Ten-year advisers of good standing would not be required to attain a graduate diploma education standard or equivalent under a Labor Government.

This clarification was made by the office of Shadow Assistant Treasurer and Shadow Minister for Financial Services and Superannuation, Stephen Jones, following the announcement made by Jones at last week’s AIOFP Conference that an Albanese Labor Government would not ask financial advisers to obtain a bachelor’s degree to retain their qualifications if they’ve been working for a decade as an adviser and have a good record (see: Labor Would Scrap Bachelor’s Degree…).

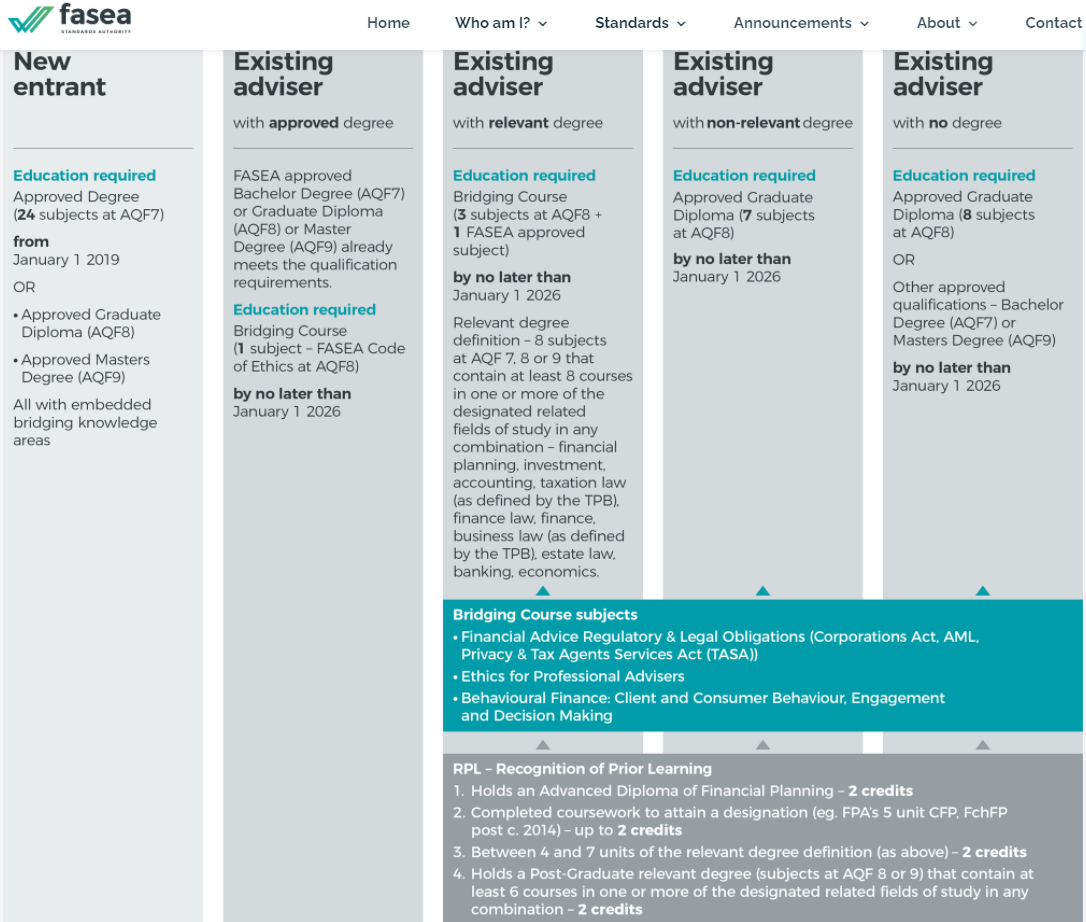

Existing advisers prior to 1 January 2019 who hold no degree are currently required by FASEA to attain a bachelor’s degree or an equivalent by 1 January 2026. Taking FASEA’s table of requirements as its reference (see below), Riskinfo asked the Shadow Minister’s office whether the existing adviser of ten+ years good standing would still be required to attain an Approved Graduate Diploma (8 subjects at AQF8).

A representative from the Shadow Minister’s office has subsequently confirmed to Riskinfo that under Labor’s policy, ten-year advisers with a good record will not be required to attain a Graduate Diploma.

In announcing Labor’s commitment last week to scrapping the bachelor’s degree (and Grad Dip) requirement for ten-year advisers of good standing, the Shadow Minister confirmed Labor would still expect advisers to:

- Pass their professional exams

- Meet continuing professional development requirements

- Abide by an appropriate professional code of ethics

AFA CEO, Helen Morgan-Banda, has largely welcomed Labor’s policy announcement, stating this week that the AFA had always envisaged a model where a higher standard could be achieved, but not at the expense of losing so many experienced advisers, which was particularly important in the risk space:

“We support the focus that Stephen Jones has placed on advisers being able to continue to service their clients,” she said, adding that, should changes to provide better recognition of prior learning and experience eventuate, this will make a significant difference in terms of the number of financial advisers who choose to continue to practice through to and beyond 2025. “This will be a very good outcome for Australians seeking financial advice, which we warmly welcome,” she said.

