The overall performance of the life insurance industry is improving, APRA’s Quarterly Life Insurance Performance Statistics for the year to June 2021 show.

A statement from the authority says the net profit after tax for the industry was $1 billion for the year ended June 2021, “a significant improvement from the previous year” (-$1.7 billion) which APRA says is “primarily owing to the improved investment market performance.” (See: Life Insurance Market, IP Profitability Improving.)

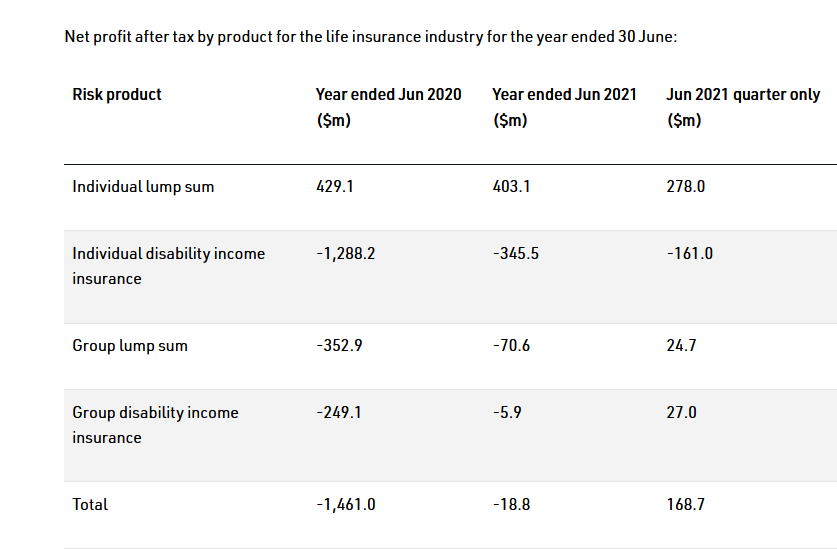

However APRA says that although performance has improved for the 12 months ended June 2021, risk products still reported a combined net loss after tax of $18.8 million (-1,461 million for the June 2020 year).

It says that in particular, Individual Disability Income Insurance, also known as Income Protection Insurance reported a loss of $345.5 million during the year, “…which is a $0.9 billion improvement in comparison to the previous year’s result.”

Net profit after tax for Individual Lump Sum sat at $403.1 million for the June 2021 year compared with $429.1 million a year earlier.

APRA says that results for Group Lump Sum and Group Disability Income Insurance remain negative but have also improved this year.

Click here for APRA’s Quarterly Life Insurance Performance Statistics.

Hmmm, stats, as we well know, can be made to say anything. Look at the decline in life advisers currently and look me in the eye and say the life industry is improving. Where do these guys come off treating us like idiots that would believe such guff?!

Comments are closed.