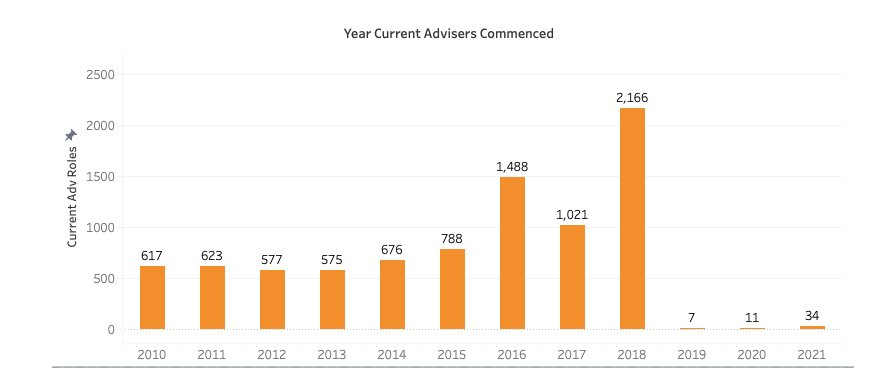

The number of new advisers joining the industry has fallen off a cliff post 2018, according to research services firm Wealth Data.

The firm’s most recent weekly analysis of financial adviser movements considers the year in which current advisers commenced. The analysis reveals that, while 2,166 advisers registered or re-registered in 2018, the next three years saw these numbers plummet:

- 2019 – 7 new advisers

- 2020 – 11 new advisers

- 2021 – 34 new advisers

Wealth Data’s Colin Williams says in his report it can be seen that the number of advisers who are current and in what year they commenced “…basically fell off a cliff post 2018”.

Williams adds that in fairness, this was driven by a surge in 2018 before new FASEA rules came into effect. “For example, we currently have 2,166 adviser roles on the FAR for advisers who commenced in 2018 and only 34 for 2021.”

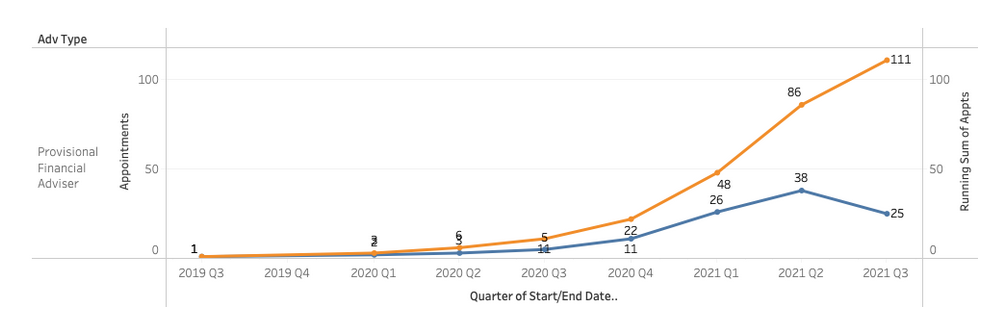

He adds that a running total of provisional adviser* appointments per quarter shows 111 provisional advisers added since mid-2019.

“If we add the total number of new advisers and provisional advisers since 2019 we come to a total of 163 (111 + 7 + 11 +34).”

Williams notes that while this is encouraging, 163 new entrants in a little more than two and a half years is not going to stop the losses.

“For example, if we use a starting point of 19,000 advisers and have a natural attrition (retirements, resignations out of advice, etc) of only four percent, that would equate to a natural loss of 760 advisers in one year.

“To replace 760, we would need to hire much more than 760 to account for the ones who simply don’t make it as an adviser.”

Williams told Riskinfo that while he used the word encouraging, it was in the context of starting off a very low base.

…I think we are now going through a period whereby there are no obvious sectors and individual firms in a position to start new advisers en masse…

“Overall, I think we are now going through a period whereby there are no obvious sectors and individual firms in a position to start new advisers en masse.

He adds that when the dust finally settles he thinks the industry will see a move towards hiring degree qualified students who can grow in the business.

“Many practices are family businesses and the next generations could be the ones to fill new roles.

He believes there will also be a greater push to streamline advice to allow advisers to see more clients in one form or another. “This will be a strategy for many, if not all, firms but particularly for the super funds which have the client base and the funds to invest in advice that could be automated to a point.”

*As background Williams notes that in most circumstances, to become a new financial adviser for retail advice, the adviser must be a ‘provisional adviser’ first and after completing exams and the professional year, the provisional adviser becomes an adviser. On the ASIC FAR, provisional advisers are not allocated a ‘year’ for the year they commenced giving advice. That year is allocated once they become an adviser in their own right.

The regulatory risk is simply too big to make advice attractive as a business to enter.

Sadly, VERY sadly, I have to concur.

Comments are closed.