Morgan-Banda added the AFA appreciates that a change of this scale will be very appealing for many, but possibly disappointing for those who have already made the commitment to complete the additional study: “We will await further details on this proposal and will enthusiastically work with all stakeholders to ensure a sensible outcome is achieved.”

What Stephen Jones has done, is a step in the right direction and Advisers appreciate what Helen has stated in that experienced Advisers especially in the risk space, need some relief and an incentive to remain in the Industry.

We now need the Liberals to see the light, as this is so much more than Political maneuvers.

There is more to do, though at least we are having constructive discussions now that are starting to fall back into the realm of common sense and to allow us to be heard.

Unfortunately, thousands of experienced Advisers were forced to leave the Industry to the detriment of all Australians and it is a shame it had to reach the point where the cost of Advice and Life Insurance premiums started to rise beyond reasonable amounts people can pay, which has led to the avoidable position we face today.

2022 will be a better year as there are things happening behind the scenes.

All we need is for Advisers to hang in there, have a big rest over the Christmas break and go to sleep each night having positive thoughts ( Easier said than done ) knowing that the future direction and help, will be much better than the last few years.

Jeremy, for the sake of clients and advisers I dearly hope against hope that what you say is true. I usually endorse fully most everything you say as considered, informed and on-the-money commentary. Sadly, this time, I am not so sure at all what you are saying is anywhere near reality. I’ve no doubt your intentions, as usual, are positive true and honorable, however I have no confidence in assertions made in your first 3 paragraphs.

I unfortunately have zero trust in Jones, the labor party OR the liberals (for whom I have voted most of my life!) in terms of ‘coming to the table’ or ‘starting to constructively talk’. These things are things to continue hoping for but are only cleverly disguised ‘sound bite’ opportunities and vote catching ploys, nothing more. I think we all know it as we’ve been witness to sickening amounts of it over the decades and there’s no reason to think it is slowing down – quite the opposite in fact. There’s a ‘quickening’ happening on many levels.

What about the investment advisers, financial planners AND RISK ADVISERS who do not need these qualifications at all to improve the quality of advice given to their loyal clients (for up to the past 4 decades) but yet who have paid $10K++ in money and time away from clients/family and THE STRESS of studying AND of irrelevant idiot bureaucracy-centric FARCE-IA exams (with threat of failure for a highly experienced and successful 60yr old meaning no more career)? What about them? Seems that age 50+ advisers will never have had to go through that trauma if Labor gets in. Will they be compensated? Not likely of course. I would be beyond livid!

What about those advisers YET to do the study needed for the AQF8 quals? Do they start now and potentially be wasting time and money OR do they wait until April elections to see if they have to do them. Just beyond farcical and disgustingly unprofessional of these abject clowns in government not to give certainty after Jones’ announcement. Untenable but typical for these self absorbed politicians – everyone and all plans must hinge on their belated prognostications. Sickening!

This is all beyond farcical, totally UNprofessional of the so-called ‘government’ of our country (most of whom don’t have a professional qualification to show for themselves AND would fail a FARCE-IA exam if forced to sit it!). As Ayn Rand (Google her) said (paraphrasing), “When those who produce have to seek permission from those who produce NOTHING then well may you know your society is doomed”. Strong, simple but prescient words from a clear thinker of her time. At age 60, I didn’t want to keep working in a society (or industry) that is doomed – time is precious.

I’m out to make the MOST of the time I have left. My once-great risk advice industry is on the point of collapse: Life companies – once my best partners in the industry – do not want to know advisers beyond a simple transaction. They have little time for clients upon whom their business fully depends as they hike premiums to the stratosphere without digestible explanations or options for clients. Don’t start me on the abominable ‘new age’ agreed value IP policies – they SHOULD be illegal. If you really want to show you care then fix your damn TPD definitions life companies – what a RORT!! Yep, these “are not your father’s life companies anymore”. No such thing as a real ‘adviser/life company relationship’ anymore. Do I need to start on ‘high staff turnover’ or ‘client service officers working from home’. Too sad for words.

Leave the tax payer funded bureaucrats plaguing your life with endless changes and demands behind and vote with your feet. I know YOU have done this Jeremy but some others need a gentle push. Best thing you’ll ever do! Stress is gone now . . . If you’re over 60, a risk adviser (or not) grab your tax free super, sell your client base to those younger and more tolerant of pointless change and compliance. Do it, there’s zero downside. Buy yourself a motorcycle, go to the beach, lay by a pool with a beer under a palm tree. Do whatever the hell you want instead of slavery each day to faceless self absorbed masters who care not for you OR your clients and care for only the next election results. All true and we all know it. End of rant, have a great and safe Christmas all 🙂

Comments are closed.