Riskinfo regularly reports on adviser remuneration and commission-related issues – for good reason – and our article on ClearView’s submission to the Quality of Advice Review was clearly the most important for Riskinfo readers this week…

Further adverse changes to life insurance commission caps could see up to 87% of financial advisers stop providing standalone risk insurance advice “…decimating the life insurance industry and exacerbating the nation’s under-insurance problem,” according to ClearView’s submission to Treasury’s Quality of Advice Review.

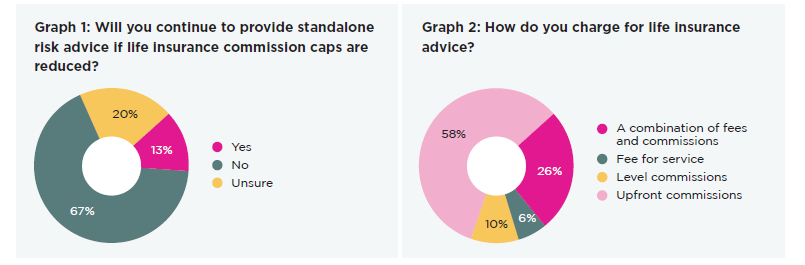

A statement from the insurer says that around 67% of financial advisers would stop providing standalone risk advice and a further 20% are unsure if they would continue, if life insurance commissions are subject to further adverse changes.

According to ClearView’s QAR submission, which is based on a survey of advisers conducted by ClearView between 20 April, 2022 and 23 May, 2022*, the Life Insurance Framework has had no material impact on advice quality since its introduction in 2018 “…and has only quashed the ability of advisers to service clients with relatively simple needs.”

“Instead, the ongoing separation of product and advice – leading to the breakdown of vertical integration and the institutional exodus from personal advice – has had the biggest impact on lifting standards, followed by higher education and training requirements.”

The company says only 5% of advisers believe LIF has had a material impact on advice quality.

The survey also found that the advice industry is heavily dependent on life insurance commission revenue, with 94% of advisers accepting life insurance commissions.

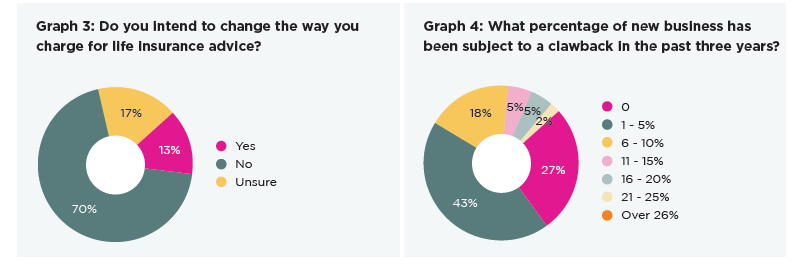

“Furthermore, 70% of advisers do not plan to change the way they charge for life insurance advice and a further 17% are unsure.”

It notes too that almost 70% of advisers do not believe consumers will pay a fee for risk insurance advice, with a further 16% unsure.

ClearView Managing Director Simon Swanson says it is “…critically important for the views and experiences of advisers to be accurately represented to regulators and policymakers to avoid unworkable legislation and poor outcomes.”

…historically [the adviser] voice has been drowned out…

He says advisers are often the ones most impacted by regulatory change “…but historically their voice has been drowned out by the large institutions and their industry bodies.”

Swanson says it’s clear from the research that advisers “…are extremely engaged and want to play an active role in shaping the policies that affect their businesses and livelihoods.”

Since the introduction of LIF, 30% of advisers often turn clients away and 42% of advisers sometimes turn clients away because their needs are too simple and it is impossible to profitability service them, under the current regulatory regime and reduced commission caps.

ClearView says that less than a quarter of advisers believe that current commission caps (60% upfront and 20% ongoing) are appropriate while 73% of advisers believe they are inadequate.

“The sudden, unexpected onslaught of COVID-19 also highlighted the problem with rigid two-year clawback provisions with 62% of advisers indicating that 1-10% of new risk insurance business had been subject to a clawback, due in part to clients suffering financial hardship linked to the pandemic.

The ClearView QAR submission is urging Treasury to simplify advice processes and avoid tinkering with life insurance commission rates to improve advice accessibility, affordability and quality.

“Consumers should be able to choose how they pay for life insurance advice, be that fees, commissions or a combination of both,” Swanson adds.

“LIF is not perfect but it is better than some of the alternatives that have been suggested including a complete ban of commissions. Further changes are unnecessary and would have many potential unintended consequences including fewer people seeking professional advice, fewer advisers providing life insurance advice and the financial cost of caring for the sick and injured falling back on families, society and the government,” he says.

*The ClearView Quality of Advice Survey was an online survey of financial planners conducted by ClearView between 20 April, 2022 and 23 May, 2022. An invitation was emailed to around 4,000 financial advisers that currently use ClearView products. The total number of completed responses was 403 advisers.

The Australian regulators, recent and current Government must be the most ignorant and stupid people on the face of the planet NOT to see what happened in the UK and learn from it. All the utter craziness playing out here has already occurred in the UK with it all being revoked and higher commissions being reinstated as a way to save the life insurance industry there.

For our regulators and our Governments to not have the brains to look at the mistakes made elsewhere and learn from them, shows exactly how blind, dumb and ignorant they really are.

Seriously…are these people kindergarten children?

JADN, Well said and very much the thoughts on many adviser minds currently. On the surface, based on their actions, it would indeed seem to be stupidity or at best not listening or understanding. To expand a bit, I think there is more self-interest than stupidity in play here. No public official could be quite AS “stupid” as you say, certainly not if they are in possession of all the facts. Even so – knowing the facts – the self interest takes over and will always trump the interests of advisers and consumers. Politicians ONLY care about consumers to the extent that it does not impinge on their re-election chances.

Therefore, in kowtowing to the lefty special interest groups, ind super funds, consumer advocates (against commissions across the board!) and the life company execs who want coms DOWN or gone and clawback INcreased then YES, politicians will say damn the consumer best interest. They conclude, it is a GOOD LOOK for us to reduce commissions so let’s do that. Best way to keep ‘most’ people happy and it is ‘most’ people who will vote in our favour.

So, rather than the stupidity, is is a calculated perverse self interest play. They should all be sacked and have charges laid for the damage they’ve done to people’s lives and the economy. I’ve always said the running of a country is FAR too important to entrust to UNQUALIFIED, way overpaid and clearly self interested politicians.

Comments are closed.