FASEA is canvassing industry opinion on amending the wording of the contentious Standard 3 of the Financial Planners & Advisers Code of Ethics.

A statement from the authority says it is considering an amendment to align the wording of the standard to its intent as explained in its 2020 Guide.

FASEA Chief Executive Stephen Glenfield says that FASEA understands that some stakeholders have raised concerns regarding the wording of Standard 3 “…and welcomes stakeholder feedback on proposed options to align the wording of the standard with the intent of the standard.”

Standard 3 states that advisers “…must not advise, refer or act in any other manner where you have a conflict of interest or duty.”

Glenfield says that the Code of Ethics provides an ethical framework of values and standards to assist advisers in exercising their professional judgement in the best interests of their clients.

The statement explains that based on feedback received from a range of stakeholders on standard 3 since the Code was registered and more recently during the consultation process conducted on the Guide, FASEA is now considering amendment to the wording.

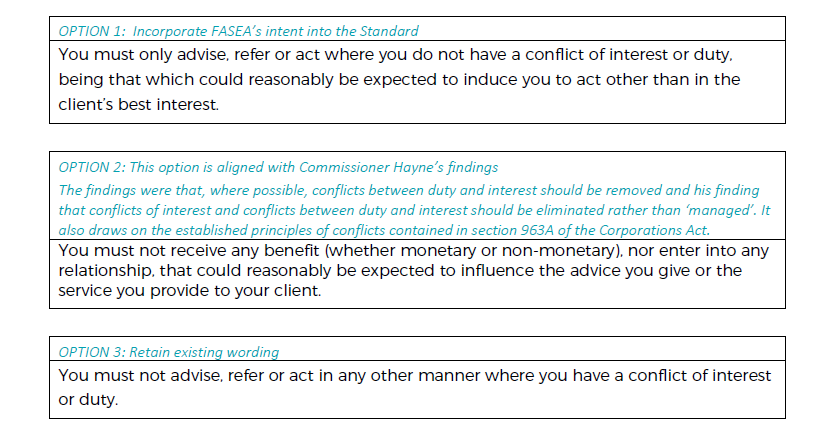

The consultation paper says the authority seeks broad stakeholder feedback through consultation on amending standard 3, specifically on the following options for the working of the standard.

The consultation paper also acknowledges “… ongoing commentary that standard 3 is not workable and that guidance cannot be legally relied upon for interpretation.”

The paper says that FASEA is committed to preserving the intent of the current Code; namely, that financial advice only be offered by advisers who are free from conflict.

“FASEA is also open to making changes to the means by which this clear intent is realised through the provisions of its Code.”

Consultation Interests of FASEA

The paper adds that FASEA encourages feedback on Standard 3 and is interested in specific feedback on:

- Which, if any, of the three options, as offered above you prefer

- Other wording you might propose that is clearly for the purpose of realising the current (and continuing) intent of Standard 3, with a focus on making that intent clear and to enable effective implementation

- The practical application of options 1,2 and 3 in terms of: consumer experience; adviser practice; licensee practice; guidance

Feedback and submissions can be submitted through FASEA’s dedicated consultations email consultation@fasea.gov.au until 1 December 2021.

Despite FASEA issuing guides and people trying to interpret Standard 3 in different ways the intent is very clear. I don’t think that the intent will change, even if the wording does. Interpretations will still be made, including by the disciplinary body when a complaint is raised with them and in those circumstances it will be very difficult to advisers to justify fees based on FUM and risk commissions. Hence part of the reason why some think that the code of ethics is unworkable for us.

Comments are closed.