Profitability within the life insurance industry is improving, APRA statistics for the 12 months to March 2021 show, with the IP sector reporting a $1.1 billion improvement in comparison to the previous year’s results.

APRA’s Quarterly Life Insurance Performance Statistics publication for the March 2021 quarter shows the life insurance market “gradually recovering” from the economic impacts associated with the pandemic.

The authority says in a statement that the net profit after tax for the industry was $1.0 billion for the year ended March 2021, representing “..a significant improvement from the previous year primarily owing to the improved investment market performance.”

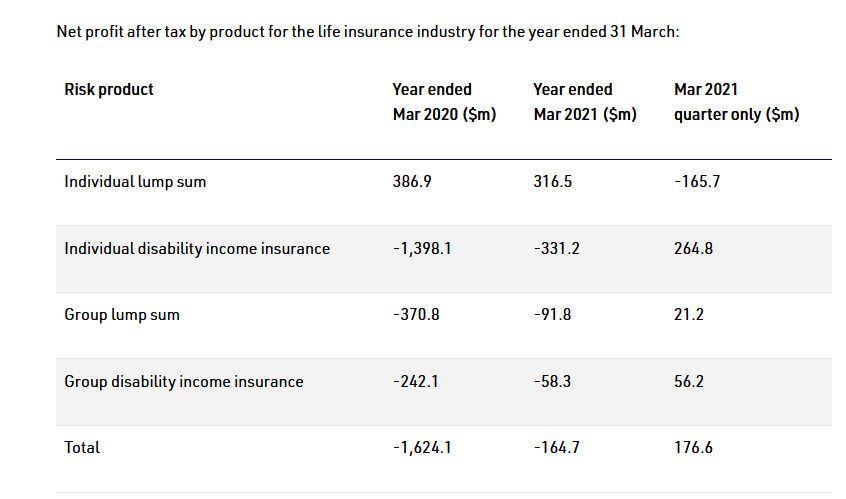

An APRA table shows that for the year ending March 31, 2021, risk products reported a combined net loss after tax of $164.7 million.

“In particular, Individual Disability Income Insurance (also known as Income Protection Insurance) reported a loss of $331.2 million during the year, which is a $1.1 billion improvement in comparison to the previous year’s result,” the statement says.

Results for Group Lump Sum and Group Disability Income Insurance have also improved this year.

Click here for the March 2021 Quarterly Life Insurance Performance Statistics publication

Actually, profitability in the life sector is deteriorating.

1: Income protection has been in loss. When that happens accounting regulations force you declare all future losses into financial statements.

2: Therefore, if the losses stay the same, life companies will report no losses or no gains into the future. That’s because they already accounted for the losses.

3: Given there were more losses in the last year, it means losses were even bigger than they were expected to be.

4: What’s worse is, these results are AFTER the positive impact of higher premium rates. (And, yes, the future lifetime value of those increases can be allowed for to offset / reverse future losses that were accounted for in the past.)

Comments are closed.