Latest APRA data reveals that Individual Disability Income Insurance profits have resulted in the industry recording a net profit of $1.1 billion for the year ended 31st December, 2022.

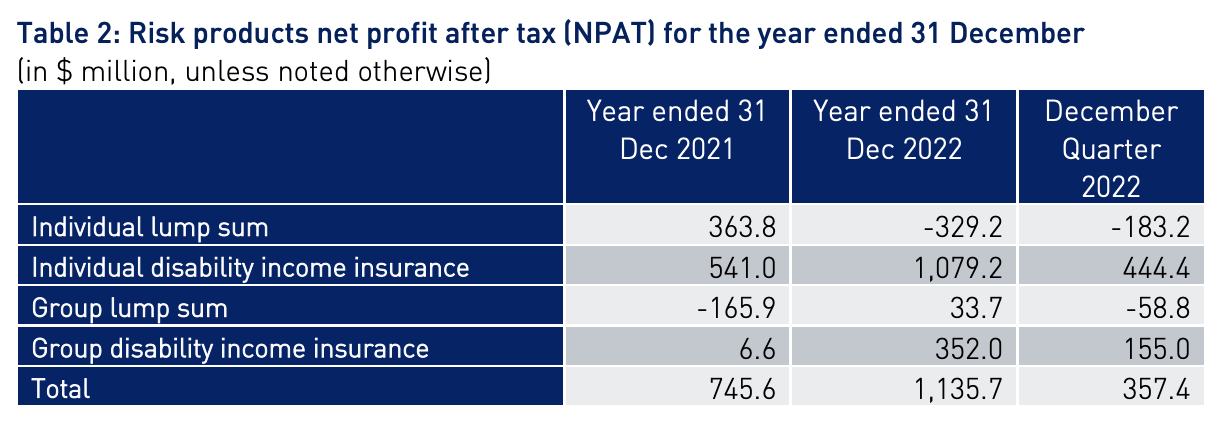

The corporate regulator’s Quarterly Life Insurance Performance Statistics for December 2022, released last week, reports an improved result for the sector, recording an overall profit of $1.1 billion compared to profits of $745.6 million for the year ended December 2021.

This result was largely driven by $1.1 billion profit recorded by Individual Disability Income Insurance (Individual DII) business, which itself is attributed to factors including:

- Movements in bond yields

- Repricing activities

- Releases of COVID-19 reserves throughout the year

The report also highlights that Individual lump sum business reported a loss of $329.2 million and was the only risk product to report a loss, which can largely be attributed to an increase in net policy expenses.

Group Lump Sum and Group Disability Income Insurance (Group DII) business reported profits of $33.7 million and $352.0 million respectively for the year ended 31 December 2022. APRA notes that this is an improvement in performance for both products in comparison to the prior year, and was driven primarily by lower net policy expenses for Group Lump Sum business and reserve releases for Group DII business.

Click here to access APRA’s highlights report for its December 2022 Quarterly life insurance performance statistics.