A guide to retirement planning, Retirement Income for Life – Solving the Longevity Equation has been released, offering Australian financial planners insights into managing longevity risk for their clients.

Authored by a team of actuaries, superannuation, and retirement experts with financial planning qualifications and published by Optimum Pensions, this new guide “…introduces innovative retirement income streams and strategies, blending the best of both new and traditional products.”

A statement from Optimum Pensions says that in today’s dynamic landscape of retirement planning in Australia “…the focus on longevity risk has never been more critical.”

It notes that with the emergence of new products from superannuation funds and insurers, “…financial planners must be proactive to meet the evolving needs of healthy retirees. Retirement Income for Life supports financial planners in navigating these changes, empowering them to assist their clients in achieving long-term financial security.”

…combining new retirement products with existing ones can potentially increase retirement income by 15% – 30%…

The company says the key highlights include:

- Enhanced retirement income potential: The guide reveals that combining new retirement products with existing ones can potentially increase retirement income by 15% – 30%, offering opportunities for financial planners to engage with clients for an extended period.

- Optimising age pension benefits: Certain retirement products receive preferential treatment when it comes to the Age Pension, providing a strategic advantage for retirees. The guide details how only 60% of the money used to purchase these products is assessed under the assets test, dropping to 30% after age 84.

- Balancing act in retirement planning: The guide addresses the challenge of balancing client retirement lifestyle expectations with the diverse retirement income options available in the market. It provides actionable steps to implement key principles, ensuring a comprehensive and personalised retirement plan.

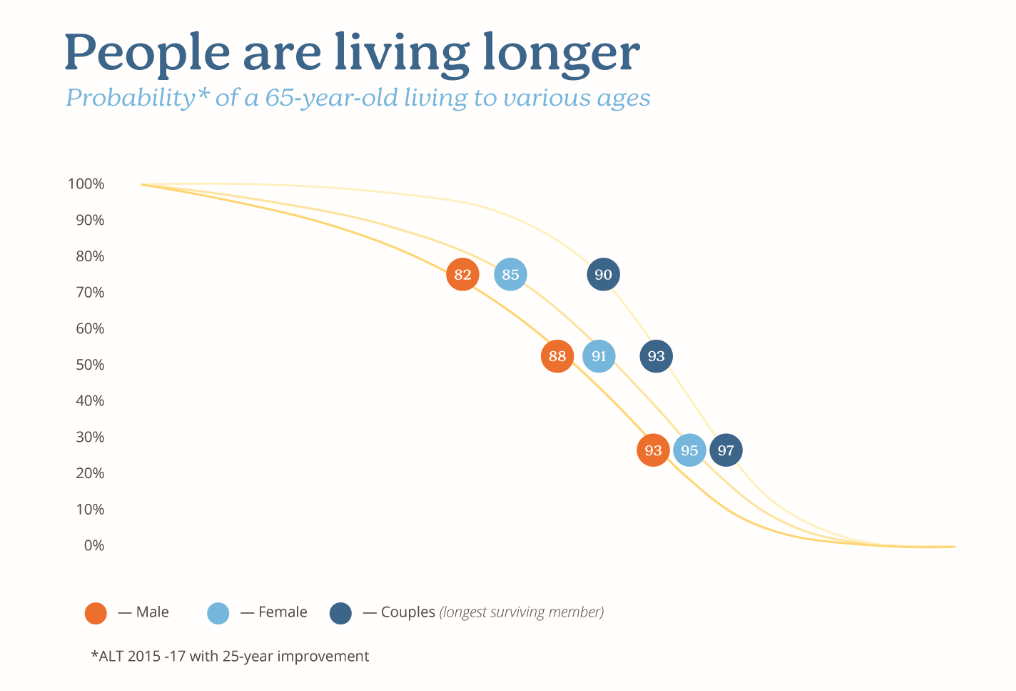

- Life expectancy considerations: Two dedicated chapters guide financial planners in understanding and addressing the life expectancy of each client. Emphasising the risks of relying on average life expectancy, the guide equips planners with tools and statistics to make informed decisions.

- Innovative products for flexibility: The discussion includes new products such as investment-linked annuities, offering longevity protection with investment choice. This allows retirees to make investment decisions tailored to their needs, providing flexibility in changing economic environments.

- Real-world case studies: The guide brings concepts to life with real-world case studies, showcasing successful strategies that financial planners can readily apply in their practice.

Click here for more information