The Financial Adviser Standards and Ethics Authority is to be dismantled, with its existing brief of responsibilities split between ASIC and the Treasury.

This announcement was made in a joint statement released by the Federal Treasurer, Josh Frydenberg and Assistant Minister for Financial Services, Superannuation and Financial Technology, Senator Jane Hume.

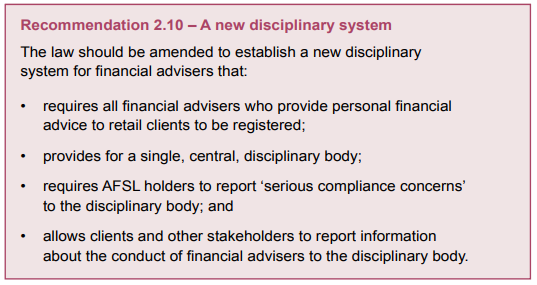

Under the theme of ‘…simplifying the regulatory framework applying to financial advisers’, the release addressed Banking Royal Commission recommendation 2.10, which calls for a single, central disciplinary body to be established for financial advisers.

The Government says it will give effect to this recommendation by expanding the operation of the ASIC-controlled Financial Services and Credit Panel, which currently supports the regulator in the exercise of its regulatory functions with respect to the making of banning orders against individuals for misconduct.

The statement notes that expanding the role of the FSCP will leverage its extensive expertise and existing governance structures, thereby avoiding the need to establish a new body to perform this role.

Consolidating this new function …is also intended to avoid regulatory overlap

Consolidating this new function within ASIC is also intended to “…avoid regulatory overlap and minimise the possibility of multiple investigations by multiple agencies into the same conduct related to the provision of financial advice.”

The Government will move FASEA’s standard-making functions and responsibilities to the Treasury, while it says the remaining elements of the authority’s role, including administering the FASEA Adviser Exam, will be incorporated into the FSCP’s expanded mandate.

these reforms …will further streamline the number of bodies involved in the oversight of financial advisers

In stating these reforms “…will further streamline the number of bodies involved in the oversight of financial advisers,” the Government notes this results in FASEA being wound up.

Legislation that will give effect to these changes is intended to be introduced into Parliament in the first half of 2021.

Summarising this announcement, which also covered other reforms recommended by the Banking Royal Commission, the statement says the Morrison Government is committed to continuing to improve the regulatory framework applying to the financial advice sector and ensuring that Australians can get access to affordable advice to help them plan for their future.

That is a step in the right direction, though ASIC has admitted it has little idea as to why most Australians can no longer afford advice. Treasury has probably less experience and knowledge than ASIC, so the merry go-round will continue, unless the Regulators and the Government acknowledge that irrelevant, time consuming and expensive studies on subjects that Life Insurance advisers will never use, to attain useless Qualifications, is one of the main reasons Advisers have left the Industry in their thousands.

At least the Government is starting to listen. What they now need to do is understand the issues. Only then can we start fixing them.

The first thing that should also be scrapped, is the ridiculous Exam which has continually been shown as a total waste of time and money for experienced advisers who are already struggling under the weight of everything that has occurred in 2020.

This seems like the government doing what it thinks Financial Advisers want without actually consulting with Financial Advisers.

It doesn’t help that the Financial Advice associations can’t work together to put out a few key messages:

1. The governement/ ASIC can, to protect the public, set policy as it affects practice BUT NOT DICTATE PRICE (commission levels through LIF) OR PRODUCT (banning Agreed Level Income Protection).

– The government/ ASIC should stay out of dictating pricing (aka commissions paid by a willing buyer to a willing seller) and let the free market decide comission levels and NOT LIF (Life Insurance Framework).

2. Scrap LIF and let free-market economics between Life Insurance companies and Financial Advisers (their distribution channel) find the price equilibrium. This means allowing each insurer to set their own commissions for upfrtont and trail commissions and observe the Trade Practices Act from preventing insurances companies from acting as a cartel.

– If the government/ ASIC had listened to Financial Advisers who predicted what has eventually transpired rather than the FSC who represent the insurers and banks (who sold their insurance businesses for a lot more because they were able to distort the market by using LIF to reduce the expense line and get a higher multiple for the sale of their insurance businesses), the mess that has ensued with reduced inflows to insurers which has resulted in insurers subsequently crying poor to APRA which has then resulted in APRA making sweeping changes over Dec 2019 with pretty much ZERO consultation with the Financial Advisers (again!!!) and has not benefited the public nor Financial Advisers, would have been avoided!

