- Agree (92%)

- Disagree (5%)

- Not sure (2%)

The vexed question of life insurance commission caps naturally resonated very strongly with our adviser audience this week…

Latest complaints data released by AFCA lends weight to the argument that consumer issues relating to the quality of life insurance advice are almost non-existent.

This in turn supports the contention held by what is anecdotally a significant proportion of the financial advice community that the Life Insurance Framework commission caps are unfair and unjustified and should be reconsidered as a matter of priority.

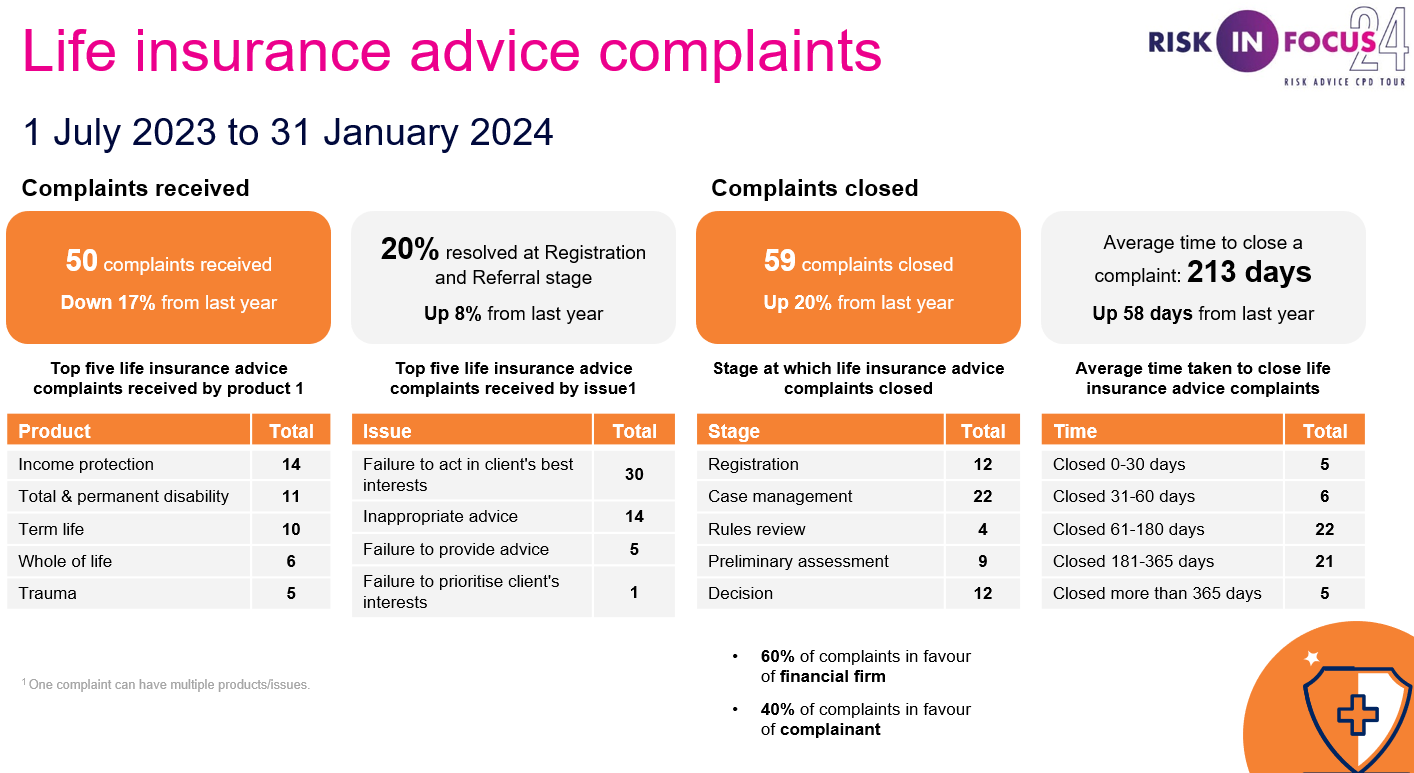

The following slide prepared by AFCA as part of its presentation at Riskinfocus 24 reports a grand total of 50 life insurance advice complaints recorded by the authority for the seven-month period between 1 July 2023 and 31 January 2024:

Although this data only relates to a seven-month period, readers may want to compare these numbers against the 105,454 complaints received by AFCA in the 12-months spanning the 2023/24 financial year (see: Financial Complaints Soar Beyond 100,000).

