The substantial increase in ASIC’s adviser levy cost recovery estimate for 2022/23 has generated significant interest and a strong reaction by the sector during the last week…

ASIC has published its Cost Recovery Implementation Statement for 2022-23, detailing its estimated levy for financial advisers.

The summary of estimated industry funding levies for the financial advice sector lays out a minimum levy for AFS licensees of $1,500 plus $3,217 per adviser.

Under the Government’s temporary levy relief for financial advice licensees the ASIC levies were restored to their 2018-19 level of $1,142 per adviser for the financial years 2020-21 and 2021-22. Earlier this week Government announced this would not be extended (see: No Extension to Adviser Levy Relief.)

The regulator’s 2022-23 CRIS points to 2,655 AFS licensees, that provide personal advice to retail clients on relevant financial products, with 16,019 advisers.

ASIC’s estimated cost recovery amount from this subsector is $55.523 million.

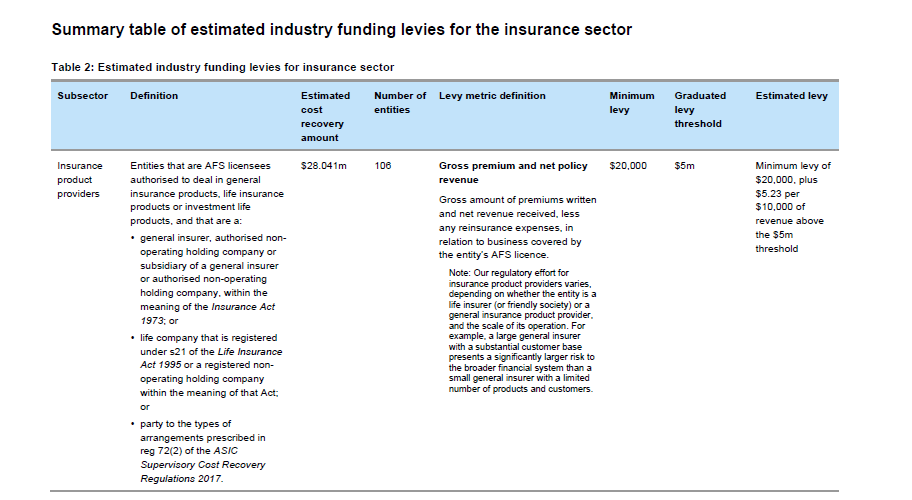

Meanwhile, the CRIS documents also show that insurance product providers’ estimated minimum levy is $20,000, plus $5.23 per $10,000 of revenue above the $5m threshold. It states there are 106 product providers.

ASIC adds that the estimated levies are a guide only and final levies will be based on ASIC’s actual cost of regulating each subsector and the business metrics submitted by entities.

Final levies will be published in December 2023 and invoiced between January and March 2024.

It is a constant battle, as different Government entities vie for Government funding and then try to find creative ways to offset the vast amounts that Tax Payers put into their coffers, by coming up with “Cost recovery” calculations that seem to defy logic or fairness.

The loss of twelve thousand Advisers, due to the maze of compliance and red tape that is now being unwound, should be a beacon to show that “what was,” did not work, yet remaining Advisers today, are expected to pay for the mistakes of the past, with the innocent paying for the sins of the guilty.

Advisers paying for the wages of Regulators who accept that the miasma was a mine field that created hell for Advisers and massive financial losses for the entire Australian economy, would fail any Best Interest Duty.

The FAAA have articulated the issues, though need to go harder and say they as an organisation will not accept the levy and it MUST be adjusted down to a level that is fair and correlates so the guilty pay and the innocent are rewarded.

Comments are closed.