There was strong interest this week in our story outlining that a client risk matrix process is being advocated as a way for advisers to develop a consistent and workable approach towards delivering fit-for-purpose life insurance advice recommendations…

A client risk matrix process is being advocated to advisers as a way to develop a consistent and workable approach towards delivering and implementing fit-for-purpose life insurance advice recommendations.

Designed to be utilised by both risk specialists and financial planners, the principle behind a client risk tolerance matrix rests in utilising a process that can address all the differing approaches taken by clients towards the extent of the insurance risk they wish to cover and the extent to which they prefer to self-insure.

The details of this approach were shared with advisers across the country last month by TAL’s Scott Hoger and David Glen, as part of the Riskinfocus 24 Risk Advice CPD Tour.

In a regulatory environment which Hoger and Glen maintain has become complicated for both the adviser and the consumer, the two presenters acknowledged that at the commencement of the life insurance advice process, most clients will be seeking a perfect solution at the lowest price possible.

When cost-of-living reality kicks in, however, the client may often settle on a compromise solution – one which sees them self-insure for some elements of their risk exposure and elect to adopt cover for other elements.

Advisers were taken through a number of case studies which demonstrated a client’s risk exposure and the manner in which a client risk tolerance matrix, taking into account the client’s own risk tolerance level, delivers this compromise outcome of insuring some of their risk exposure, but not all.

…the client risk tolerance matrix …has the advantage …of being totally transparent, consistent, repeatable and fit-for-purpose

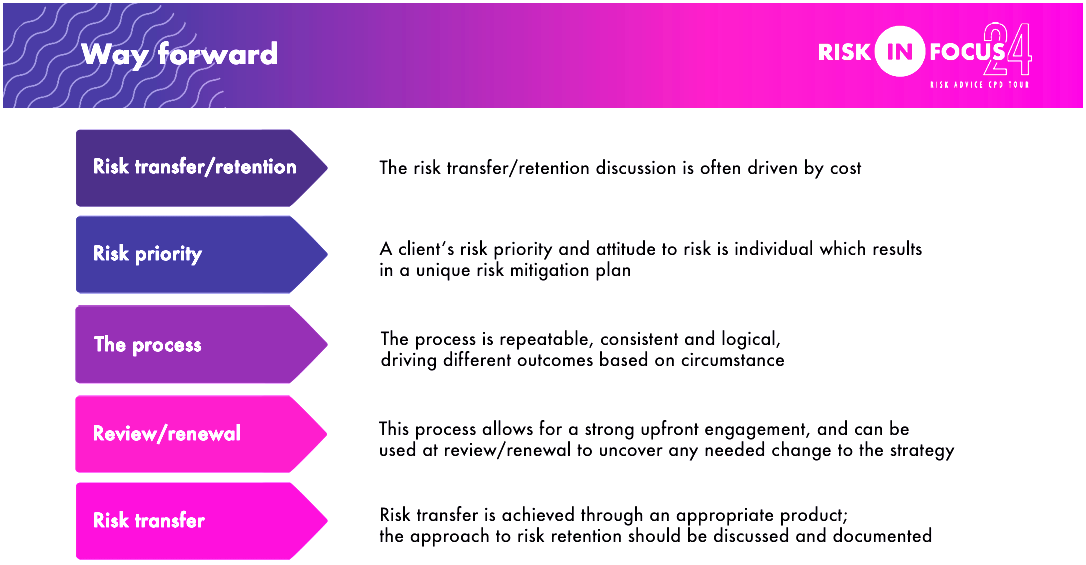

While much of this process may present as a logical sequence for many experienced advisers, the nature of the client risk tolerance matrix and the context in which it is presented to the client has the advantage, according to Hoger and Glen, of being totally transparent, consistent, repeatable and fit-for-purpose for almost any client scenario.

They also believe this transparent risk quantification methodology assists advisers build trust while helping their clients evaluate the risks commensurate with their risk tolerance profile.

While each of the elements attaching to a client risk tolerance matrix were explored during the TAL presentations, advisers were offered this summary of the process, which both Hoger and Glen advocate as a robust process for any adviser seeking to deliver life insurance advice regardless of the regulatory environment under which financial advisers are required to operate: