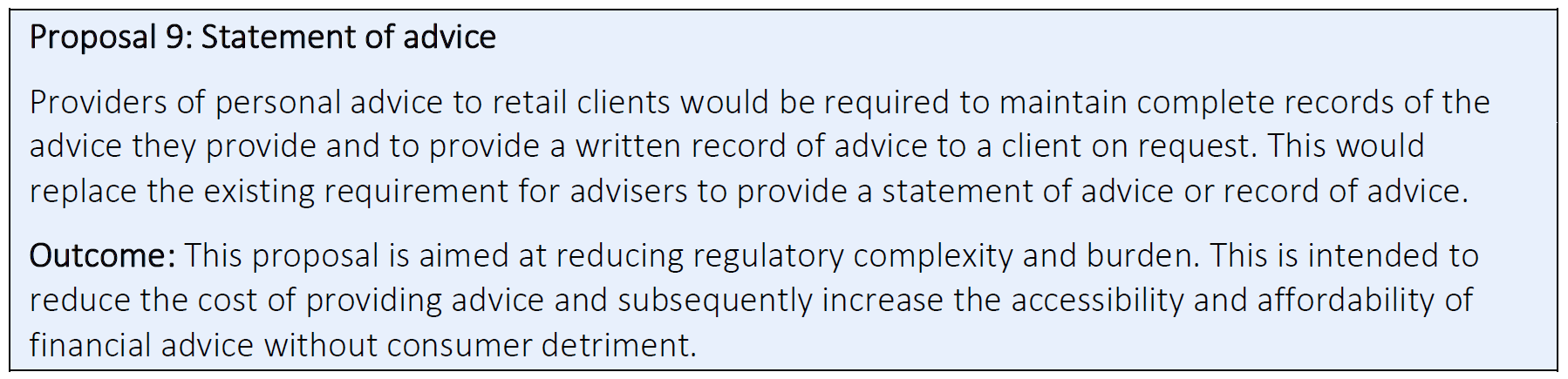

The Federal Treasury has released a consultation paper outlining the interim findings and reform proposals for Michelle Levy’s Quality of Advice Review, in which some of the key recommendations include scrapping Statements of Advice and replacing the Best Interests statute with a new ‘good advice’ requirement.

The interim report, which includes 12 proposals, recommends the removal of a significant raft of compliance requirements – including the abolition of annual fee disclosure statements – which are impeding advisers from delivering affordable advice to many Australian consumers, but it falls short of making any recommendations in relation to addressing life insurance commission caps.

In her introduction, the independent reviewer notes the purpose of the Review is to consider whether changes should be made to the regulatory framework applying to financial advice to improve the accessibility and affordability of financial advice:

…the changes need to be substantial if financial advice is going to be widely accessible and truly affordable

“My answer to that question is ‘yes’”, says Levy, adding she thinks the changes need to be substantial if financial advice is going to be widely accessible and truly affordable.

She says it is clear the current regulatory framework is a significant impediment to consumers accessing financial advice and that it is also preventing advisers and institutions providing advice and assistance to their customers:

The proposals in this paper are intended to make it easier for consumers to access financial advice…

“The proposals in this paper are intended to make it easier for consumers to access financial advice that meets their needs from a range of different providers and for advisers and financial institutions to have more helpful conversations with their customers.”

Levy notes some stakeholders might be concerned that the proposals would retract what she refers to as hard fought changes intended to protect consumers, to which she responds:

“I do not hold that view. The proposals are intended to make it easier for consumers to get personal advice. Therefore, they are also intended to make it easier for providers of financial advice – financial advisers, product issuers and digital advice providers – to provide personal advice. In my view this greater ease is achieved without introducing a corresponding risk of harm to consumers, who will be protected by a proposed new obligation to give good advice and by the many existing consumer protection provisions in the law.”

Life insurance commission caps

The consultation paper notes it does not include any proposals in relation to life insurance and general insurance commissions because the Treasury is still collecting information on these and other areas. It says it expects to receive life insurance data from ASIC by the end of September 2022.

The paper adds that while it is not intending to release another proposals paper, the Treasury will continue to discuss proposals as they are developed and that there will be an opportunity for stakeholders to provide further feedback.

Riskinfo will shortly report more details in the consultation paper recommendations, but in the meantime, advisers can click here to access a copy of the Quality of Advice Consultation paper – Proposals for Reform.

Finally some common sense starting to come into the debate, unfortunately too late for many good advisers fed up with the over-regulation of the past decade.

Well put Leighroy, it is interesting to contemplate if the politicians, industry ‘entities’ and heads of insurance and investment companies who conspired to collapse our industry will ever be held to account for decimating businesses of advisers and driving advisers OUT of their precious industry – advisers with irreplaceable multi-decade experience of people skills and insurance advice.

