While the financial advice sector is expected to experience more change in the short-to-medium term, a new report says the industry is currently in a “unique position” to transform and rebuild itself as a reliable and integral aspect of the future of financial services in Australia…

The Oliver Wyman report, Future of Financial Advice: The Australian Renaissance, says that while some observers have commented on the collapse of the industry, learnings from other markets and industries suggest that the current period represents “an opportunity for rebuilding a sector that better meets customer and regulatory outcomes and is economically sustainable”.

One of the report’s authors, Oliver Wyman partner Angat Sandhu, told Riskinfo that financial advice organisations should reassess how they create more a sustainable sector for themselves and for their customers.

This means a change in the customer experience, in customer management and greater use of customer data.

“Firstly, they must understand their customers better, secondly segment them better and thirdly understand their customers’ needs over time in a more meaningful manner.”

Sandhu said it was important that advisers ask themselves to what extent they actually do understand customers’ needs, not just when they engage with them – but to what extent do they understand their changing needs over time?

“If you sample some customers and ask for feedback, will they be engaged, happy and understand the value you are providing?”

He adds that a practical challenge is that smaller advice firms may not have access to the data or the data infrastructure they need and should look at who they could partner with to help address this issue.

Another challenge for the advice sector is to articulate the value it provides to clients.

In looking at the evolution of the sector in the United Kingdom and the United States the report says the key takeaways for the Australian financial advice market include:

- Regulatory changes and consumer demand for impartial advice will further catalyse the growth of Australia’s IFA sector

- Similar to what has happened in the UK, scalable financial advice models will likely leverage digital technologies to improve the experience offered to customers, while also reducing service costs and compliance burdens

Its market outlook says the broader wealth management market remains in a state of flux with ongoing regulatory reform, changing consumer expectations and the evolving competitive dynamics in the sector. “The exact outlook and timing is uncertain but we expect the market and its participants to evolve in multiple ways.” The market outlook for advisers includes:

- Further consolidation resulting in a small number of larger players dominating the market, with favourable profitability and valuations, and greater opportunities to invest in new technology, attract talent, diversify revenue, and access capital

- Decline in adviser numbers by a further 10 to 15 percent as more tenured advisers exit the industry in the short term

- Rise of the smaller independent financial adviser firms offering specific value propositions as non-conflicted advice becomes more sought after

As to advice models the report points to:

- Greater availability of tiered advice offerings, giving customers greater choice

- Rise of digital direct to consumer and hybrid models to meet the needs of both the affluent and mass segments

The report also highlights potential competition for the IFA sector including:

- Injection of private equity capital into the sector to help professionalise and uplift efficiency

- Industry funds reassessing how they meet their members’ needs particularly as a large proportion of those age and have more complex needs

- The ability of banks in the long term to identify how best to help their large customer bases with broader financial wellness needs that could benefit from “guidance” and “advice” offerings conducted in a low-risk manner

- Accelerated growth in smaller technology enabled start-ups targeting niche, but highly valued, advice offerings that will disrupt the market

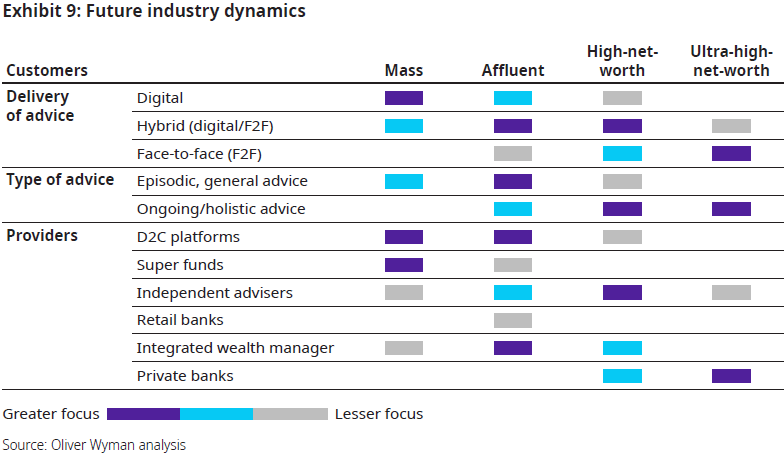

The Oliver Wyman report says it expects the future advice ecosystem to be more targeted for different customer segments, more diverse in terms of industry participants as well as usage of different advice models. The diagram below outlines the evolution of the advice sector expected between now and 2025.

Five actions for financial advisers

Five actions for financial advisers

The report says that rather than a threat, the evolving market structure should be seen as “a significant opportunity for the financial advice sector to reposition itself as necessary and reliable for consumers financial well-being”.

It states that the priority focus of advisers should be to develop ways to restore the trust gap in the short term in order to secure and build from existing client bases, as well as comply with changing regulatory expectations. In parallel, it says, there are five actions to pursue to position successfully in the future sector structure:

Action One: Prioritised Segment Focus

Establish a clear value proposition underpinned by a customer-first mindset; invest in understanding customer needs and re-start the process of transforming their service offerings. Advisers here need to go well beyond the traditional and static “fact-find” process to more holistically understanding their motivations and behaviours and doing so in a dynamic manner over time. “These customer-first capabilities are relatively new to the financial advice sector and will take time and different skillsets to embed.”

Action Two: Stratify Service Offerings

Align service propositions to specific customer segments, selecting priority segments to double down on and being the adviser of choice for those segments. Examples of these could include providing holistic advisory services to specific segments (retirees, young professionals in select industries/sectors, early-stage entrepreneurs etc.). For others, this will involve trying to provide a narrower range of services to a broader customer set. “This can only be effectively done by first better understanding your customer set and subsequently critically assessing where your competitive advantage lies.”

Action Three: Code Data Within DNA

Develop a detailed data footprint about customers at every point of interaction, taking advantage of open-data to enable a better understanding of their ever-evolving needs and so a better alignment of service offerings. “Similar to customer-first, this is another capability that is in its infancy in the financial advice sector but critical for its future success.”

Action Four: Uplift Technological Capabilities

Embrace developments in Regtech across Australia by utilising technology to reduce costs, while simultaneously improving compliance. Similarly, using technology to increase connectivity and engagement with clients, especially in a post- Covid environment.

Action Five: Partner orchestration

Take advantage of technology to orchestrate partnerships across the advice value chain, including integration into digital ecosystems via APIs to enable a seamless customer experience. “This will become critical especially for firms that aim to meet a broader set of customer needs and/or realise there are others that can provide select services at lower cost and better quality,” the report states.

This piece sounds like so many others who’ve spoken on the subject, yet have never been at the coalface experiencing what it’s now like as an adviser, especially in life-risk insurance.

Comments are closed.