3. Move Financial Advice into being recognised a profession by having MEANINGFUL AND RELEVANT exams and qualifications – by discussing and listening to Financial Advisers AND NOT ACADEMICS!

4. Have 100% of Financial Advice fees be a tax-deductible expense – this facilitate making financial advice more accessible.

5. A key test for whether someone has received personal advice is whether they have paid at least $1 for the advice. This measure will be accompanied by a public awareness/ education campaign that helps the public understand that if they have not paid at least $1 for personal advice, they have not received personal advice and have therefore only received general advice and do not have any recourse to make a complaint about bad personal advice.

6. A $1,000 refundable bond (which can be reduced if financial hardship can be demonstrated) when making an complaint which will not be refunded if a complaint is found to be frivolous or vexatious complaint – this will stop people from “slinging mud just to see if it sticks” and reduce Professional Indemnity insurances, which will then go a long way towards reducing the cost of advice.

7. Only allow qualified advisers (on ASIC’s Financial Adviser Register) to provide limited/scaled/general advice which will have no compliance burdens

a. This will make education to the public more accessible where the public can also opt to get personal advice (which they will pay at least $1 for) or they can direct an adviser as to following parameters:

i. Amounts of cover for the various types of cover (Life, TPD, Critical Illness/Trauma, Income Protect, Business Insurance, Child Cover)

ii. Structure of premiums – stepped or level premiums

iii. Structure of cover – inside super or outside super

iv. Which insurer they want to have their cover with

b. The safegurard to this measure is that if the qualified adviser is able to see that the client is about to make a very bad choice/choices, the adviser can step in to say that they believe the client should pay to receive advice to get a better outcome and the adviser will inform them of the cost of advice. At that point, the client can still decide not to accept advice and proceed (after they have signed a waiver to say that they have been counselled to pay for advice that they have declined) or they can choose to accept (and pay) for advice which is in their best interest.

c. Having only qualified Financial Advisers providing general advice on Life Insurance will stop banks from re-entering the life insurance sales industry by using call centre telemarketers who are not qualified financial advisers (which is what the FSC are currently pushing) and the qualified Financial Adviser can warn someone in case they are about to make a bad decision.

The way I am reading this, is that while FASEA is being dismantled everything that they put in place (Code of Ethics, Educational Standards, Exam, etc) remains as it is, just administered by another body. I think that this was always going to be the case once the single disciplinary body was formed. I like the concept of the Code of Ethics and educational standards, however how they are being applied does cause me concern. Until these issues become practical and workable, the body monitoring them really is irrelevant.

SNAFU

I also understand that FASEA’s Code of Ethics, their Ethics exam, and the requirement to complete their degree by 2025, all still remain. In that regard, things haven’t really changed. The AFA have pointed out that “disciplinary matters and the oversight of the FASEA Exam will be assigned to the Financial Services and Credit Panel, which is a part of ASIC, and with the standard setting functions within FASEA, to be transferred to the Treasury.” So we will still have TWO regulators administering the FASEA nonsense. If the standard setting functions (and I assume this includes FASEA’s code of ethics) were transferred to ASIC, then one would have hoped that ASIC would absorb them into the existing Safe Harbour steps. But this doesn’t seem to be the case. At the risk of sounding cynical, some see the dismantling of FASEA as a positive move. Only time will tell…

The dismantling is an opportunity to fix a number of problems. Vertical integration and a tight code of ethics can never work together and was the rock on which the FASEA ship foundered.

Now they can either water down the code of ethics so we get another Royal Commission in 5-7 years or they can go after truly conflicted behaviour, in which case only a few of the biggest licensees will have to drastically change their business model.

IF THIS OCCURS, then those valued advisers who have now left the industry will find this is very bitter pill to swallow.

It appears to be a very good step towards saving the life insurance advice industry but the proof will be in the pudding when the dust settles. I still have grave fears about ASIC’s agenda though as they still clearly appear to me to be an organisation with a hidden agenda to run non-aligned advisers out the industry anyway they can, for the benefit of industry superfunds (i.e. ASIC Report 413 – just a totally inaccurate, unjustified and misleading document.)

And how ASIC can say they can’t see how advice has become unaffordable to everyday Aussies, now just proves how out of touch they really are with what’s happening out there as a result of their actions.

The revolt against FASEA was inevitable. It’s not like the industry had standards or ethics to begin with.

Comments are closed.