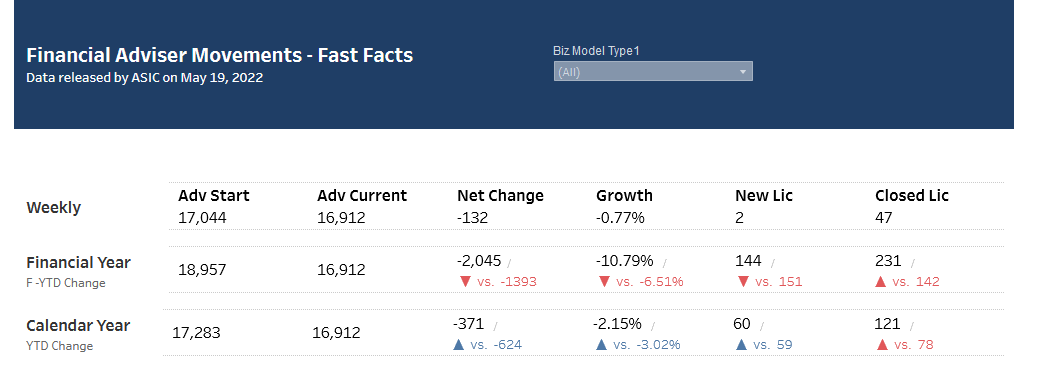

Latest weekly data on adviser numbers was dominated by losses with the effective closure (down to zero advisers) of 47 small licensed AFSLs.

Wealth Data’s analysis also shows the number of advisers decreased by 132 from 17,044 to 16,912 and the number of licensees dropped to 2,003.

The firm’s Colin Williams says in his latest weekly update that it appears that ASIC has been catching up with licensees that had not been removing advisers due to not passing the FASEA exam.

He says this issue was raised in a Senate Paper earlier this year and that in the calendar YTD, 121 licensees have closed and 231 closed for this current financial year.

“There must be some concerns over the governance of small licensees. In many cases, the owner of the AFSL is also the adviser and is required to ‘dob themselves in’ when something goes wrong,” Williams writes.

He adds that with regards to the FASEA Exam, the AFSL was required to remove advisers who had not passed the exam and were not eligible to have another go through to September.

“It is obvious that this was not done by many small AFSLs and it is only now being chased down by ASIC.”

Williams adds that this is one of the weakest weeks with only 15 licensee owners managing growth for a total of 24 advisers.

“The only shining light was the seven provisional advisers being appointed. Three licensee owners each had a net growth of three…”

Key Adviser Movements This Week

- Net change of advisers – down 132

- 15 licensee owners had net gains for 24 advisers

- 116 licensee owners had net losses for 155 advisers

- Two new licensees commenced and 47 ceased

- Seven provisional advisers commenced and one ceased

When you start doing International flights again, how will you feel if your Pilots announce at 39,000 feet, that they are brand new to the job, the auto pilot seems to have malfunctioned, the tracking system seems to have stopped working and we have just flown into a storm.

When the Qantas A380 had hundreds of warning bells sounding and it looked like a certainty that the plane would crash, killing all on board, what saved them, was that at the cockpit controls, were experienced pilots who ignored the clanging and used their combined years and thousands of hours flying in all conditions, to come up with a plan that NIL new pilots could have ever achieved.

As more experienced Advisers leave and let’s face it, 1200 remaining risk specialists is not enough to maintain a viable Life Insurance Industry, then HOPING that some more new Advisers may join, is NOT a solution.

Bravo Jeremy, great perspective and analogy! I know life company execs read these columns and comments but sadly I’m pretty sure only 0.5% of politicians do. As luck would have it, the pollies are the only ones who seem able to change things these days and, worse, only when it helps them. Alas, we’ve only just had an election – no need for them to try hard for another number of years . . .

Comments are closed.