FASEA has deferred to the Government on making a decision around any possible amendments to the wording of its much-debated Code of Ethics Standard 3, which addresses adviser conflicts of interest.

In a summary report released this week following submissions it received from industry stakeholders regarding any potential wording changes to Standard 3 (see: FASEA Seeks Consultation…), the authority recommended that, given is imminent wind up and transfer of functions to Treasury and ASIC as at 31 December 2021, “…FASEA considers it appropriate that any final determination on amendments to Standard 3 be addressed by the Minister in 2022.”

…conflicts of interest and duty should be eliminated rather than managed

While the authority failed to make a recommendation on any amendments to the wording of Standard 3, it nonetheless offered a strong indication of its position when noting at the end of its summary that it supports the view expressed by the Hayne Royal Commission that “…conflicts of interest and duty should be eliminated rather than managed.”

The recent consultation sought by FASEA asked industry stakeholders to submit their views on three different options in relation to any amendments to the wording of Standard 3:

- Option 1: Incorporate FASEA’s intent language into the Standard:

- You must only advise, refer or act where you do not have a conflict of interest or duty, being that which could reasonably be expected to induce you to act other than in the client’s best interest.

- Option 2: Align the Standard 3 language with the findings included in the final report of the Financial Services Royal Commission:

- The findings were that, where possible, conflicts between duty and interest should be removed and his finding that conflicts of interest and conflicts between duty and interest should be eliminated rather than ‘managed’. It also draws on the established principles of conflicts contained in section 963A of the Corporations Act:

- You must not receive any benefit (whether monetary or non-monetary), nor enter into any relationship, that could reasonably be expected to influence the advice you give or the service you provide to your client.

- Option 3: Retain the existing Standard 3 wording:

- Standard 3 wording currently reads: You must not advise, refer or act in any other manner where you have a conflict of interest or duty.

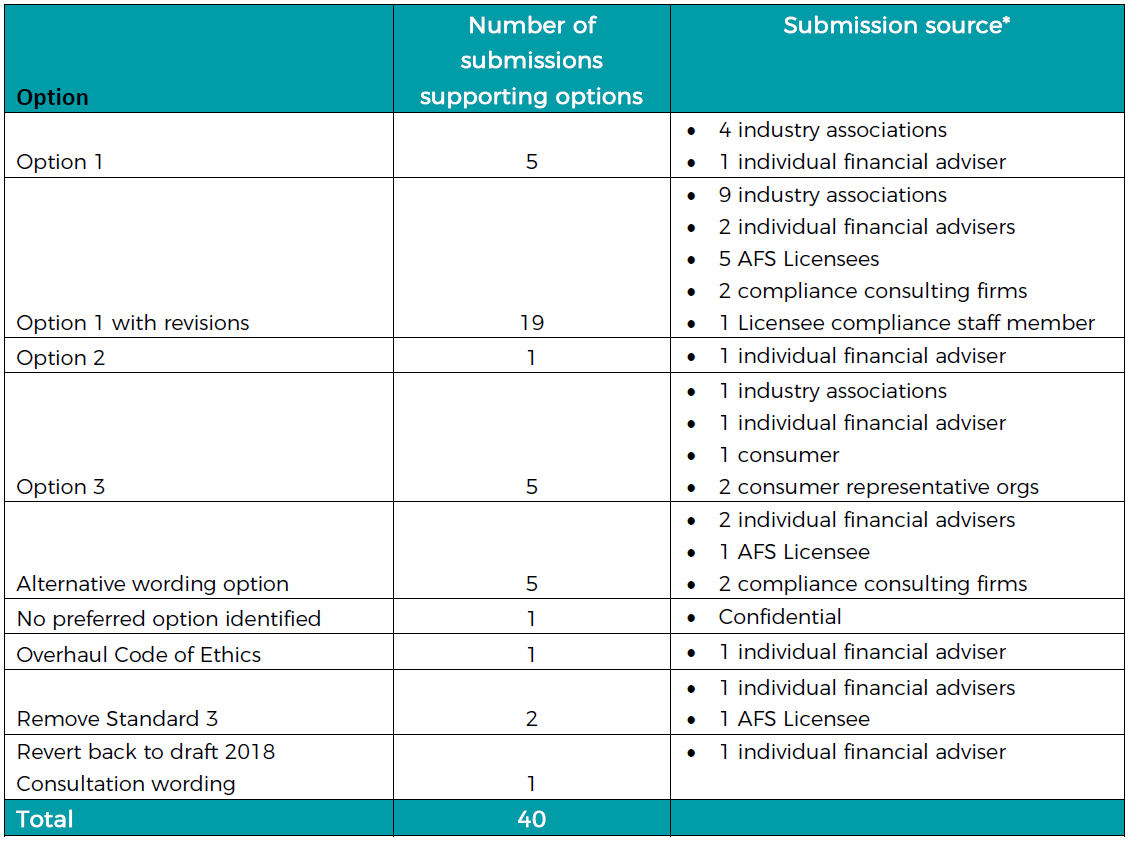

Preferences for these three options from the 40 submissions the authority received are outlined in the table below, :

Equal weighting to consumer/industry views

FASEA advises the 40 submissions it received were from:

- 14 Industry Associations

- 10 individual advisers

- 7 Licensees

- 3 Compliance consultants

- 3 consumers and consumers representatives

- 1 Regulator

- 1 Licensee compliance resource

- 1 industry behavioural finance expert

The outgoing authority recommended that consumer and industry views should be given equal consideration in determining whether to amend Standard 3.

Riskinfo will report further developments in 2022 as the responsibility for the final decision on whether to amend Standard 3 now appears to rest with the Assistant Minister for Superannuation, Financial Services and Financial Technology, Senator Jane Hume.

I wonder if everyone having a view understands that option two (2) is much stricter than option (1). Option one is: that the potential conflict must be such that it “induces” you to act in a certain way…induce is stronger than influence, something might have the potential to influence you without inducing you. That means, ANY CONFLICT has the potential to influence you…it means any conflict must be avoided… This is not in line with other codes of ethics from other professions…Doctors would not be able to accept benefits from Pharmaceutical companies, nor accept medicare bulk bill payments…etc. These benefits have the ability to “influence” but wont necessarily “induce” the Doctor to do the wrong thing. “to Induce” allows management of conflict, where it wont induce the relevant provider…option 2 is out of step with most every other profession. And of course, option 3 gives no room for “professional” judgement…We all quote “Hayne”, but he was asked to provide his “professional judgement” on all relevant matters,. that was his professional right as a lawyer…but we, as financial planners are not capable of exercising personal professional judgement…is that what regulators are saying? Then what is the point of transitioning financial planning to a profession if we are still treated as a normal occupation. We are caught somewhere in between and instead of our industry representative bodies working together to solve these issues, they are all competing. Look at the medical profession, particularly in the US, how strong and influential is their professional associations! Come on Planners and Associations, step up to the mark, work together for the good of our long term prospects and the sake of the Australian people, waiting patiently for a dependable professional service to emerge!

Comments are closed.