Easily the most engaged story among Riskinfo readers this week was our report on AFCA’s top ten tips for advisers…

Advisers around the country have been given valuable insights into the workings of industry complaints body, AFCA, including the authority’s top ten tips for advisers.

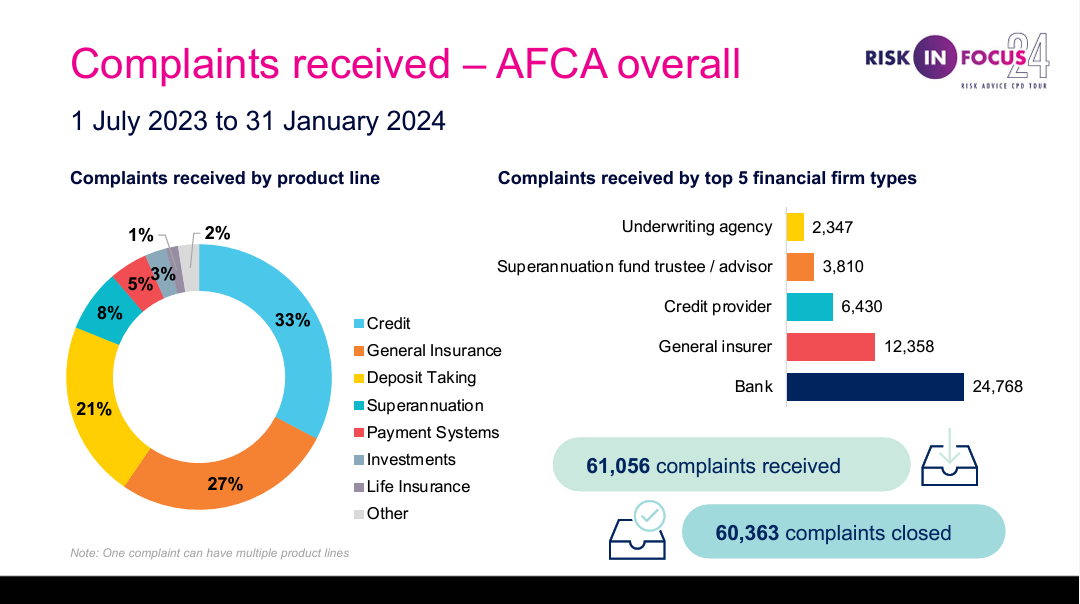

Speaking with audiences at the Riskinfocus 24 Risk Advice CPD event series last month, AFCA’s Lead Ombudsman Investments and Advice, Shail Singh, provided a breakdown of the authority’s complaints data, including the proportion relating to life insurance products and life insurance advice.

The following chart summarises consumer complaints received by the Australian Financial Complaints Authority by product line in a seven-month period commencing from 1 July 2023. It reveals life insurance products accounted for only 1% of the 61,000+ complaints it received:

During the same period, of the 61,000+ complaints received by the authority, only 50 related to life insurance advice:

While only based on small numbers, the data indicates income protection was the top complaint area in relation to life insurance advice, followed by TPD and term life complaints.

…60% of the complaint determinations were resolved …in favour of the advice firm

Also of note is the fact that 60% of the complaint determinations were resolved by AFCA in favour of the advice firm, with 40% in favour of the complainant.

Singh also outlined AFCA’s connection with issues attaching to the Government’s Compensation Scheme of Last Resort and the implementation of the Quality of Advice Review.

He also worked though a number of insurance advice complaint case studies, outlining why some of the outcomes favoured the adviser while others found for the complainant.

Top Ten Tips for Advisers

Of pivotal importance in some of these case studies was the existence (or lack) of thorough file notes made by the adviser, a critical point which Singh stressed a number of times and which also featured prominently in his top ten tips for advisers, as detailed in this summary:

Editor’s note: Riskinfo sincerely thanks AFCA Lead Ombudsman Investments and Advice, Shail Singh and Ombudsman Patrick Hartney (Sydney event), for AFCA’s commitment to engaging with the Australian financial adviser community as a valued contributor to the Riskinfocus 24 Risk Advice CPD Tour event series.

Editor’s note: Riskinfo sincerely thanks AFCA Lead Ombudsman Investments and Advice, Shail Singh and Ombudsman Patrick Hartney (Sydney event), for AFCA’s commitment to engaging with the Australian financial adviser community as a valued contributor to the Riskinfocus 24 Risk Advice CPD Tour event series.