The Federal Treasury has issued a consultation paper on financial adviser education standards which proposes removing the requirement for a bachelor’s degree if an adviser has 10 years’ experience, a clean record and has passed relevant exams.

Assistant Treasurer and Minister for Financial Services, Stephen Jones, says in a statement that “…by treating seasoned, respected advisors like undergraduates, the previous …Government drove much-needed experience out of the industry without addressing quality of advice standards.”

The paper, which reflects a commitment made late last year by the current Government while in Opposition (see: Labor Would Scrap Bachelor’s Degree…), also proposes several options for amending current education requirements on new industry entrants.

Jones says the Government is committed to improving the overall professional qualification framework to attract talent back into the industry.

the consultation paper “…is an opportunity to revisit the education requirements for existing advisers

The report itself states in summary that the consultation paper “…is an opportunity to revisit the education requirements for existing advisers, specifically those who have significant on-the-job experience.”

It says that in particular, it is an opportunity to explore how the Government’s election commitment to remove tertiary education requirements for 10-year advisers of good standing who have passed the exam could be implemented.

It also presents an opportunity to explore the requirements for new entrants to ensure they remain appropriate and continue to facilitate improvements in the quality of financial advice.

The paper says the Government understands the importance of removing barriers to entry into the financial advice profession and ensuring it continues to develop into a career of choice.

“Without compromising the progress that has been made towards professionalisation, the Government wants to ensure that the standards for financial advisers strike the right balance between valuing formal education and on-the-job experience, whilst continuing to ensure consumer trust and confidence in the advice they receive.”

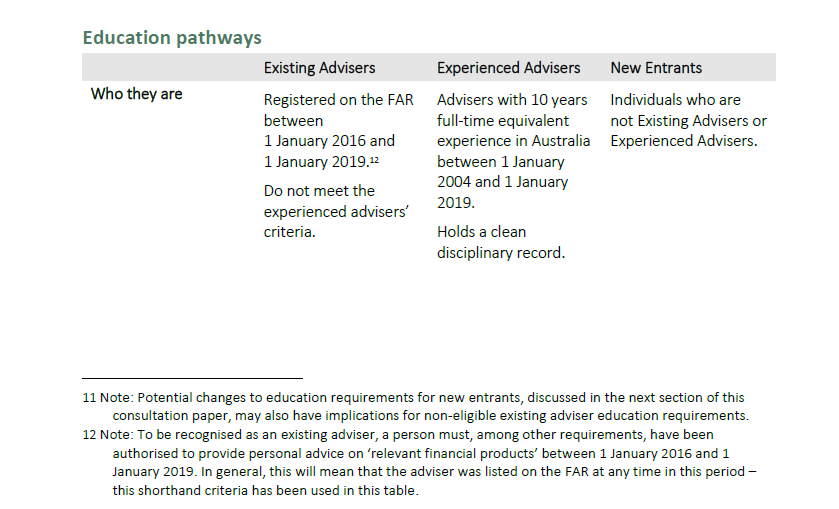

Looking at options to amend current standards for existing advisers, the paper notes the Government’s election commitment to remove the requirement to undertake any additional formal study to meet the education standards for ‘experienced advisers’.

“Experienced advisers would still need to pass the exam. To implement this commitment, a new pathway could be introduced, in addition to those for existing advisers and new entrants. This consultation paper seeks feedback on the proposed eligibility criteria for this new pathway.”

…to access this new pathway an existing adviser would have to meet defined eligibility criteria…

It says that to access this new pathway an existing adviser would have to meet defined eligibility criteria.

Those who did not meet these criteria would continue to be required to meet the current education requirements for existing advisers – at most, an approved eight-unit graduate diploma by 1 January 2026.

10 years’ experience

The paper explains that to fulfill the 10 years’ experience requirement, “…advisers will be required to have had 10 years of full-time equivalent experience in the 15 years between 1 January 2004 and 1 January 2019 in Australia.”

The 10 years would not have to be consecutive. It says that 10 years of full-time equivalent experience out of a 15-year window allows consideration for time out of the industry and part-time work.

“Importantly, the period between 1 January 2004 and 1 January 2019 covers significant historical events, such as the global financial crisis, ensuring eligible experienced advisers have lived experience in volatile economic conditions. Additionally, this ensures that the 10 years’ experience is relatively contemporary.”

Clean Record

To access the experienced pathway, advisers would be required to have a clean disciplinary record.

The paper states that this criterion is intended to act as a quality assurance mechanism “…to prevent advisers who have demonstrated misconduct from accessing favourable arrangements, thereby protecting the integrity of the financial advice profession and ensuring consumer protection.”

Click here to access the consultation paper, for which submissions will be open until 16 September 2022.