Most interest this week was generated by our report on some of the key outcomes from Investment Trend’s 2021 Adviser Risk Report. The report clearly highlights the fact that it’s not just premium pricing that’s of critical importance for advisers, but also premium stability – both in terms of improving policy retention and as a key influencer when it comes to advisers reconsidering their insurer of choice…

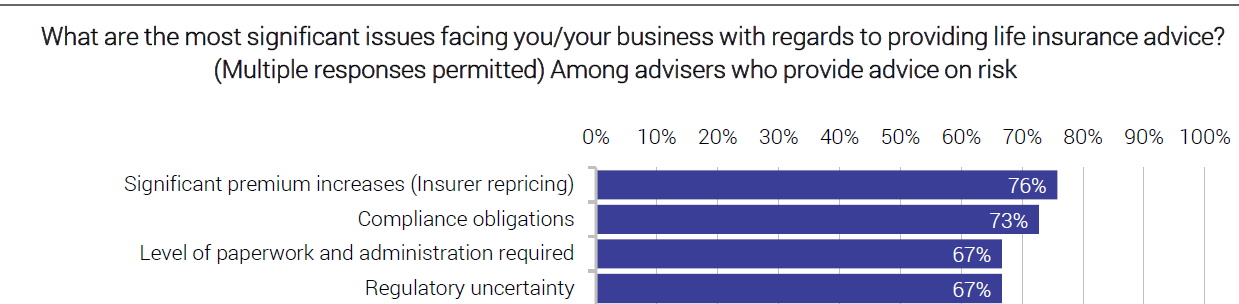

The most critical issue facing advisers who offer life insurance solutions is significant premium repricing by insurers.

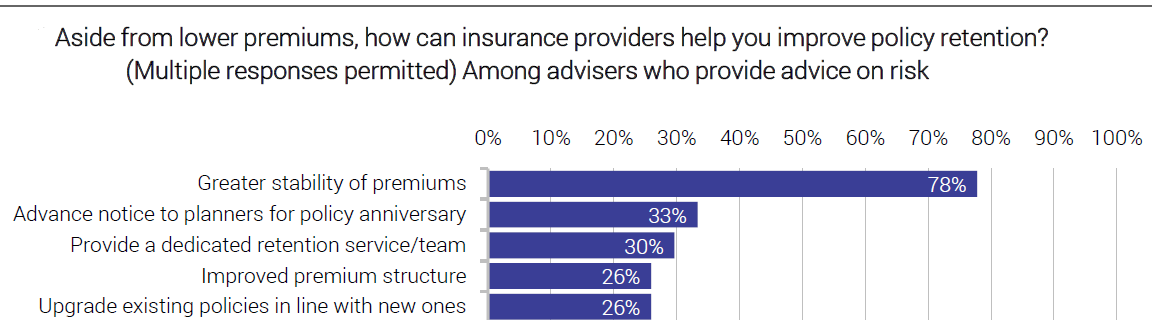

This is one of several key takeaways stemming from Investments Trends’ 2021 Adviser Risk Report, where another key finding indicates that greater premium stability is easily the biggest driver for advisers (after lower premiums) when it comes to improving policy retention.

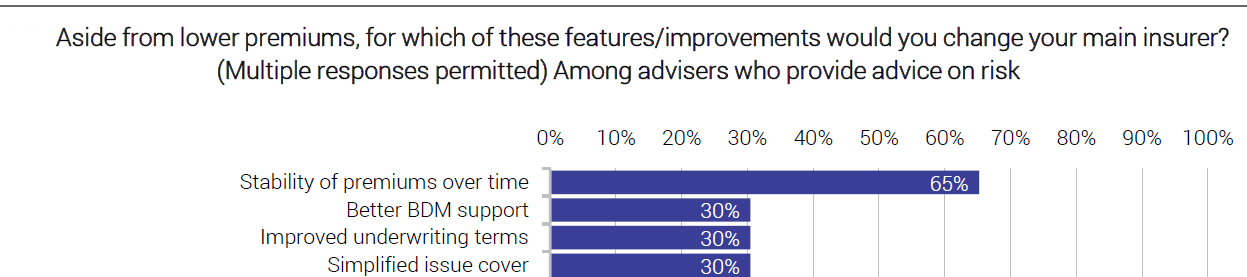

…stability of premiums over time is also the stand-out factor …when it comes to which features or improvements would cause risk advisers to change their main insurer

In a clear message to insurers, stability of premiums over time is also the stand-out factor (other than lower premiums) when it comes to which features or improvements would cause risk advisers to change their main insurer.

For Riskinfo readers who participated in the Investment Trends 2021 Adviser Risk Report, their top responses to these three critical issues are set out in the following charts:

In the coming weeks, Riskinfo will report other key findings from the Investment Trends 2021 Adviser Risk Report.