OnePath Life has confirmed premium increases for existing policyholders with IP and TPD cover, effective from this month.

This confirmation of rates increases follows OnePath’s announcement in July of pricing changes for new IP customers.

In an explanatory brochure to its customers, OnePath says that:

- Income protection cover costs will increase by 25 percent

- TPD cover costs will increase by 12.5 percent

The insurer also notes these increases are in addition to any age or CPI increases and that they apply across both stepped and level premium contracts

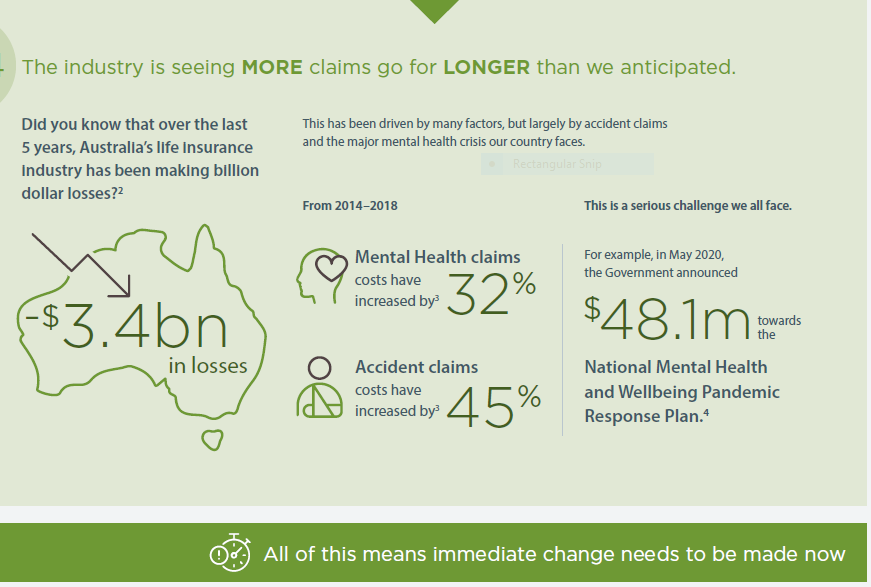

In its message to its customers, OnePath explains that the industry is seeing more claims go for longer than it anticipated, largely driven by accident claims and mental health claims. It states that from 2014 to 2018:

- Accident claims costs have increased by 45 percent

- Mental health claims costs have by increased by 32 percent

OnePath adds that it had been due to review its pricing earlier this year but had “… held off on any increases since March 2020 and have absorbed losses given the challenges Covid-19 has brought us all”.

No insurer is immune

…eight of the largest life insurers in the country have increased their premiums over the last 12 months

The company says that no insurer is immune to having to increase prices. “In fact, eight of the largest life insurers in the country have increased their premiums over the last 12 months.”

It also outlines to customers that their cover is flexible and that there are various options and actions they can take to enable them to manage costs. These include:

- Decreasing the sum insured

- Decreasing the benefit period on the IP policy

- Increasing the waiting period on the IP policy

- Removing any extra-cost options that may not be needed anymore

- Switching from a fully featured cover to a cover with less features

The Life Insurers are responsible for the current situation, in that they allowed their mouthpiece (the FSC) to encourage ASIC to build a false story, based on false data around churn and did nothing to stop the disgraceful antics of all the misleading investigations, including the Hayne Royal Commission, which has led us down this current path.

There is a need for 30,000 specialist risk writers in Australia, though what we have ended up with after all the “improvements,” is a large decline of risk advisers, a decline in New Business, an increase in claims and what does the Industry do to offset this?

They screw their existing loyal clients by increasing the premiums by double digit percentages and then wonder why lapses are increasing.

The solution was already in place prior to all the Regulatory change.

That solution was to leave the good advisers alone and retain what was in place, throw out the handful of rogue advisers and allow the Advice practices to recruit new advisers to continue building the Industry.

This situation can easily be fixed. What we need is for the Government to listen and ACT.

A resounding YEP!

The Life Insurers are responsible for the current situation, in that they allowed their mouthpiece (the FSC) to encourage ASIC to build a false story, based on false data around churn and did nothing to stop the disgraceful antics of all the misleading investigations, including the Hayne Royal Commission, which has led us down this current path.

If you’re losing money, you notice it – I’m sure you have been to the races before, Jeremy. You pretend like commission was a non-issue for advisers. Generally, a policy is expected to placed for 5-10 years given on the insurer pricing horizon, but you want to reinstate 100-120% commissions because of fake news? You think insurers made up stuff to ASIC? On what proof? Do you understand the penalties that would come with that? Adviser commissions is one of the largest financial ponzi schemes in Australian history. What are you smoking?

So yes, insurers have to hold some blame (for paying that much to begin with). But the advisers hands are definitely not clean.

Comments are closed.