Raising an eye this week was our story on AFCA’s Data snapshot for the year to June 30, in which complaints related to life insurance and life insurance companies paled by comparison with general insurers, banks, credit providers and super fund trustees/advisers…

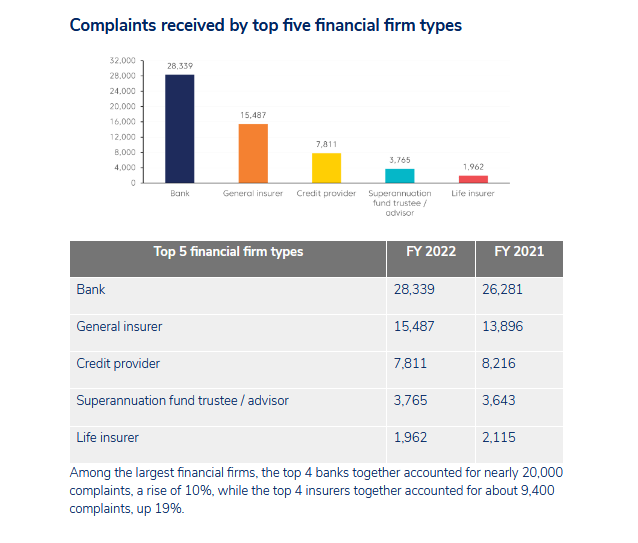

Australians in dispute with banks, insurers, super funds, investment firms and financial advisers lodged more than 72,000 complaints with AFCA in the past 12 months, but life insurance complaints and complaints about life insurers were low.

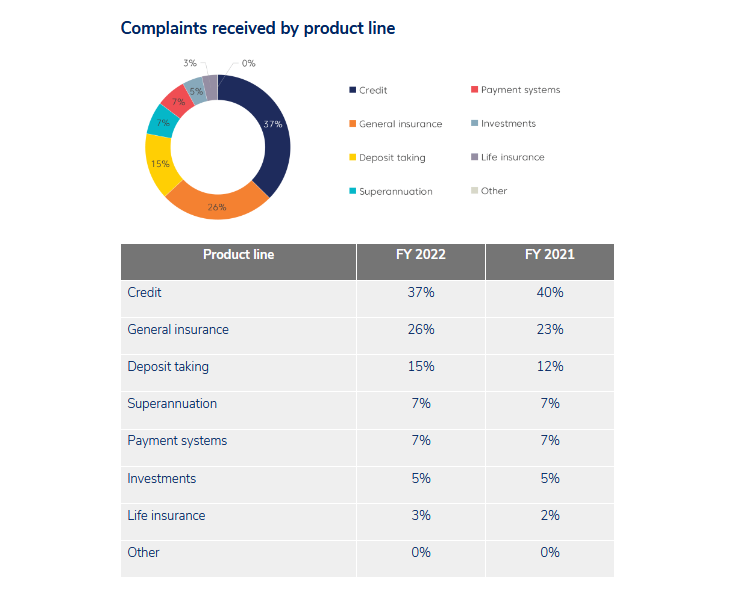

AFCA’s Data Snapshot shows that of the complaints received, only three percent were about life insurance, albeit up from two percent in FY2021, and that complaints received by the top five financial firm types saw life insurers with the lowest complaints at 1,962 down from 2,115 in FY2021.

In total, 72,358 complaints that were lodged with AFCA – a rise of 3% on the previous financial year – and 71,152 complaints were closed, according to the authority. (See also: Life, Advice Complaints to AFCA Minimal).

The Main Product Issues

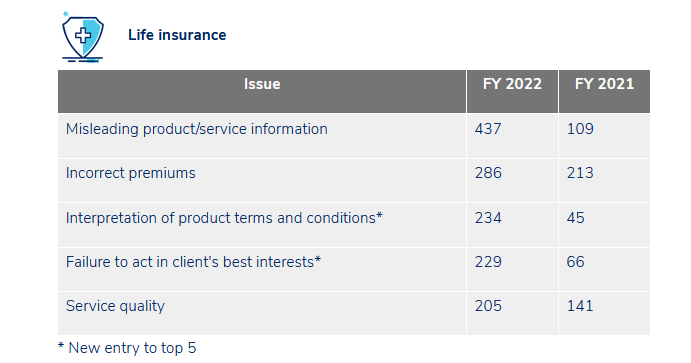

In the life insurance product category, the leading complaint issue was misleading product/service information, followed by incorrect premiums, interpretation of product terms and conditions, failure to act in a client’s best interests and service quality:

Click here to access AFCA’s 2022 Data Snapshot.