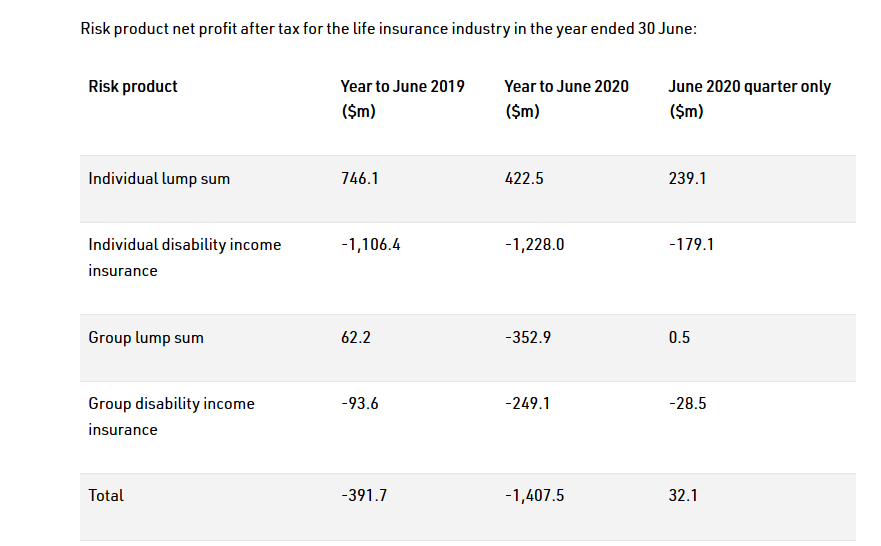

Risk products reported a combined after-tax loss of $1.4 billion, for the 12 months to June 2020, APRA’s Quarterly Life Insurance Performance Statistics for the June quarter show.

A statement from the authority says that within risk products, Individual Lump Sum (LS) is the only category reporting a profit in the 12 months to June 2020.

“Individual Disability Income Insurance (DII) has made a substantial loss of $1.2 billion during the year, primarily driven by reserve strengthening as adverse claims experience persists. Group LS and DII have also deteriorated this year reporting a $353 million and $249 million loss respectively,” APRA says in its ‘highlights’ analysis of the statistics.

It says that for the year to June 2020, the industry has reported a significant net loss after tax of $1.6 billion ($0.4 billion profit June 2019) and a return on net assets of -6.4 percent (1.8 percent June 2019).

APRA says the deterioration was caused by the persistent poor performance of risk business during the year and large falls in investment revenue mainly from the market volatility impacts of Covid-19 in the March 2020 quarter.

However in the June quarter, the industry has reported a profit of $423 million “… a significant improvement from the two previous periods. This was primarily driven by the pick-up of investment revenue as investment market volatility lessened, as well as the favourable performance of Individual LS risk business”.

Another gloomy quarter of losses for IP results

Meanwhile, the FSC says in a statement that the release of APRA’s quarterly life insurance financial performance statistics, reveals another gloomy quarter of losses for income protection results.

FSC Senior Policy Manager for Life Insurance Nick Kirwan says the [quarterly] results continue to be dominated by higher than expected claims for individual income protection insurance (IP), “…which saw a net loss after tax of $179 million in this product alone, wiping out almost all the profit from other individual product lines.

“These income protection losses were driven by a surge in the number and duration of claims, especially for mental health conditions. We expect mental health claims to increase in the months and years ahead from the effects of the Covid-19 pandemic on the economy, exacerbating people’s isolation and financial hardship.”

He noted that overall, during 2019 life insurance companies paid out $12 billion saying the flip-side of that coin is that these increasing claims are the reason why many Australian households will have noticed increases in their life insurance premiums.

… life insurers must balance the books and remain sustainable …

“ We know premium increases are never welcome, but like any business, life insurers must balance the books and remain sustainable. Premiums coming in must cover the cost of the claims going out.”

He says that looking further ahead, most life insurance companies are busily developing a new generation of simpler, more sustainable income protection policies that focus on covering core needs. These new policies will give customers more choice, and will be all about the three A’s: Availability, Affordability and the Assurance that your life insurance company will be there when needed.

The Insurers are busy developing a new generation of Income Protection policies with the 3 A’s being, Availability, Affordability and Assurance.

The fourth A, being the Advisers who would sell these policies, seems to have been forgotten, which coming from the FSC, is not surprising.

The disconnect from reality that the FSC shows, even after everything they have done, which has led to the chaos all Australians face today, is breathtaking.

Someone may need to remind them that Australians are not inclined to rush out and buy the new iteration of Life and Disability Insurances, as there are other more pressing priorities and Insurance sits low on the list of, to do now jobs.

It will be interesting to see how long it will take for the penny to drop and positive changes will be made so Life Companies can revert back to a sustainable model, though I fear it will be too late for thousands more Advisers who will wither on the vine.

We all know why ? It’s just a pointless issue to keep telling them

We cannot be wrong! we have more letters after our names than brain cells!! egotistical maniacs who cannot see the Forrest for the trees

Frustrating is an understatement

Something is not right in these figures. Ignoring investment market changes (which nobody has control over), how exactly are these losses being brought about? Claims alone cannot be the answer.

If claims are the answer, how much do they vary from the original product actuary’s calculations?

If there is a variance – how often have management addressed this issue? What have the boards been doing while this (apparently obvious) decline in profitability has been occurring?

Who has not been doing their job?

I find it amazing that regulators have looked at this, and decided that the Australian public is better served by reduced cover. Most especially, cover for mental health conditions. Not higher-priced cover, but the complete absence of any ability to obtain that cover.

The result can only be an increased burden on the public purse.

The principles underlying insurance appear to be lost in the maze of management butt-covering.

At no stage has anyone made a viable public statement on this decline of the ability of insurance companies to manage the public pools for which they hold stewardship. Instead, we have regulators deciding on policy product design. The marketplace may be inefficient, but it is rarely the case that government is more efficient.

Comments are closed.