Piquing readers’ interest this week was the news that while no licensee segment increased its numbers over the past year, the large private licensee market shrank only marginally…

While no licensee segment increased its numbers over the 12 months to the end of the financial year, the large private licensee market (100-plus) shrank by only 2%, according to Adviser Ratings.

In looking at adviser numbers at the end of the 2022-23 financial year, the research firm also notes, in an article on its website, that “…once again, limited licensees and banks said goodbye to the highest proportion of advisers across the financial year…”

Limited licensees lost 48% of their advisers, while banks lost 27%.

…collectively, privately-owned boutique, mid-size and large licensees now oversee more than two-thirds of advisers…

The firm adds that collectively, privately-owned boutique, mid-size and large licensees now oversee more than two-thirds of advisers.

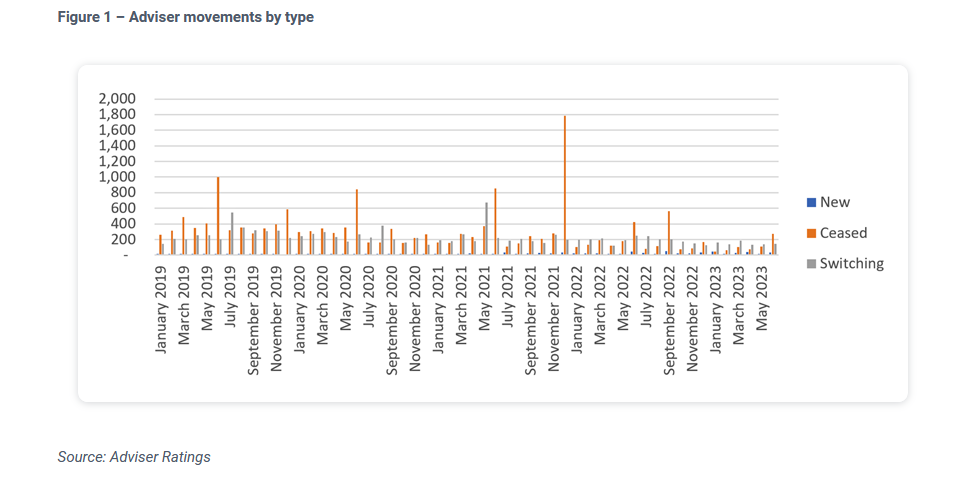

In its end-of-year analysis, Adviser Ratings says that while adviser numbers are generally improving “…we witnessed the usual bump in exits at the end of the last financial year.”

It says that after a mostly stable year, hundreds of advisers exited the industry in the month of June – a trend that’s broadly in line with what it has seen in the past (also see: Adviser Numbers for FY2022-23).

“With 275 departures, June was the busiest month for industry farewells since September last year, which was just before the exit deadline for advisers who had twice failed the professional standards exam. Across the most recent financial year, there were more than 1,700 exits, a third of which happened in September.”

It says that in the past, the rate of departures in June has been slightly higher, as advisers have looked to avoid ASIC’s levy on licensees.

It says that in the past, the rate of departures in June has been slightly higher, as advisers have looked to avoid ASIC’s levy on licensees.

…the past financial year is the first one we’ve seen since 2018 in which monthly exits have typically been in the dozens, rather than hundreds…

“This year’s June adviser exits follow several months of very quiet activity. In January, just 46 advisers left – almost the same as the number of new entrants. In fact, the past financial year is the first one we’ve seen since 2018 in which monthly exits have typically been in the dozens, rather than hundreds.”

Adviser Ratings says that given these trends “…we expect numbers to continue to stabilise and hover around the 15,000 mark, especially as some advisers are buoyed by the more positive QoA Review changes.”

Earlier in the year, the firm’s survey data found “…almost four-in-five advisers intended to stay in the profession after completing the bulk of their requirements and investing in their practices. A further one-in-10 said they were unsure, with many in that camp awaiting further word from the Government about the QoA Review implementation.”

It adds that in the weeks following the release of Financial Services Minister Stephen Jones’ roadmap “…advisers have shared mixed reactions to the reforms. Positive sentiment has been expressed towards efforts to reduce the compliance burden and duplication, while there has been skepticism and concern from some advisers about plans to allow non-relevant providers to offer advice.”

As to new arrivals through the financial adviser pathway, the firm says it’s still seeing “…more of a trickle than a flood. Across the financial year, 366 new advisers were added to the Financial Advisers Register. As such, the ratio of exits to entrants is still close to 5:1.”