In the second of this three-part series, the team at Business Health outline six key observations they have experienced over the last 21 years when it comes to client attributes for advice practices, and they share some great tips – from your peers- for any adviser seeking to optimise the value of their client relationships while in turn building the value of their business…

Observation 1

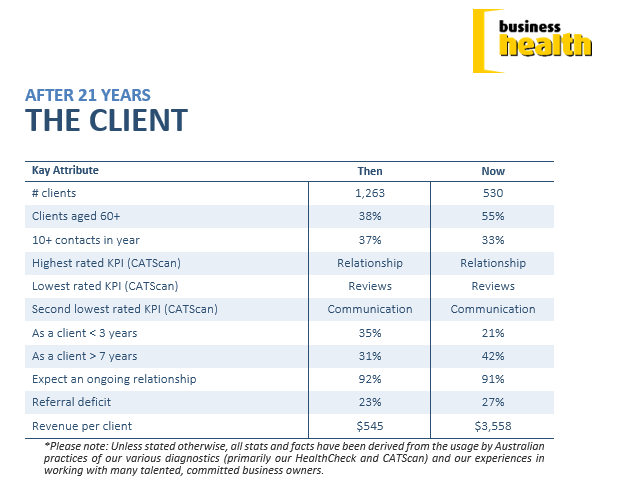

The standout mover has undoubtedly been the dramatic reduction in client numbers over the years. Practices today are serving fewer Australians. How ironic – this reduction is occurring at a time of the greatest wealth transfer in our history, as aging parents (the majority of today’s financial advice clients) look to navigate the vagaries of retirement and pass on their wealth to their children in the most effective way. If ever experienced, professional advice was needed – isn’t it now?

Observation 2

Given the huge reduction in client numbers over the years, it’s encouraging to note the commensurate increase in ‘revenue per client’. Practices have been largely successful in removing transactionally based clients (traditionally funded through grandfathered revenue) without any major ‘hit’ to their bottom line. In doing so, they’ve proven the 80:20 rule.

Observation 3

‘Business Relationship’ has been rated most highly in every year, with the % of clients expressing their intention to maintain an ongoing relationship with their adviser, never dropping below an impressive 90%. When matched with the equally impressive % of clients willing to refer their own adviser, it’s clear to us that ’relationship’ is one of your most valuable assets.

Observation 4

Clients have continually reported that they don’t necessarily ‘enjoy’ their adviser’s review/progress to plan process. The fact that it continues to be the lowest rated of our CATScan indicators, is a source of great frustration for us as we believe that the review provides the opportunity for the adviser to demonstrate their value (for the fees being paid). It is certainly the adviser’s ‘moment of truth’.

Observation 5

At no point in our 20 year history has the level of practices seeking client feedback exceeded one in three. This has meant that somewhere between 60% – 70% of Australian practices have been operating without an objective understanding of how satisfied, or not, their clients were. While this has always been a somewhat misguided approach, it has become even more so, given the somewhat parlous image of our industry this century – GFC, Royal Commission, corporate failures and so on, ring a bell?

Observation 6

The accumulator demographic which has comprised the major portion of the client base for most practices has obviously aged and has seemingly not been supplemented by a younger base. Clients aged 60+ now make up 55% of the clientele – significantly higher than the 38% stat of 2001. They have stayed and they have greyed. And they don’t have the same needs as they once did.

Tips

- Don’t forget your greatest point of difference – your relationship. Here are some of the tips practices, just like yours, have shared with us over the years, to nurture their relationships:

- The key drivers haven’t changed – frequent (10+ times throughout the year), meaningful and customised communication.

- Variety in your communication can be good – mix it up between email, phone and virtual. But at least one ‘in person’ for your ‘A’ clients.

- While being ‘virtual’ will challenge some, it certainly isn’t insurmountable and we suspect that for some clients, it will prove to be an attractive part of your offer. Virtual isn’t going away, make sure your clients don’t!

- Never assume the strength of your relationship, ensure it by regularly seeking feedback from your clients at key ‘trigger’ points – onboarding, after review and on leaving. Allocate responsibility to someone in your practice to be the client advocate and ensure client satisfaction becomes a key performance indicator for them.

- Milestone recognition – say ‘thank you’ to clients who have remained loyal, referred you etc

- You can’t build a deep and meaningful relationship with your clients if you actually don’t know them. What are their life goals, hopes for their children, their favourite sport, preference for meeting times and so on? Collect this type of data, ensure it’s stored on your CRM and refreshed regularly.

- Leverage your plan review process into a genuine, fulfilling experience for your clients:

- In person or virtual, our message is the same – the review is your moment of truth. Grab the opportunity.

- Never defer it.

- If clients are married, ensure both husband and wife proactively participate.

- From the scheduling of the initial appointment through to the final summary – seek the client’s feedback as to what they liked or disliked about their review experience and how it could be improved.

- Proactively manage your ‘revenue per client’ number. This is one of our favourite measures as it directly calls into play the relativity of the practice’s offer to the fees the client is paying. It’s easy to measure, manage and review each year.

- While the metric itself will differ depending upon the business model, the bottom line remains the same – is the practice delivering tangible value commensurate with the fees the client is paying. And is it doing this profitably?

- Implications for pricing models, include:

- Given costs rise regularly, ensure you review your fees accordingly

- Incorporate ‘profitability’, 30%+?

- Fee models:

- Subscription

- General and personal advice

- Event or service driven (scaled?) – example – Centrelink, aged care,

- Retainer

- Minimum level

- Maximum capped

- ?

- Fees are being disclosed and compared through very transparent structures. Regularly ask/answer the question – why should I become, or remain, as a client of yours? What would your staff say?

- This is, in our opinion, the battle ground of this decade – how do you ‘prove’ your value, each and every year?

- The answer will lie in clear, frequent and personalised communication, which goes to not only clients, but also prospects and referral partners.

- Clearly, your website and social media presence have an important role to play here as do testimonials, case studies, videos and events (in person or virtual).

- Where will your new clients come from?

- What’s your ‘referral deficit’. We arrived at this term when we compared the % of clients who said that they were prepared to refer their adviser, to the actual number who had actually referred. Are you asking your clients for referrals in the optimal way?

- Be aware that your clients’ needs are fast changing and they don’t have the same needs as they once did. The implications for practices are clear – revenue will dissipate over time unless you find a way to retain and/or replace it:

- Protection and accumulation imperatives, which were, for many, the primary reasons for seeking out the adviser in the first place, are being replaced by annuity/pension drawdown concerns, while their interests will also have moved to estate planning, aged/health, ethical investing and philanthropy. And succession planning for your SME clients.

- How does your service offer hold up? In-house capability or referral to like-minded professionals?

- How well do you know the children of your best clients? What do they think of you?

Business Health is an independent organisation specialising in customised advice and solutions to the financial services industry…