Our report on the decline in retail income protection insurance new business sales – sadly – is the Riskinfo Story of the Week…

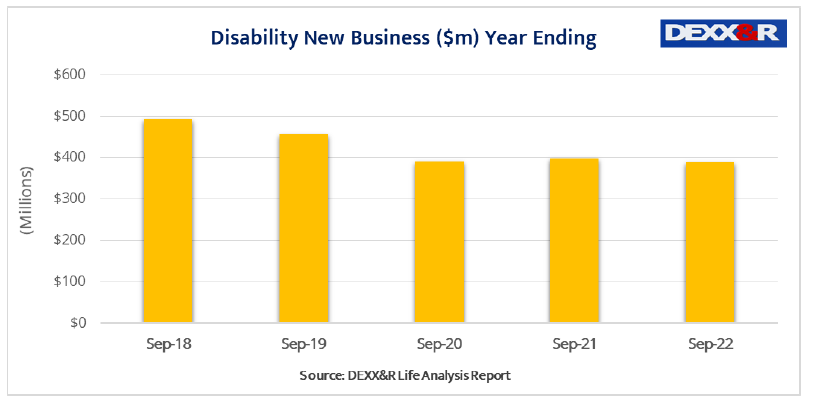

Disability income new business hit an 11-year low over the year to September 2022, according to the latest data from DEXX&R, but discontinuances remain at historically low levels.

The research firm’s Life Analysis Report for the September 2022 year says that disability income new business decreased by 2.6% to $388 million, down from the $399 million recorded in the 12 months to September 2021, citing this as an 11-year low.

DEXX&R also found that individual risk lump sum new business was down 11.4% to $912 million from the $1.03 billion recorded in the year to September 2021.

DEXX&R also found that individual risk lump sum new business was down 11.4% to $912 million from the $1.03 billion recorded in the year to September 2021.

It says that amongst the top five companies TAL recorded an increase of 6.6% in individual lump sum business to $156 million. AIA Australia recorded a 16.7% increase to $128 million over the year.

Meanwhile the research firm also points to total individual risk sales being down 9% in the year to September 2022 to $1.3 billion.

Meanwhile the research firm also points to total individual risk sales being down 9% in the year to September 2022 to $1.3 billion.

Total risk in-force premium increased by 3.1% at the end of the year to September 2022 to $16.3 billion, up from the $15.8 billion recorded at September 2021.

Discontinuances

Under individual lump sum discontinuances DEXX&R found the attrition rate was unchanged at 9.1% in September 2022 when compared to the attrition rate at September 2021.

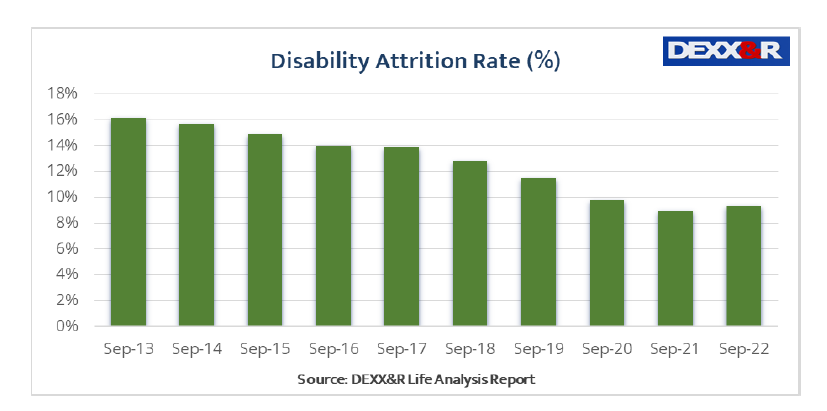

As to disability income discontinuances, DEXX&R says the attrition rate increased for the first time in nine years, up from the 9% recorded in September 2021 to 9.3% for the September 2022 year.

The firm notes that discontinuances remain at historically low levels “…indicating that not withstanding the small increase during the years to September 2022 retention levels remain at a higher level than that applicable over the past 10 years.”

It says this trend is expected to continue “…as the terms and conditions offered by existing products are significantly more favourable than those offered by current onsale products.”

The report includes data on all risk business issued by life companies from their statutory funds.

The report includes data on all risk business issued by life companies from their statutory funds.

Five hundred years ago the Scottish poet ,Robbie Burns, in discussing the future of the field mouse, said “the best laid schemes of mice and men gang aft agley”

Quite clearly no one over at Apra studied poetry at school. All human nature that matter.

This was all totally predictable. Experienced risk advisers took one look at the new post October 2021 income protection “market offerings” and decided there was incredible risk for them and their clients if they agreed to a client’s request to find them an income protection policy that didn’t “cost an arm and a leg”.

Most life insurers now quietly confirm that there was no real consultation between the storm troopers at Apra and the life insurance manufacturers that Apra were supposed to be regulating. This was all driven by aggressive recently- arrived management at Apra. It was the classic military 101 tactic for close quarter fighting – a toss of the grenade into the room, without looking, walk out, slam the door, move on.

By October 21 most risk advisers had sat and passed the FASEA exam, and had become extremely aware of the implications of failure to meet Standard 5. That’s the Standard that imposes communication rules and requires the adviser to have a reasonable basis that the client has not only understood the advice, and its general implications, but also the particular implications of the advice for that particular client. Standard 5 sets up the classic “he never told me that” complaint!

What these figures also represent is absolute proof of the good work of life risk specialists. Where they have been able to sit in front of a complaining client, who is frothing at the mouth, having received their latest premium increase, the advisers have been able to explain the severe implications of swapping an agreed value legacy product, with full features and benefits, for something that can only be described, in income protection terms, as absolute rubbish.

“IP business hits an 11 year low, but lapses are at the same rate!.” They discontinuances probably represent only those clients who couldn’t be bothered ringing their adviser. Those figures could also represent those income protection policyholders who had lost their adviser to the ravages of LIF.

Those un-advised IP policyholders weren’t to know about strategies involving reducing benefits, and/or reducing benefit periods, and extending waiting periods, in order to make their contracts possibly more affordable. That takes an experienced specialist life risk adviser acting in the best interests of the client.

And new IP business down 9% just in the last year! I suspect it’s down 50% since October 21 but of course no one is admitting that, not yet.

If the IP industry was a surgical patient, the surgeons would be contemplating “going back in”

‘Old Risky’ has hit the nail on the head. His comments are gold and show deep insight. I feel I could be writing them myself as I agree with most all he says. What a crying shame it is only the ‘converted’ (like me) that reads his comments and they never see the light of day in Canberra. Being ‘out’ as of Dec’21 I can say it is still very sad for me to watch our once great risk industry sink this low, knowing it has a long way to go yet to reach bottom. Bottom, or the final exodus of advisers, will more than likely happen with a bang in a 6 month period just prior to the 2026 degree requirements where riskies will be forced to get FULL financial planning qualifications. APRA will have a job on its hands keeping the life companies afloat then! Let’s hope those statuatory funds are healthy because there won’t be any income arriving through the front door after that. What a mess. Uni quals for a risk adviser . . . a bit like an orthopeadic surgeon being forced to be fully qualified as a heart, brain, liver and gastro specialist as well. Politician lunacy and consumers suffer along with the advisers. Great jobs politicians!

Comments are closed.