Data released by DEXX&R in December reveals a continuing decline in discontinuance rates for both lump sum and disability insurance products.

The researcher’s latest Life Analysis Report, reveals the individual lump sum insurance attrition rate fell to 11.2 percent in the year ending September 2020*, down from 13.8 per cent in September 2019 and down from its peak of 15.6 percent in September 2013.

(*DEXX&R defines its attrition rate as representing discontinuances as a percentage of in-force premiums.)

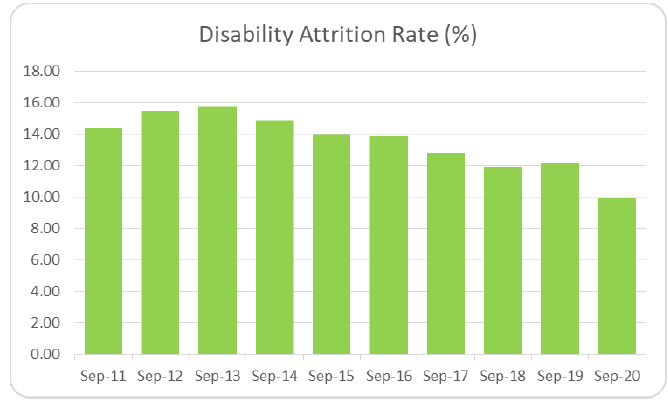

…the attrition rate for disability income insurance business has fallen …to a ten-year low

This latest report also reveals the attrition rate for disability income insurance business has fallen for the seventh consecutive year, dropping to a ten-year low of 9.9 percent in September 2020, down from a high of 15.8 percent in September 2013.

DEXX&R notes this trend indicates that clients are retaining their existing disability income policies at a higher rate than has been the case over the past ten years.

New business sales

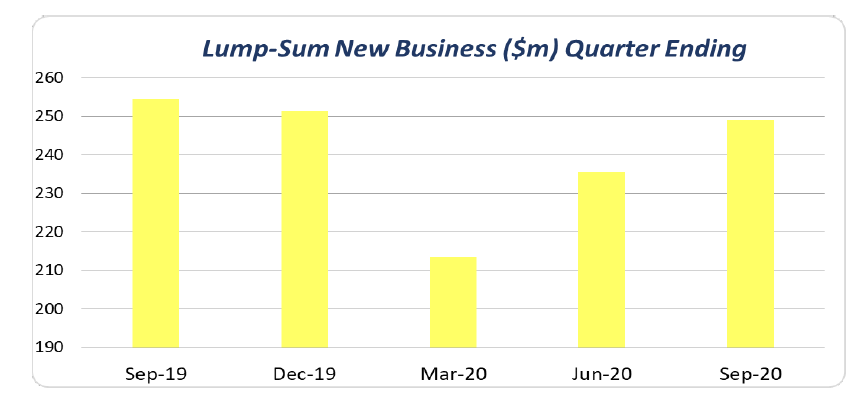

The researcher also reports that lump sum new business fell in the year to September 2020 to $1.0 billion – its lowest level in the past five years.

DEXX&R attributes this decline to ongoing disruption in the advice distribution channel, including:

- The restructuring and transfer of ownership of retail bank owned dealer groups

- A fall in the number of life risk advisers

While new individual lump sum new business sales were down year on year, the researcher also reports a strong increase in sales in the quarter ending September 2020, representing a 5.8 percent increase over the June 2020 quarter results:

Meanwhile, disability income new business fell in the September 2020 quarter and was also down year-on-year from the year ending September 2019, with DEXX&R noting this is the lowest level of new business recorded since the year to September 2011, representing a nine-year low.

DEXX&R says this fall is attributable to:

- Disruption in advice channels

- APRA’s mandated product intervention effective from the end of March 2020.

See also: Pandemic Boost to Life Risk Sales in June Quarter).