Attracting strong reader interest this week was our report on a set of guidelines designed to address the challenges advisers face on how to best balance IP and TPD product solutions in their client recommendations…

Advisers confronted by how to best balance IP and TPD product solutions in their client recommendations have been offered a set of guidelines designed to help address this challenge.

Presenting at the Riskinfocus 24 Risk Advice CPD Tour event series under the theme of ‘Solving the Disability Dilemma’, MLC Life Insurance Partner Education Manager, Marshall Ross, shared with advisers latest demographic and other trends which can potentially inform how they can best structure IP and TPD product recommendations for the client.

Ross referred to the evolution of disability cover in the Australian market from the 1950s until today, during which time the nature of the Australian population and its workforce has also undergone significant change.

Not least of these changes relates to the evolving nature of the Australian workforce, which has transitioned from a predominantly blue collar working population in the 1950s and 1960s to one which is now predominantly white collar, with only six percent of Australians now employed in the manufacturing sector.

These demographic changes have a direct impact on the type of disability cover which will deliver a best fit for the Australian consumer in 2024, as will other factors that include the causes of disability within the Australian community. For example, Ross told his audience that in 2022, 22% of Australians reported having a chronic mental health condition, compared with only 9.5% as recently as 2001.

Ross also noted the proportion of disabilities caused as a result of work-related injuries continues to decline.

…the role of strategic risk advice is to meet an informed compromise of comfort and cost

Under these changing conditions Ross advocates the importance of trade-offs when it comes to considering which elements of the client’s life should require coverage in the event of disability, noting that the role of strategic risk advice is to meet an informed compromise of comfort and cost.

Once that compromise with the client has been articulated and agreed, Ross outlined the need to eliminate any overlap between IP and TPD coverage when considering the optimal pathway for addressing considerations including:

- Replacement income (long-term)

- True compensation for loss

- Targeted value for expenses

- Debt repayment

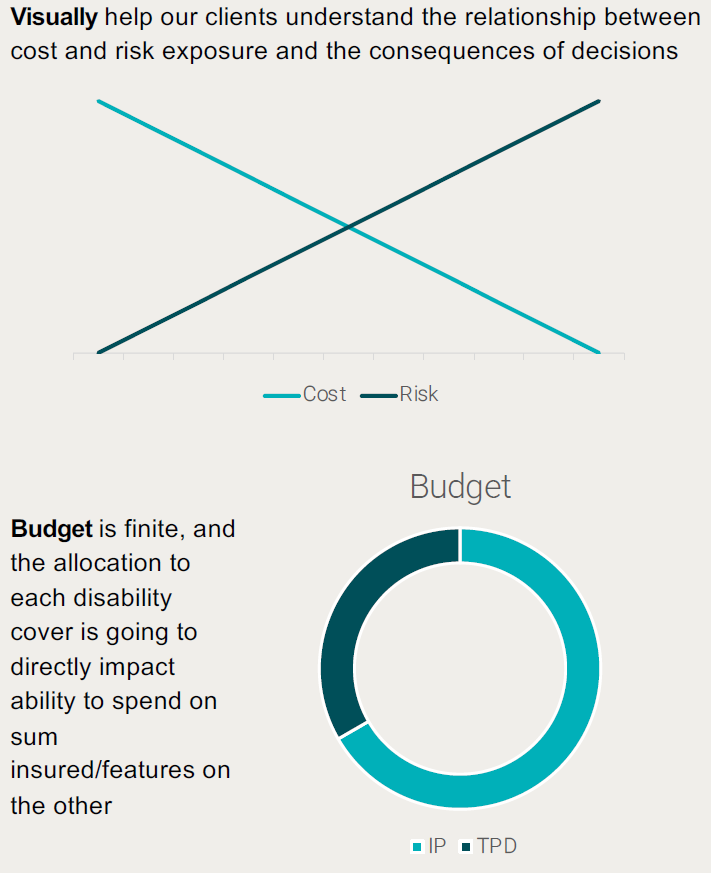

During a time of significant pressure on household budgets, Ross also spoke of the ever-present need to balance cost and risk exposure.

This balancing act of a client’s relative capacity to self insure and their ability to fund protection is demonstrated by this simple but effective graphic used by Ross to drive home his point:

Ross drilled down into case studies and other scenarios, outlining options available to advisers and their clients regarding the interplay between an IP income stream and/or a lump sum TPD solution.

Along this pathway, however, he also challenged advisers to consider what may be the opportunity cost of cover that doesn’t necessarily align with clients’ values and objectives.

His higher-level summary in seeking to create scenarios under which to solve the disability dilemma included these observations:

- Clients have a limited ability to pay rising premiums, so we must adjust our mindset

- Tailor cover thresholds to client comfort, budget and objectives

- Use a collaborative process where the client understands and gives informed consent