There was much reader interest this week in our report on new research which found nearly half of Australians can’t afford to wait for default disability insurance, and highlighted that Australians support reform to legislated default product design……

New research has found that nearly half of Australians can’t afford to wait for default disability insurance with women the most impacted, and highlights that Australians support reform to legislated default product design.

The research, undertaken by MLC Life Insurance, found that overall 46% of Australian workers have three months’ or less savings in the event of a disability which prevents them from working, with almost a third of women only having one month of savings.

MLC Life says the research challenges the current government-mandated default design of disability insurance to include only TPD “…showing that women are especially vulnerable to loss of income in an environment where TPD insurance requires claimants to sustain a total and permanent disability and sees individuals waiting an average of 2.5 years before they even lodge a claim.”

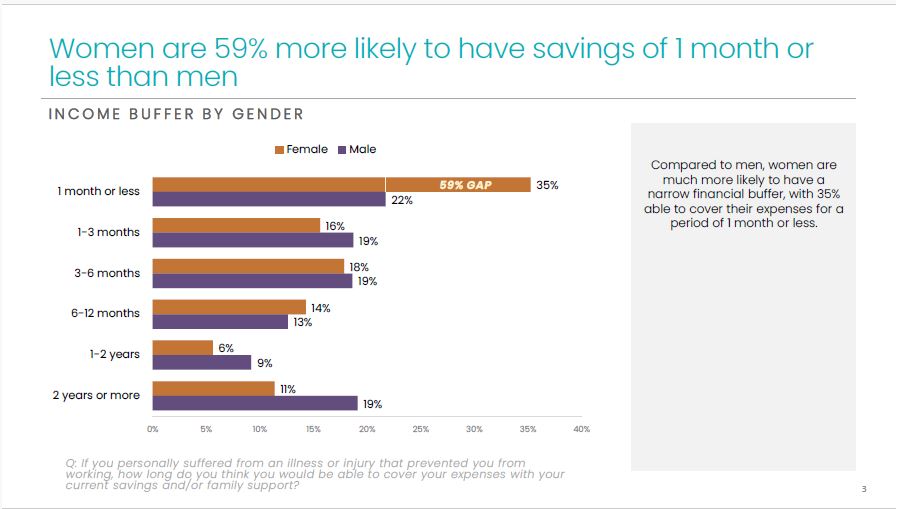

It says that while 22% of men have savings of less than a month, the same is true for 35% of women, demonstrating a 59% gap.

The company quotes research revealing that while 19% of Australian men have a savings buffer of two years or more, just 11% of women live with the same level of financial security.

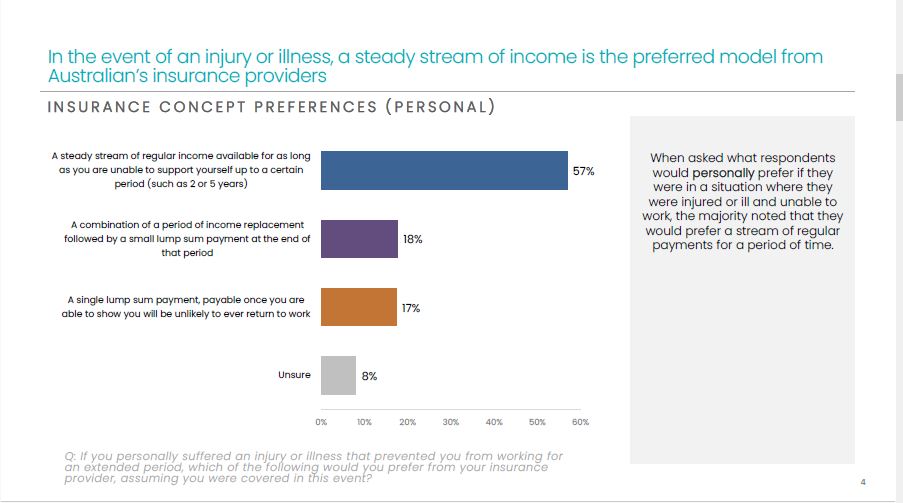

…57% prefer a steady stream of regular income over a lump sum payment in the event of illness or injury…

The research was conducted by MLC Life to explore the evolution of the product design of default TPD insurance. It shows Australians are overwhelmingly in favour of a new approach, with 57% preferring a steady stream of regular income over a lump sum payment in the event of illness or injury.

