TAL has released its new income protection insurance product offer to the retail advised life insurance market, intended to provide a focus on value, fairness and sustainability.

Taking effect from 24 September 2021, the insurer’s new proposition implements a number of sustainability measures outlined by APRA as part of its intervention into Australia’s individual disability income insurance (IDII) market (see: APRA Sets New Course for IP Sustainability). These measures, according to the regulator, are designed to “…drive changes in product features that violate the principle of indemnity or exhibit heightened risk due to the uncertainty arising from long time horizons.”

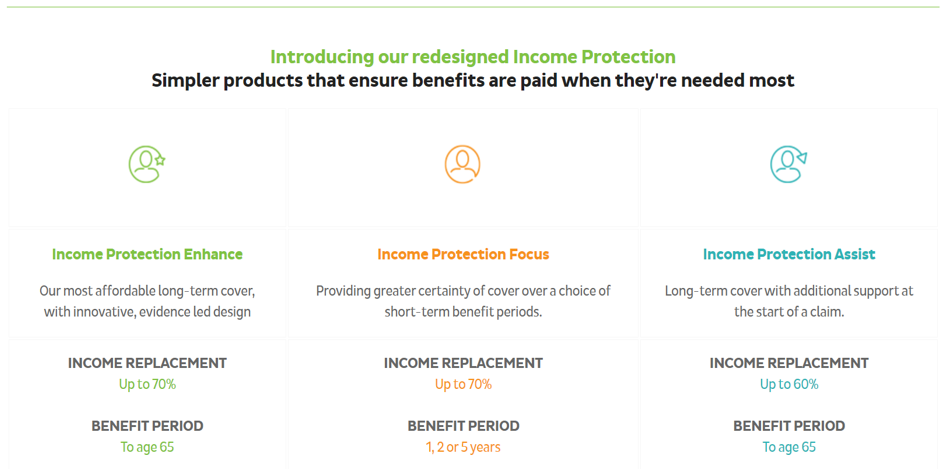

Retaining its flagship Accelerated Protection brand, the insurer’s new proposition offers three product options mainly differentiated by key factors including replacement ratios, benefit periods, total disability definitions and booster benefit options:

Income Protection Enhance

- Income Protection Enhance is presented as the most affordable of the two long-term benefit product options in the new range, offering a benefit of up to 70% of income through to age 65.

- An Any Occupation definition will apply after the first two years on claim, where the insured benefit will reduce to two thirds of the benefit amount from the 25th month, but where the maximum benefit may be restored for eligible claimants, subject to criteria related to the nature (seriousness) of the disability.

Income Protection Assist

- Income Protection Assist also offers long-term cover to age 65, but where up to 60% of income may be payable as a benefit.

- Under this option, there is a built-in Early Support Booster offering up to 125% of the benefit amount for the first six months on claim; this feature intended to provide the client with extra support when needed most.

- Once again, an Own Occupation definition in the first two years of claim will be replaced by an Any Occupation definition from month 25 of claim.

Income Protection Focus

- Income Protection Focus offers a range of shorter-term benefit solutions, replacing up to 70% of income for a benefit period of one, two or five years.

- TAL says there are no changes to eligibility conditions over the duration of a claim, and that the Own Occupation definition will apply throughout.

In structuring these three product choices, TAL highlights the fact that the duration of 92% of income protection insurance claims is less than two years.

The insurance group’s CEO and MD, Brett Clark, characterises the IDII reforms as “…an important piece of work for the entire industry,” and that the industry must persist in its goal of designing sustainable and fair products that work well for all customers, including those customers who need to make a claim, as well as those customers who may not.

Interested advisers and support colleagues can click here to access the new TAL Accelerated Protection PDS from the Riskinfo Resource Centre.

…And click here for a brief summary document released for advisers by TAL, which provides additional information around the key features reported here, as well as other product features and benefits contained in the new offer.