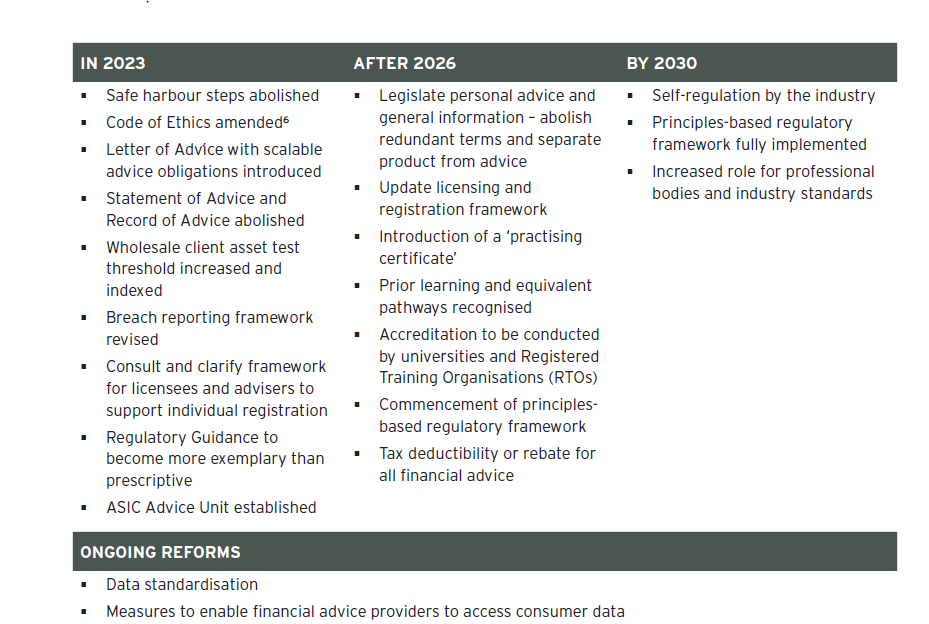

The roadmap outlined in the FSC’s White Paper on financial advice, including timeframes, offers one pathway to a future in which the industry can eventually wrest back the ability to self-regulate. The potential significance of this initiative for advisers and consumers clearly makes this the Riskinfo Story of the Week…

The Financial Services Council has released a landmark white paper addressing the future of financial advice in which it calls for changes designed to significantly reduce the cost of delivering advice.

The council’s White Paper on Financial Advice, described as a blueprint for a simplified regulatory framework, highlights the important milestone the financial advice industry has reached in becoming a profession.

In making this statement FSC CEO Sally Loane says it’s time the Government “…modernised the current complex and costly regulatory framework to recognise and respect the professional judgement of advisers.”

Loane adds that current regulations prescribe compliance obligations at every step of the advice process. “They are an unprecedented driver of cost for financial advisers and consumers, and are past their use-by date.”

The paper also outlines how the blueprint could reduce the cost of providing financial advice by almost $2,000, or up to 37 percent.

The five key white paper recommendations are to:

- Abolish the Safe Harbour steps for complying with the Best Interests Duty*

- Abolish complex Statements of Advice for a simpler, consumer-focused ‘Letter of Advice’

- Break the nexus between financial product and advice and remove complex labels for different categories of advice

- Raise the threshold under which consumers are identified as ‘retail clients’ to those with assets of less than $5 million (up from $2.5 million) and index the threshold to CPI (currently not indexed)

- Move to sustainable self-regulation by 2030 in which prior learning and pathways, and individual registration are supported by the AFSL regime

The FSC says its proposals would also increase protection for up to 275,300 consumers who could be reclassified as retail clients and therefore brought into the consumer protection framework for financial advice – a change it says has long been sought by consumer advocates.

The FSC says its proposals would also increase protection for up to 275,300 consumers who could be reclassified as retail clients and therefore brought into the consumer protection framework for financial advice – a change it says has long been sought by consumer advocates.

The impact of the recommendations

The council commissioned KPMG to undertake analysis of three of its key recommendations – abolishing the safe harbour steps, introducing Letters of Advice and simplifying the categories of advice.

It says KPMG’s modelling shows that not only will the cost of providing advice be reduced, but advisers will also have more time to spend with new and existing clients.

The recommendations will reduce the cost of providing financial advice per client from $5,334 to $3,466

KPMG’s analysis shows the FSC’s key recommendations:

- Will reduce the cost of providing financial advice per client from $5,334 to $3,466

- Would save financial advisers up to 32 percent of time when providing advice to clients

- Allow advisers to provide advice to up to an additional 44 new clients each year

- Enable advisers to produce 2.2 Letters of Advice as opposed to 1.5 Statements of Advice per adviser per week

- Reduce the time required to complete the advice process from 23.9 hours to under 16.8 hours per client

Loane says the FSC’s recommended reforms, if implemented, could generate cost savings for the advice industry of $91 billion over 20 years.

She says the FSC has welcomed “the strong support and constructive feedback” it received from the advice industry, consumer advocates and its members after having opened this current debate with its Green Paper in April (see: FSC Seeks Adviser Input on New Paper on Financial Advice.)

“We now want to see the past few years of significant reform and professionalisation of the sector rewarded with a regulatory framework that trusts advisers’ professional judgement,” says Loane.

*The Safe Harbour recommendation

The white paper says the removal of the safe harbour steps should be the first priority of the Government “to enable a principles-based advice model under the existing regulatory framework.”

It states that compliance with these steps, introduced as a requirement for meeting the Best Interests Duty in 2013, is a key driver of cost and prohibitive to enabling limited advice to be provided to consumers.

“The steps impose specific obligations on the provision of personal advice that must be followed to meet the best interests of the consumer.

…low risk financial advice on simple issues is commercially unviable for many advice businesses

“This means that low risk financial advice on simple issues is commercially unviable for many advice businesses because for such advice to be compliant, it would require the advice to have factored in any other circumstances under Section 961B(2)(g) of the Corporations Act 2001.”

The paper recommends abolishing the safe harbour steps in 2023, immediately following the completion of the Government’s Quality of Financial Advice Review.

In making this recommendation, the paper notes that in practice, the safe harbour steps have resulted in a system where meeting the Best Interests requirement has become a ‘tick-box exercise’:

“Regulators have also deemed advice to not to have complied with the Best Interests Duty if the safe harbour steps are not followed,” it says.

The paper states that the FASEA Code of Ethics should support compliance with the Best Interests Duty but not be the sole overriding measure by which the Best Interests Duty is met.

“ The Best Interests Duty alone should be the overriding legal duty on providers of financial advice. The process for meeting that duty should not be prescribed but based on the principles established in the Code.”

Click here to download the FSC’s White Paper on Financial Advice.

Timeline for the Reform of the Financial Advice Sector

The FSC recommendations don’t refer to the current requirement that all advisers must complete FASEA’s degree by December 2025, unless it’s buried in the detail somewhere. Ridding the industry of this requirement, especially for risk specialists, is a must, and if not actioned now, the mass exodus of advisers will continue.

I wasn’t aware the FSC had anything to do with Advice. Why are they so concerned now? Where were they 10 years ago when the Àdvice sector was saying the regulatory intervention was ridiculous and would increase costs back then, as it is now. This is not new, FSC. Stay away from advice and advisers Mrs Sloan and perhaps ask yourself why the rates of your member’s back books are experiencing ridiculous increases. FSC, you tried to rid the world of advisers to suit yourself an now you have admitted your mistake but we don’t want your involvement in the Àdvice sector. Thanks.

Comments are closed.