More than 30% of advice practices closed their doors during the pandemic, while the broader Australian economy thrived, according to Adviser Ratings, which has delved into the industry’s “reinvigorated sense of purpose and direction.”

The research firm says that in stark contrast to the broader Australian economy, which experienced a surge buoyed by government support during the Covid pandemic, the financial advice sector faced its own unexpected downturn.

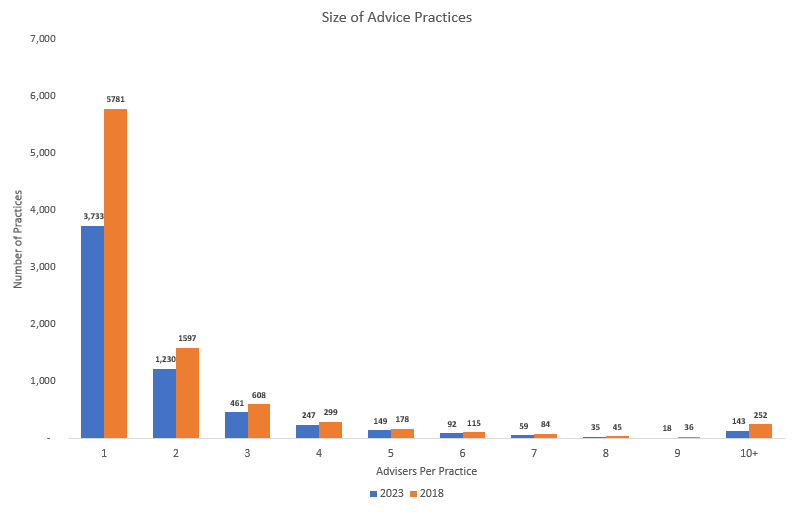

“A staggering 2,828 advice practices, constituting over 30% of the market, closed their doors,” Adviser Ratings says (see chart below).

Decline in advice practice numbers

While many sectors flourished or were bolstered by government interventions, “…financial advice practices paradoxically grappled with a legislatively-imposed recession, highlighting the complex interplay of industry-specific challenges amidst nationwide economic resilience.”

The report reveals that the 8,995 advice practices in 2018 had dropped to 6,167 in 2023:

Advice practices by size and number of advisers (2018 v 2023)

The research company adds that now, on the precipice of potential economic downturns and a massive generational wealth shift “…the importance of qualified financial advice has never been more pronounced.

“The complexities of modern financial markets against a backdrop of geopolitical uncertainty coupled with a potential real recession across the broader economy, mean that individuals and families, now more than ever, need guidance in navigating their financial futures.”

It also points to the imminent transfer of wealth to younger generations as post baby boomers age, adding that this transfer not only represents significant monetary sums “…but also a shift in financial attitudes, investment preferences, and a need for advice that aligns with changing values.”

the government …has listed financial advisers as one of 66 occupations experiencing a severe shortage…

“Unfortunately, there are far fewer advice practitioners – so much so that the government, through Job Skills Australia, has listed financial advisers as one of 66 occupations experiencing a severe shortage.”

Adviser Ratings notes that despite the skill shortage, commercial credit rating agencies have pronounced the sector is in far better shape today “…with those practices left standing on average having a far better credit rating … than the average from several years ago.”

“Accordingly, perhaps the profession envisaged, as part of the endless reforms or the ‘scorched earth’ approach as described by many, is closer in practice than theory.”

Quoting four different financial planners, the firm highlights that with this drop in adviser numbers, advisers see the huge opportunity for those who are committed and who are refining what they do to meeting the changing needs of the population.

…while the reforms were initially disruptive, the tides are turning…

“The consensus among advisers is clear: while the reforms were initially disruptive, the tides are turning. The challenges posed by potential recessionary times, the focus on retirement and the generational wealth transfer have offered a renewed purpose and direction for the sector,” Adviser Ratings says.

It adds that it will take some time to replace the 2,828 practices lost in the last five years “…and the right adviser to service the hundreds of thousands of orphaned clients, let alone the influx of new ones.”

Click here for Adviser Ratings full report.

Supply and demand has always been the main common denominator to revenue growth in ALL Industries.

When red tape, restrictive and unworkable Regulations, combined with lobbying from vested interest groups, uninformed and Politically biased Politicians and Institutionalised Public servants, plus ideologically minded Big Business who when all combined, are too far removed from the real world, is thrown into the mix, we end up with a plethora of words and PR spin, with a collapse of common sense and Business sense.

The collapse of 30% of Advice practices and over twelve thousand Advisers leaving the one Industry that needed more, not less Advisers based on the demand, is an indictment on the above players and they should all hang their heads in shame, though of course they never do and that is why they employ spin doctors and PR experts to sell the idea that a pile of dog poo, is in actual fact a fertiliser of great strength and we must all be congratulated on the vision and pursuit of making the world great again.

Blah, Blah, Blah.

So what we have ended up with in the brave new world of Financial Advice, is a dramatically reduced risk advice Industry, with sky rocketed premiums, fewer and fewer Advisers willing to provide advice in the risk space due to the complexity, red tape, risk and reduced upfront revenue that is a loss making exercise upfront, with a revenue axe hanging over advisers heads, that makes it not attractive to pursue.

With Investment / Retirement Planning Advice, it has been a boom for Advisers who have been able to increase fees and only work with high net worth clients that improves the Advice practices bottom line, though negative impacts are now being borne by middle class Australians who need advice and can no longer access it.

It does not matter which political party is in power, as the main common denominator always raises it’s ugly head as per the above explanation and everyone loses out when COMMON SENSE heads for the exit door.

The solution is easy, has always been waving at the window, though the solution by the vested interest and uninformed brigades, has been to close the blinds.

There are improvements now being discussed, though the solution to banging your head against the wall, has always been to just NOT do it, though in todays world, the inclination is to listen to the inane and based on the last 10 years, insane ideology, make decisions and Regulations drawn up from the asylum and then scratch our collective heads in amazement when the proverbial hits the fan.

We live in a world where the doers are ridiculed and ignored, while the “theory based deep thinkers” who have done nothing, are applauded and encouraged to do more.

This a never ending cycle and a human frailty, where people get bored with what’s good and allow the door to be opened for the nutters to get on the stage and cause mayhem until the hook comes out and they are politely asked to leave, only for them to come back in through the front door wearing different clothes, though with the same inane and insane mindset.

And the cycle continues.

Thanks for the interesting article Risk Info, however you and many other publications keep falling into the same old trap. That trap is lumping all “advisers” together and not detailing the type of adviser to which you refer through the article.

We all know a pure risk adviser is a very different animal to an investment planner so why not offer details and stats for each. Reporting such as in this article is like saying ‘X amount’ of tradespeople left the industry last year. So what? Which ones are you talking about? Plumbers? Electricians? Carpenters? WHICH tradespeople? Same with members of the medical community, for example.

Please, for an organization that calls itself RISK Info, please be a little more accurate with the precise stats that refer to ‘RISK’ advisers as distinct from other types of advisers. You’re not alone – all the publications are guilty of this. Be a trailblazer, show ’em how to do this and start a trend . . .

Comments are closed.