In a sad reflection of the current state of the financial advice sector in Australia today, this article is the Riskinfo Story of the Week…

A comprehensive survey looking at the mental health and emotional wellbeing of the financial advice industry makes for sobering reading, with the report’s authors stating that the industry “…is in real mental and emotional distress.”

The 77-page Mental Health and Emotional Wellbeing of the Financial Services Industry report, which was undertaken by Forte Asset Solutions‘ Steve Prendeville and Artemis Investments’ Philippa Hunt says that in summary advisers are “…overwhelmed and feel the loss of control over their business and decisions are based on constantly changing rules and resulting compliance overload.

“That loss of personal agency and power over their life is creating stress and driving many out of the industry.” However the authors note a number of advisers are intending to stay and they don’t have low client bases.

The survey included a major section on the LIF reforms which asked respondents if their business or income had been effected by the LIF legislation changes – with 74% agreeing it had been.

When asked whether their stress levels had been impacted by the LIF legislation on their business or income – 21% said ‘significantly increased’ and 41% said their levels had ‘increased’ although 32% said they had ‘remained the same’.

Similarly, as to whether the LIF legislation had created financial stress in their business cashflow or income, 28% said it had ‘significantly increased’ financial stress; with another 37% stating it had ‘increased’ financial stress although 34% said their financial stress had ‘remained the same’.

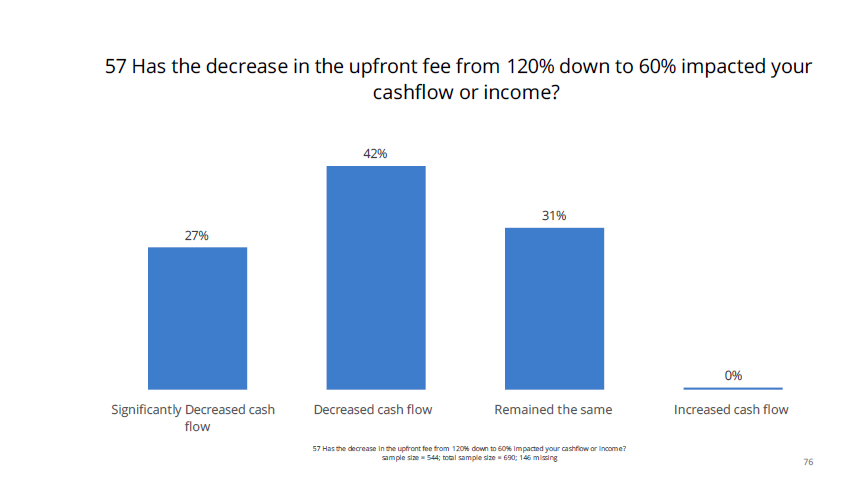

The survey also asked if the decrease in the upfront fee from 120% to 60% had impacted cashflow or income with 27% stating it had ‘significantly decreased’ cash flow; 42% that it had ‘decreased’ cash flow while 31% said it had remained the same.

Financial Adviser Exam

With regard to the financial adviser exam the authors say this was rated as the one of the highest causes of stress and anxiety for 84% of respondents.

“The exam is regarded as flawed, difficult for many to pass the first time. Many had more than one attempt to pass the exam. The exam is regarded by academics as a level equivalent to a Master’s degree. The questions were confusing and did not examine content. This exam is set to pass before the ethics course is done. Unethical in itself, according to anecdotal commentary.”

Key Statistical Findings

The authors say the survey looks at mental and emotional health, FASEA, the Life Insurance Framework (LIF) and its effects now, Fee Consent forms now that these are implemented and where advisers see their future. It was targeted to all financial advisers, both investment and insurance whether in business or employed by another business such as accountant or mortgage broker and staff of advisers. On the health impacts it found:

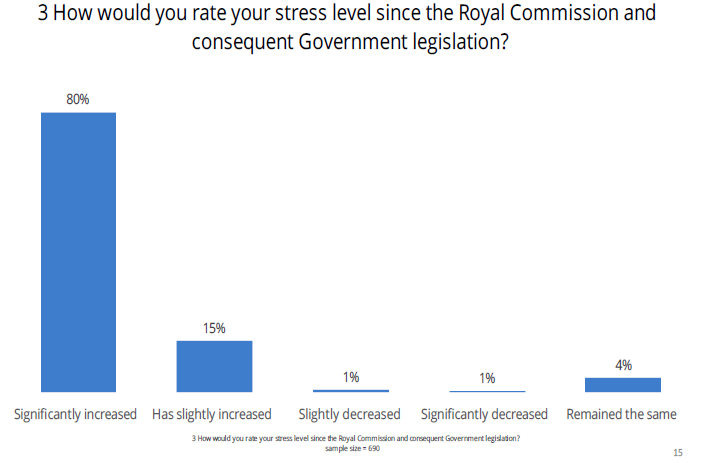

- 80% reported that their stress level had ‘significantly increased’; compared to the overall rate. Rates are highest among those ‘exiting’; who own their own business, have a diploma in financial advising. Lower rates were reported by females, those advising 11-14 years and those in business 6-10 years

- 53% reported that their mental health had ‘significantly declined’; rates are higher among those who own their own business, who have a diploma in financial advising and males

- 39% reported their physical health ‘significantly declined’; rates are highest among business owners. Lower rates were reported among staying advisers and those who have owned their businesses for 6-10 years.

- 36% reported that their mental health being a financial adviser with the negative press has ‘significantly declined’; rates are higher among business owners and males. Lower rates were reported by females

- 63% believe the mental health of staff is affected. Rates are higher among staff members of staying practices and lower in those advising 6-10 years

- 48% reported that their mental health has ‘significantly declined’ from the financial implications of the recommendations; rates are highest among business owners, men, those age 51-60, those advising and in business 25+ years. Lower rates were reported by those who has passed the FASEA exam, and those age 31-40