Individual risk new business was down nearly three percent in the year to June 2021, however discontinuances rates have improved, new data shows.

DEXX&R’s Life Analysis Report for the year ending June 2021, which includes data on all business issued by life companies from their statutory funds, found total risk new business increased by 7.3 percent to $2.2 billion in the year to June 2021.

While total risk new business increased, thanks to growth in group risk, the research firm notes that individual risk new business fell by 2.9 percent.

It says that total risk in-force business increased by 7.1 percent over the year, which is up from the $15.3 billion recorded in June 2020 to $16.4 billion at June 2021.

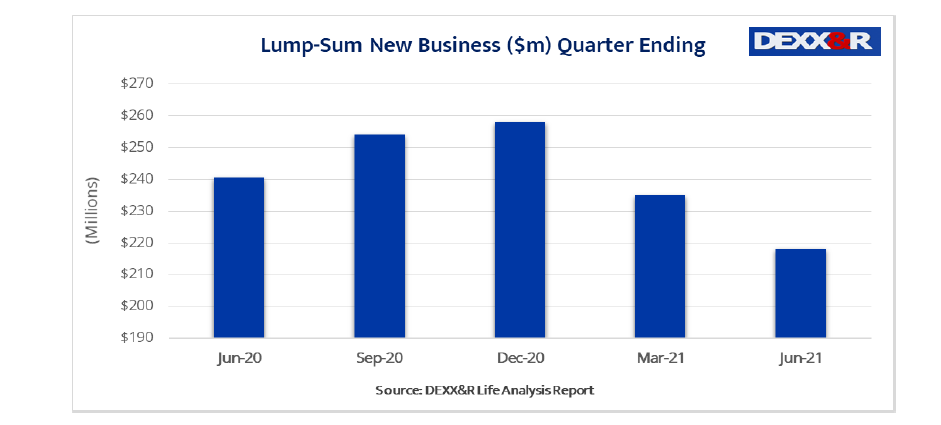

However during the June 2021 quarter individual lump sum new business decreased by 7.1 percent to $218 million, $17 million less than the $235 million recorded in the March 2021 quarter.

Individual Lump Sum Discontinuances

Individual Lump Sum Discontinuances

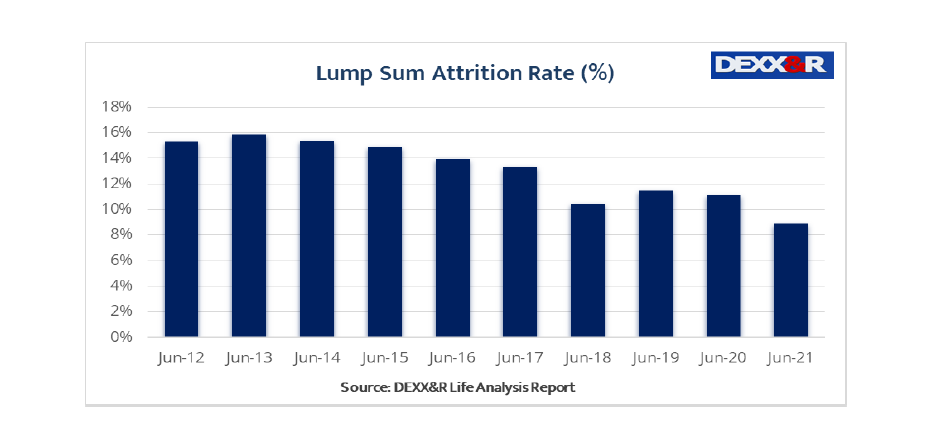

The DEXX&R Attrition Rate, which calculates discontinuances as a percentage of in-force premiums, found that the Individual Lump Sum attrition rate peaked in June 2013 at 15.9 percent.

The company says the Attrition Rate fell to 8.9 percent in June 2021, down from 11.1 per cent in June 2020.

It says its Attrition Rate formula provides a stable and consistent measure of discontinuances by premium value over time.