Kent Griffin, CEO at MLC Life, says the current approach to disability insurance in superannuation is centred on a binary assessment of total and permanent disability.

“…While it works for some, the evolving needs of members and changing nature of disability requires a debate about the most appropriate default disability insurance system that meets these needs.”

He says TPD is a “…crucial safety net for those experiencing severe and long-lasting impairments, however its binary framework falls short in addressing the complex needs of Australians who experience temporary disability through injury or illness which is increasingly common in today’s environment.”

MLC Life says the current regulatory framework has led to most trustees providing only TPD and death insurance by default “…leaving many members reliant on proving TPD without temporary incapacity support to enable them to get back on their feet and focus on recovery.”

It says that while TPD insurance serves a crucial purpose “…its essential terms, lump sum nature and the fact that many TPD claimants ultimately return to work raises serious concerns about its effectiveness and sustainability as part of the current legislated default system.”

“The research shows almost 50% of Australians thought current practice was unacceptable and 60% support changing the current default system if it reduces costs for consumers.”

Mark Puli, Chief Group Insurance Officer for MLC Life, says Australians revealed “…a clear preference for income stream alternatives to lump sum payments in the event of disability.”

He says this preference “…aligns with the reality that many Australians simply lack sufficient savings to sustain themselves for extended periods of unemployment due to temporary disability.”

…under the current lump-sum disability insurance model, a majority of Australians (55%) indicated they would pursue a disability claim even if they anticipated recovery …

MLC Life states that “…alarmingly, under the current lump-sum disability insurance model, a majority of Australians (55%) indicated they would pursue a disability claim even if they anticipated recovery or a return to their previous employment.”

It says this “…stark finding highlights the inherent flaw in the current default disability design, which may incentivise individuals to prioritise meeting the eligibility criteria rather than focusing on their recovery.”

Griffin says people shouldn’t have to choose between their health and financial support “…inadvertently increasing their risk of developing a level of permanent disability that necessitates support under the National Disability Insurance Scheme. This heightened risk places a strain on the sustainability of the entire health and wellness ecosystem and worker safety net.”

The research accompanies the release of a green paper by MLC Life exploring the evolution of disability insurance in super to deliver better outcomes for Australian workers facing illness and injury and superannuation trustees acting in the best financial interests of members.

Puli says MLC Life is determined to work with government, trustees and consumers “…to develop a more equitable and sustainable framework for supporting members with a disability, especially those with mental health-related disabilities.”

He says this framework “…should consider income stream alternatives within superannuation, address the gaps created by a total disability framework and instead focus on health, wellbeing and recovery, and enable a better and supportive interaction between private and public support schemes such as the NDIS.”

The research was conducted by Freshwater Strategy for MLC Life Insurance.

Click here for more information.

Oh here we go. Round one of the PR exercise to sustain an argument that TPD is not sustainable.. This argument is being driven by re-insurers of which we do not have enough operating in Australia. Reinsurers are never happy in any environment and they always come up with reasons to reduce payouts. Anyone want to dispute that statement?

As I’ve said before, I remain of the view, until I see evidence to the contrary, that many insurers are paying out TPD claims where the definition in their policy DOES NOT require the claim to be paid. This is particularly annoying with so-called mental health claims where it’s pretty obvious that some insurers don’t know the meanings of the two words “total” and “permanent”

Anecdotal evidence that I’ve heard says that insurers claims people are reluctant to seek psychiatric specialist opinion on whether or not someone with a mental health illness has a disability that actually matches the definition, which of course is the basis of the premium costing. Apparently they think it’s okay to pay the GP $300 or $400 for a report, but buck at paying $800 plus for a psychiatric report.

This current claims attitude amongst the life insurers contrasts to the WorkCover insurers and the third-party insurers who will never give a permanent disablement benefit for a person claiming total and permanent disablement as a consequence of a mental health condition, without paying for TWO psychiatric opinions

These life insurer-driven machinations I suggest are a direct result of the impact on the self-employed life insurance adviser sector of LIF and FASEA and the utterly predictable 60% loss in advised new business. Of course you won’t get that sort of acknowledgement from this type of self serving report

And as Mr Rice said yesterday in the Senate hearing, we should not be trusting product manufacturers to act in the best interest of clients at all times

Comments are closed.