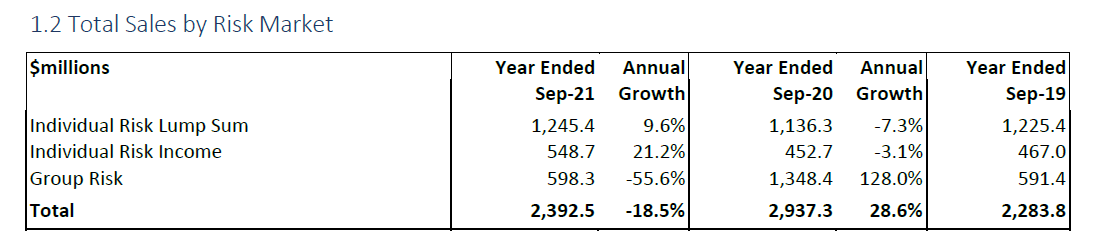

Annual Individual Risk Lump Sum Sales rose 9.6 percent to $1.245 billion while Risk Income Sales jumped by 21.2 percent to $548.7 million for the year to September 2021, according to Plan for Life.

Asked about the reasons for the rises in Sales, Plan for Life says that part of the reason for the growth is likely to be Covid related.

“Sales during the Dec19, Mar20 and Jun20 quarters were low across the market before recovering. Lump Sum Sales in particular are only 1.6 percent higher than for the year ending September 2019, with company-specific growth … the other main driver.”

The actuaries and research firm also noted that while it varies a bit by company, only around 26 percent of ‘Sales’ relates to new policies, with the remaining 74 percent due to Age/CPI increases.

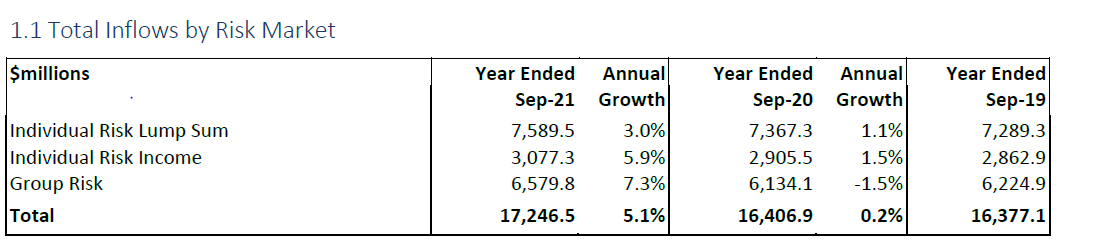

The Market Overview notes that Risk Market Inflows rose by 5.1 percent over the year to September 2021 from $16.4 billion to $17.2 billion, while overall annual sales in the risk market fell by 18.5 percent due to reported Group Risk Sales finishing down by more than half.

The firm says that in the Individual Risk Lump Sum Market (Term Life, Total & Permanent Disablement and Trauma Insurance) inflows were up by a relatively modest 3.0 percent while overall Individual Risk Income Inflows rose 5.9 percent over the past year.

“only around 26 percent of ‘Sales’ relates to new policies, with the remaining 74 percent due to Age/CPI increases”

Of that 26% of new sales, what percentage was legit new customers and what percentage was churn? What is the average age of portfolios doing? Are the stepped premium increases (the overwhelming majority) in the range of 10-20% increases? Are we just kicking the can down the road?

Time for an honest conversation about the future of this business. Who is game to challenge the norm?

Comments are closed.