Individual Risk Lump Sum New Business

Individual Risk Lump Sum New Business

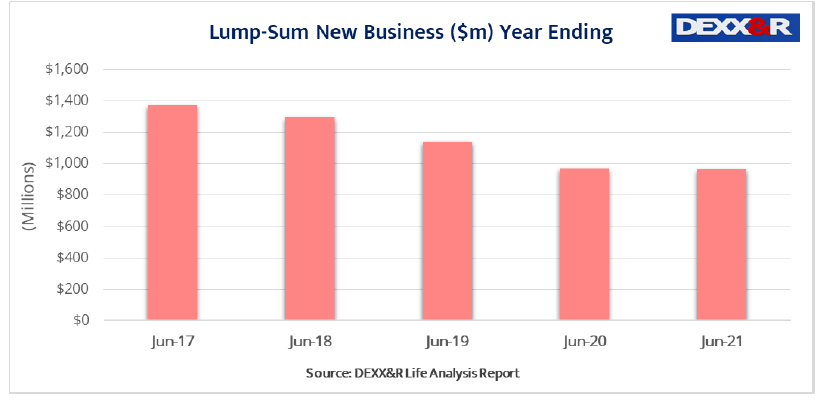

The report also found that Individual Risk Lump Sum New Business was down by 0.7 percent over the year to June 2021, which it says is the third straight yearly decline in lump sum new business sales since June 2018.

…the continued decrease in business “…reflects the impact of Covid-19 lockdowns and disruption in the advice distribution channel

DEXX&R says the continued decrease in business “…reflects the impact of Covid-19 lockdowns and disruption in the advice distribution channel, including the restructuring and transfer of ownership of retail bank owned dealer groups, and a fall in the number of life risk advisers.”

Yes, falling adviser numbers indeed. The untold story is behind the scenes here. I say “untold” but we are all aware of it. It is mainly untold in the broader media, even the broader financial media most of us read daily. All those on comments pages like this may find it easy to criticize advisers who fail this FARCE-IA exam twice and abhor them as ‘the lowest common denominator’ that needs to be flushed from the industry. In the words of the infamous Greta, “[b]How Dare You[/b]!”.

The untold story would show that many, if not most of those ‘failing’ advisers are older, committed risk advisers loyal; to their clients. The last thing they need testing on is their “ethics”. No exam can test for ethics and this should be self evident to all. Hmm, maybe not, these days eh?! These older advisers served their clients assiduously for 20, 30 or even 40 years without a complaint or so much as a ripple in their dedicated attitude and performance looking after the best interests of their clients. Just because they can’t operate under hi-tech classroom exam conditions they fail and are lambasted as industry dead weight and cast aside. SHAME on ALL OF YOU (Greta again) who propagate this including self absorbed govt hacks who have their wages guaranteed each week from taxpayer funds.

These ‘older’ advisers are being forced, under threat of having their livelihood stolen from them, to sit an exam which is academically focused on areas that have never and will never come into question in the execution of their duties to look after and serve their clients. Another part of the untold story is that many of these advisers are risk advisers who ONLY wish to look after the insurance side of the client and may work with a full financial planner/investment adviser for the other stuff.

These risk-only advisers are finding the FARCE-IA ‘exam’ totally irrelevant to their area of expertise. Where is the ‘exam’ or qualification for these specialist advisers? Why are they forced into irrelevant AFQ8 uni degrees? All of these older advisers are shown zero respect on these pages by many and by the self-absorbed regulators. They know their craft and have performed it admirably in the best interest of their clients for many decades.

Now they are being cast aside, their retirements forced under less than ideal financial circumstances (early forced retirement). It is unspeakably cruel. NOBODY is rising to their defence or calling for relevant risk focused exams or qualifications to retain their significant experience within the industry to train newcomers. What these regulators have done and continue to do is unforgivable in relation to these older advisers, especially the risk advisers who garner ZERO benefit for themselves or their hapless clients from these farcical, misguided and irrelevant exams and qualifications. If the regulators or industry zealots want qualified ‘risk’ advisers then create an appropriate pathway and qualification for them and cease ending the careers of good older risk advisers unnecessarily. This is why risk adviser numbers are falling.

If discontinuances are so low then why not report on new business as a percentage? Perhaps there is more money going out than coming in?

The other question that should be asked is that with discontinuance rates so low, how healthy are these life portfolios? How are those loss ratios performing?

If you had of mentioned commissions then you might have got more of a response but it is pretty obvious that advisers simply don’t care about the insurance companies bottom line and are about as loyal as the key bowl at a swingers party.

Increases in premiums in the short term may have helped cover up rising lapse rates, though that will fail to stem rising losses.

When you get a renewal notice saying your premium is rising by 10 to 70% the reaction is predictable.

People will not tolerate continual double digit increases and the lapses will continue to rise.

Comments are closed.