agency includes data which shows that in the financial and insurance services sector June payments were overdue by an average of 75 days, 650 percent higher than the June 2019 figure.

CreditorWatch says its new data shows an increasing number of Australian SMEs are delaying entering into administration, instead remaining propped up by Government support.

While it points to a 20 percent decrease in the number of SMEs entering into administration from May to June (and 50 percent fewer than in June 2019) along with decreases in court actions and payments defaults, the agency says policy makers should be concerned.

Patrick Coghlan, CEO of CreditorWatch, says that while at first glance, a decrease in business administrations, court actions and defaults seems to indicate a rebounding economy, when it took a deeper look “…it’s clear that trouble is brewing and that businesses are struggling with significant cash flow issues”.

He says payment delays give the game away. Payments in June were overdue by an average of 49 days across all industries, 342 percent higher than the June 2019 figure.

The financial and insurance services sector was highlighted in the media release as one of the most impacted industries.

Amongst the other industries highlighted was arts and recreation services (up 900 percent) and retail (up 367 percent) suggesting, says CreditorWatch, that behind the scenes SMEs are struggling to make ends meet.

Coghlan says that Government stimulus packages have provided businesses with a buffer of protection. Until now, the priority has been to keep as many businesses as possible above water.

“Come September however, support packages will be lifted and we’ll find that a substantial number of ‘zombie businesses’ have been kept artificially afloat. Banks will not be prepared to prop up unviable companies and nor should taxpayers, however, the government can ease the impending insolvency curve by lifting Safe Harbour measures gradually and forming an administration service to support the industry,” he says.