These advisers, typically older complaint-free advisers loyal to their clients that are now PERMANENTLY GONE – no ‘good words’ or even actions can bring them back now after being forced to sell their businesses with a lifetime of clients contained therein. These advisers and their exceedingly rare experience have been pissed up against the wall by cloistered academics, bureaucrats making their name and corporate heads more interested in next Friday’s pay cheque and quarterly bonus. All these self absorbed entities, of course, have never had a conversation of any merit with a client or sat at the coalface of our industry in any meaningful way – client facing I’m talking about. These are the people making decisions WITHOUT meaningful interchange with advisers to find out the RIGHT things to do to truly make a difference. Michelle Levy is tinkering around the edges until she reinstates 100% commission and 1 year claw-back for risk. End of story.

Mention of this heinous crime against Australians – pushing experience OUT of the industry – is never made by the politicians ‘saying’ they want to fix things – nothing ever about compensation to the advisers they pushed from the industry with ill-prepared, inappropriate and onerous educational requirements and punitive so-called ‘ethics’ exams. Risk advisers have have NOTHING done for them and zero consideration from any decision makers in this whole malaise, instead just made to face the gas ovens..

While it is excellent that Michelle Levy is looking strongly at removing so much unnecessary compliance burden and advice documentation (Goodbye SoA – we can only hope!) I find it unnerving there’s been no mention of risk commissions. I’ve always maintained that unless we have a return to 100% commissions the industry will not recover.

Our once great industry has been on its knees too long for 80% to make a recovery possible. If new entrants are to find it attractive to join and endure the first number of years without a regular income then this level of remuneration (100%) is not negotiable in this context. There’s simply no valid argument against this. It is a win/win for the client/adviser and is inconsequential to any risk of so-called ‘churning’.

If Michelle Levy or any do-gooder industry entity with influence over this starts talking about fees for risk advice again then, my good colleague, know sadly that it is all over at that point. Further and intertwined with a return to 100% commission is a the requirement for a reduction of responsibility period to 1 (ONE) YEAR – as it was and worked well to support our industry perfectly for DECADES. It is entirely untenable to have hard-earned income at risk for 24 months – just unprecedented in corps law and inappropriate for any client-centric desired outcome. How the life companies got 2 years ratified for their clear financial gain still eludes me. They should continue to hang their heads in abject shame for such anti-adviser collusion.

After 4 decades in this now very-close-to-failed industry, I can promise you here and now that unless these changes are implemented just as I’ve mentioned there will be no risk industry of any note past 2027. The life companies will have a REAL catastrophe on their hands – not the simple ‘inconvenience’ of reduced business flow they currently endure. The people of Australia, too, will have a catastrophe as the types of policies and contractual definitions issuing forth from those dilapidated institutions won’t be worth the paper they won’t be written on (yes, you read that correctly).

its important to read what has just been written before commenting: “The consultation paper notes it does not include any proposals in relation to life insurance and general insurance commissions because the Treasury is still collecting information on these and other areas. It says it expects to receive life insurance data from ASIC by the end of September 2022…” there will be recommendations on life risk commissions…AFTER the data is fully collated.

Thanks Phil, I did read it. I suppose my concern was that the recommendations on commissions were being delayed. What for? There’s been more than adequate discussion about this over the years. What possible ‘further information’ could they be waiting to distil from the atmospheric continuum to make desicions on this that has not been previously canvased and analysed to death?

Yeah..agreed Id like to see some further discussion on it as its broadly misunderstood by the lay community

This seems desperate. When the unsinkable ship hit the iceberg, people scrambled for the Life boats. They didn’t try to patch the hole.

Here is why this is more of a nail in the coffin than a floatation device:

– Lowering the barriers to advice will be great for advisers. Click your heels, fellas: it’s business time! But getting rid of best interest duties is inevitably going to bring about poor client outcomes. The second coming for advice won’t be so forgiving.

– Lowering the barriers to advice to ensure viability of advice going forward only lowers the quality of the product. Not only will the adviser not have to act in the best interests of the client, the advice only has to be “good” enough. Who would be silly enough to buy that? Income Protection has already shed its load to remain viable and what are adviser opinions on the new wave of products? But sure, trim away at the offering from all angles to stay afloat until there is nothing left worth buying. As long as you get paid, right?

– Lowering the barriers to advice means it will be showtime for advisers to collect that sweet, sweet commission again. The higher churn velocity of policies that comes with lower barriers leads to lower profitability for the insurers. This will inevitably lead to the next insurer price war which will be much, much uglier as they are not starting from a high base. The commissions have to come from somewhere and without insurers there are no risk advisers.

– Lowering the barriers to advice does nothing for the ageing adviser population and the ageing life insurance population.

But this is the bed you made. There is a glass of warm milk waiting for you on the side table: now it is time to lay in it and get ready for the long nap.

Comments are closed.