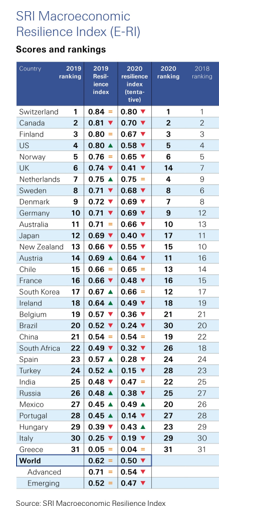

Covid-19 is expected to weaken world economic resilience by nearly 20 percent in 2020 as countries’ fiscal and monetary headroom is depleted, Swiss Re Institute’s annual Macroeconomic Resilience Index shows.

It also found that the combined insurance protection gap for mortality, health and natural disaster risks is calculated as reaching a new high of US$1.24 trillion.

The reinsurer says in a statement that among major economies, resilience in the UK, Japan and the US may be hardest hit, but they should still rank higher than many European countries.

…Switzerland, Finland and Canada remain the world’s three most resilient countries…

Switzerland, Finland and Canada remain the world’s three most resilient countries, reflecting their comprehensive economic strength against future crises.

Swiss Re says that global economic resilience held up in 2019 compared with 2018, but the world entered the Covid-19 crisis with less shock-absorbing capacity than before the global financial crisis of 2008-09. The Swiss Re Institute Macroeconomic Resilience Index (E-RI) for the world stood at 0.62 in 2019, against 0.61 in 2018.

It says that Government responses to Covid-19 are expected to significantly lower global economic resilience this year. The world index value drops to 0.5 in the initial estimate for 2020, which aims to capture the impact of the fiscal and monetary stimulus in response to Covid-19 on economic resilience.

While such stimulus packages have cushioned the blow to the global economy, they have run down many countries’ fiscal and monetary reserves. This has caused their resilience scores to fall, including drops of more than half in some economies, the E-RI found.

Insurance Resilience Against Three Major Risks

The statement also highlights that insurance resilience against three major risks – mortality, health spending and natural catastrophes – weakened in 2019, the indices show.

It says the combined global protection gap for the three perils is calculated as reaching a new high of US$1.24 trillion.

“Globally, mortality resilience declined the most, driven by a widening of the mortality protection gap in the Asia-Pacific region, where China’s protection gap expanded due to rapidly growing household debt.”

It says that health resilience was stable despite some deterioration in emerging markets. The global health protection gap widened by more than five percent to US$588 billion.

Natural catastrophe resilience was lowest of the three risk areas. Swiss Re Institute expects that health and mortality protection gaps will widen as households grapple with lower incomes, higher healthcare costs and the financial consequences of losing a breadwinner as a result of the pandemic.

“The widening global protection gap is a huge opportunity for insurers to fulfil their mandate as risk absorbers and improve societal resilience,” Jerome Jean Haegeli, Group Chief Economist at Swiss Re, says.

“In times of crisis, households need risk protection. Insurance is a key tool to help households reduce their financial vulnerability in disruptive environments.”