With thanks to the team at Slipstream Group, this article seeks to categorise the various areas to which advisers and advice businesses dedicate their time. The article concludes with a great summary – based on feedback from your peers – of the ten main obstacles they encounter which currently prevent them from business-building activity that will set them on the path to greater success…

What is getting in the way of allocating time to your strategy and project work each quarter?

Our clients faced this question at their recent accountability meetings with their respective Slipstream coaches. Whilst some clients have certainly mastered their time management, others acknowledge they struggle and have identified what holds them back.

Those who find spending time on strategy, project, and creative work a challenge identified their top obstacles as:

- Days filled with admin and money-earning work (i.e. red/blue work)

- Failure to plan enough time to achieve all tasks.

- Finding it quicker to complete tasks than to delegate them to others.

Colour-Coding Business Priorities

We encourage firm owners to find capacity by colour-coding tasks to become more efficient. Owners who follow this plan free up the time needed to execute their projects. Our coaches have found that financial planners who truly focus on capacity and time management tend to get to where they want, faster.

Work and personal time should be planned in a 90-day cycle. The 90 days should incorporate annual leave, public holidays, and personal development etc and leave an allowance for unforeseen circumstances such as sick days.

Whilst we are unsure who originally came up with the Red, Blue and Black colour coding concept, our Director of Coaching, Scott Charlton, has used this framework as a basis and added his personal stamp of ‘Gold’ time.

Red – Keeping the Doors Open

Red refers to general business administration and non-chargeable tasks such as payroll, HR, premises, IT, compliance etc. If you are not careful, red activity can take up most of your day. Many of these tasks can be outsourced. We encourage you to restructure the responsibilities of your team to move as many red tasks off your desk as possible. A winning formula is limiting the time spent in red to 20% or less.

Blue – Earning Today’s $$

In blue mode, you concentrate on ‘doing the work’. Delivering on client work, proposals, invoicing, scheduling, and client face to face time. This is comfortable territory for Accountants and Financial Planners. The ideal amount of time spent in blue for working principals is approximately 60%.

Black – Building Your Firm of the Future

Planning, strategising, projects, budgeting, future resourcing, and establishing systems are among the key tasks that sit in black mode. Ideally, you want to spend 10% of your time in black. One thing to note, is that black and gold activities are hard to dip in and out of, and as such, require larger blocks of time. Keep that in mind when planning our your 90-day rhythm. The more quality time you’re spending in black, the more you’re building a better business for tomorrow. Without black tomorrow looks like today.

Gold – Capturing and Developing Secret Sauce

This is when you are going to be working on the things that set your firm apart from the rest – the products/services tailored to your ideal clients, the research into what the needs those clients have, developing strategy papers and content. You don’t want interruptions during these activities. Give thought as to when you are going to be at your inspired best. Some people book an extra day after a conference or after a coaching meeting for such activities. This is when you are out of your normal environment and likely to be thinking more strategically.

Top 10 Obstacles to Black and Gold Productivity

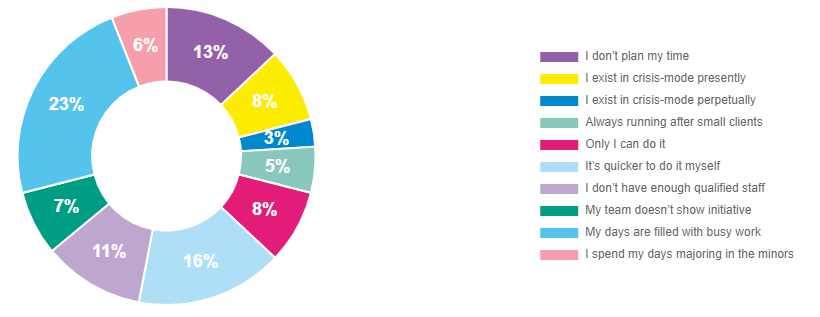

Spending too much time in red and blue can squash your growth potential as it’s the time spent in Black and Gold that propels a firm’s growth and strategic direction. Slipstream Group surveyed a panel of practitioners to find out what keeps them from dedicating more of their time to building the firms of their future. Here’s what we discovered:

The second part of this two-article series, to be published shortly, delivers a ’12 Quick Wins’ checklist to help advice businesses find more capacity…

Slipstream Group Director of Coaching, Scott Charlton. Slipstream Group delivers business coaching services for financial planning and accounting firms. Its team of professional consultants seeks to make a massive difference to owners of financial planning and accounting businesses in which its group coaching and bespoke consulting projects assist firms to grow revenue, maximise profit, work through succession planning matters, improve lifestyle, enhance team engagement and above all run a better business.

Slipstream Group Director of Coaching, Scott Charlton. Slipstream Group delivers business coaching services for financial planning and accounting firms. Its team of professional consultants seeks to make a massive difference to owners of financial planning and accounting businesses in which its group coaching and bespoke consulting projects assist firms to grow revenue, maximise profit, work through succession planning matters, improve lifestyle, enhance team engagement and above all run a better business.