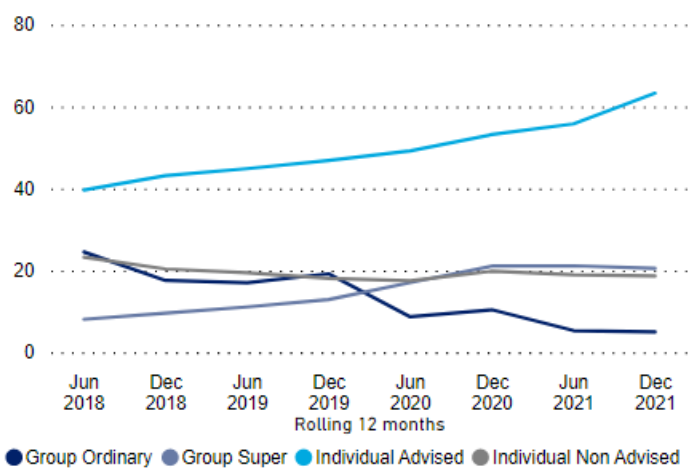

The dispute lodgement ratios for all distribution channels have remained relatively stable over the past three and a half years except for Individual Advised business, according to APRA’s Life Insurance Claims and Disputes Statistics report to December 2021.

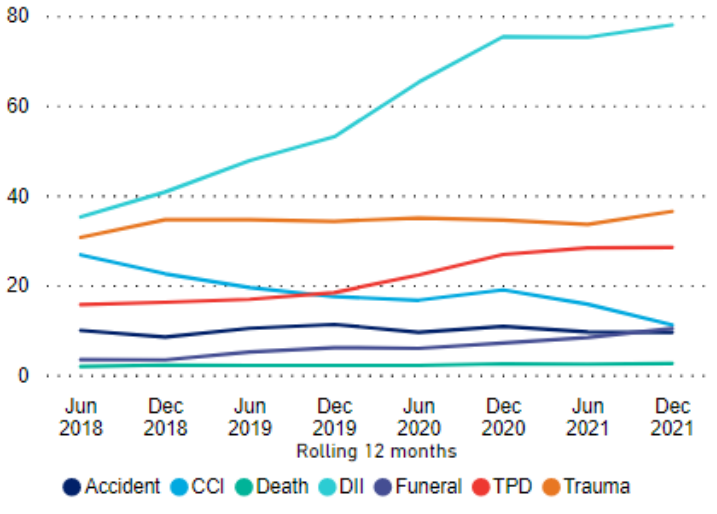

The report says the hike was mainly driven by DII “…given the various repricing activities undertaken to address the product sustainability issues.”

Analysing dispute lodgement ratios by cover types during this period reveals the disputes lodgement ratios for DII have increased considerably.

…In general, more complex products are likely to have higher dispute lodgement ratios,

“In general, more complex products are likely to have higher dispute lodgement ratios,” the report says, while also noting that, while DII shows higher ratios than TPD and Trauma, it also has a higher claims frequency.

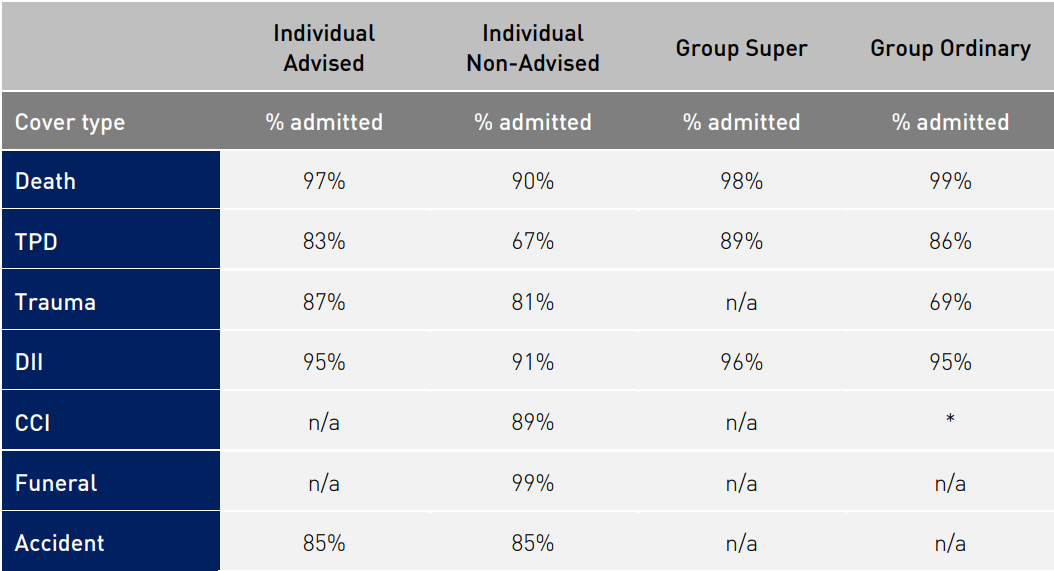

Meanwhile, when reviewing the claims admittance rate by cover type and distribution channels the statistics show that generally, Individual Advised business shows higher admittance rates than Individual Non-Advised for the same cover type (also see: Life Insurance Claims Data Continues to Show Value of Advice).

The report says this could be due to the policyholder “…having clearer expectations up front of what is covered by the product, or (related to the previous point) the adviser discouraging the policyholder from lodging a claim that is not covered by the policy.”

APRA says the exception is Accident which has the same admittance rate between two channels. However, it notes the number of observations is quite small (11 finalised claims, versus 2,405 for Non-Advised).

Click here to access APRA’s Life Insurance Claims and Disputes Statistics December 2021 report.

Could it be that Individual Advice Clients have been fully underwritten and the main reason for a dispute is NON DISCLOSURE. Group Business is usually the automatic cover given to every member, not underwritten! If you want to beat up Advisers you can guarantee this story will always come up.

Comments are closed.