The rollout of the new range of income protection insurance products in the coming weeks will receive much attention – especially from risk advisers and licensees. But another significant development just around the corner is the implementation of the new Design and Distribution Obligations which take effect from 5th October.

Riskinfo thanks Sophie Gerber from compliance and legal specialist firm, Sophie Grace, for the opportunity to re-publish this excellent summary of the DDO requirements and what this will mean – not just for product manufacturers, but also for product distributors…

The commencement of the Design and Distribution Obligations (“DDO”) is now imminent with the regime coming into effect from 5 October 2021.

Background

The origins of the design and distribution obligations are well-articulated in ASIC’s Regulatory Guide 274. Similar provisions have been implemented in other major jurisdictions around the world such as the United Kingdom (by the Financial Conduct Authority) and Europe (by the European Securities and Markets Authority).

In Australia, the Financial System Inquiry’s (FSI) recommendation for the introduction of the design and distribution obligations in 2014 was based on its view of the limitations of a framework for consumer protection in financial services that relies heavily on disclosure, financial advice and financial literacy.

In particular, the FSI concluded that ‘disclosure can be ineffective for a number of reasons’ and that ‘disclosure alone is unlikely to correct the effect of broader market structures and conflicts that drive product development or distribution practices’ that result in poor consumer outcomes.

The FSI concluded that poor design and distribution practices played a significant role in contributing to consumer detriment. It is in this context that the FSI recommended the introduction of the design and distribution obligations as a supply-side intervention that places additional responsibility for consumer outcomes on issuers and distributors.

The design and distribution obligations are intended to help consumers obtain appropriate financial products by requiring issuers and distributors to have a consumer-centric approach to designing and distributing products.

The Treasury Laws Amendment (Design and Distribution Obligations and Product Intervention Powers) Bill 2019 received Royal Assent on 5 April 2019 which amended the Corporations Act, the NCCP Act, and the ASIC Act.

Who does the Regime Apply to?

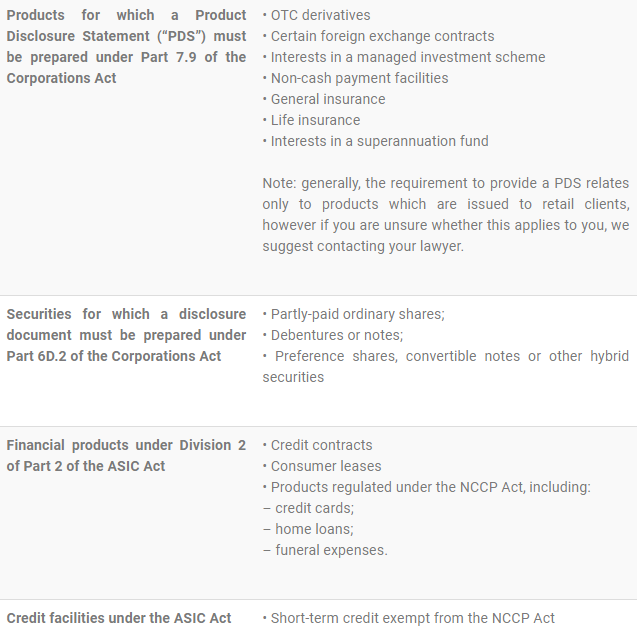

The DDO apply to a range of financial products under the Corporations Act 2001 (“Corporations Act”), ASIC Act 2001 (“ASIC Act”) and National Consumer Credit Protection Act 2009 (“NCCP Act”).

There are some product exemptions, including:

- MySuper products

- Margin lending facilities

- Fully paid ordinary shares in a company, including foreign companies

- Securities issued under an employee share scheme

There are also exemptions for certain conduct.

Further exemptions are in the process of being finalised by Treasury and ASIC with the intention that they will be in place prior to commencement of the DDO regime.

What are the Obligations?

Product Governance Arrangements

Issuers and distributors need to consider how they will implement and maintain robust product governance arrangements. These arrangements need to consider each stage of product design and development – including design, distribution, monitoring and review. ASIC expects that product governance arrangements will be client-centric and include appropriate steps to ensure:

- Representatives are trained in their understanding of the product governance arrangements and how this applies to the products developed and/or distributed by the licensee

- Compliance with the product governance arrangements and appropriate reporting lines where the arrangements have been breached

Target Market Determination (TMD)

Issuers need to develop a TMD for each of their financial products and make it publicly available prior to distributing their products. TMDs must:

- Describe the class of retail clients that form the target market

- Specify any restrictions on distribution

- specify events or circumstances that may reasonably suggest a TMD is no longer appropriate

- Specify reasonable review periods

- Specify when a distributor should provide information about the number of complaints about each product

- Specify the type of information the issuer needs to identify promptly, whether a review trigger or another event has occurred, which would reasonably suggest that the TMD is no longer appropriate

Reasonable Steps

Issuers and distributors have the obligation to take reasonable steps, that will or are reasonably likely to result in the distribution of the financial products being consistent with the TMD.

Record Keeping

Issuers are required to keep specific records about the TMD it prepares, and distributors are required to keep records of distribution information as specified in the TMD.

Significant Dealings

Issuers are required to notify ASIC of significant dealings in relation to the TMD within 10 business days of becoming aware of the dealing. RG274 prescribes certain information which must be included in the notification to ASIC. Distributors have an obligation to notify issuers regarding significant dealings in order to facilitate the issuer’s notification to ASIC.

Next Steps

Issuers:

Identify your retail products

- Identify your distributors and consider your distribution agreements and amend as required

- Identify whether you are a distributor as well – issuers who are also distributors are also subject to the distribution obligations.

- Develop product governance arrangements

- Develop a TMD and make it public on 5 October 2021

- Determine how you will comply with the obligation to take reasonable steps

- Consider your record keeping obligations and how you will comply – do your IT arrangements need to be updated or amended

- Consider your breach reporting arrangements and whether these should be updated in light of the obligation to report significant dealings

Distributors:

- Develop product governance arrangements

- Determine how you will comply with the obligation to take reasonable steps

- Consider your record keeping obligations and how you will comply – do your IT arrangements need to be updated or amended?

This article was written by Sophie Grace GM, Alicia Pevely.

This article was written by Sophie Grace GM, Alicia Pevely.

An integral member of the Sophie Grace team since 2012, Alicia has extensive experience in relation to financial services law, consumer credit law, regulatory matters and ASIC investigations. Working closely with her clients, Alicia has maintained a significant emphasis on AFS and credit licensing and liaising with ASIC. As General Manager, Alicia has oversight of all licence applications and provides advice and support in relation to more complex applications.

Would someone care to explain why it is that the insertion of a Capability Clause, in all income protection contracts available after one October 2021, passes the tests implied in this legislation. This is a contractual device which provides absolute discretion to the insurer to deem the income being earned by a claimant in a partial disability situation. It is neither fair nor reasonable. It allows the insurer to assert without any real basis that a client on a partial disability claim is not earning as much as the insurer thinks they should be able to earn.

A similar argument can be mounted against the “two-year own occupation” rule for the definition of total disability.

Comments are closed.