Clearly, the quality of life insurance advice as an issue for consumers, relative to the huge number of complaints received by AFCA, is infinitesimally small. And readers should also note that of the 50 life insurance advice complaints received during the seven-month period documented above, more than half (60%) were resolved by AFCA in favour of the financial firm.

Note to ASIC and The Treasury: The quality of life insurance advice in Australia is not an issue!

Consumer groups and others who support the retention of the 60/20 commission caps mandated under the LIF reforms can potentially argue that the reason the quality of life insurance advice is not an issue today is, in fact, due to the LIF commission caps being enforced in the first place.

More data needs to be reviewed in order to consider this question in greater depth. However, if a record of life insurance product-related complaints received by AFCA can act as a rough guideline (as opposed to life insurance advice complaints), AFCA annual reports dating back to 2018 – the year in which the authority was established – have only ever documented a very minor proportion of all complaints submitted as relating to life insurance (ie around 1% – 2%).

The mass exodus of risk-focussed financial advisers …has been well-documented

The mass exodus of risk-focussed financial advisers coinciding with the implementation of the LIF reforms and minimum education standards has been well-documented, as has the collapse in life insurance new business volumes.

Many groups have suffered as a result of the implementation of the 60/20 commission caps including advisers, advice businesses and life companies, as have many thousands of Australians through their inability to access much needed life insurance advice, especially low-to-middle income earners.

What will serve the greater good? What is the likelihood that if commission caps were revised to, say, 80/20, this would somehow trigger an explosion of poor quality life insurance advice in Australia?

This is a question for Riskinfo readers to ponder, together with the multitude of other ‘what if’ scenarios that would inevitably accompany a review of the LIF commission caps and the two-year responsibility period.

Surely it’s time to start asking the question.

The often ignored reality, is that with all the hype and world ending headlines around churning, based on the constant attacks of Advisers who were painted as all evil and at no point was the truth going to get in the way of a good story, though as is usually the case, after the damage was done and commissions were slashed, two year responsibility periods introduced, completely illogical Education mandates enacted, BID thrown in for good measure to make all those churners suffer, did the truth finally come out from none other than ASIC, who finally came clean and said churning was NOT an issue and those Advisers who did participate, were a tiny minority.

Even after coming clean on this disgraceful act of the equivalent of the Spanish Inquisition, whereby the Life Insurers and the Government had plenty of time to rectify the wrongs committed and bring back some sanity and clear analysis and thinking into the equation and water down what we all told the world would happen if the Inquisition continued, as usual, common sense was thrown out with the bath water and the VESTED INTEREST BRIGADES pushed ahead with their grand plans and caused absolute mayhem with ZERO benefit to anyone but themselves.

Increasing commissions to reasonable levels is just one step.

The most important lesson to be learned from this whole fiasco, is to NEVER assume that the Government and the vested interest lobbyists are EVER going to do the right thing. They must be attacked on every point and not be given the opportunity to gain leverage.

The final point is to make all these players accountable for their actions and demand truth as a mandatory component of their arguments, or they face the consequences, similar to what they have enforced on us.

The situation is very bleak, and upping the upfront rate to 80% doesn't actually fix things. The compromise is too large.

As JW says in his comments, the regulatory changes that have been made benefit the corporate lobbyists only and are not in the best interests of the public. You cannot trust anyone in the government to do the right thing.

We sit around hoping that someone will save us but no one is coming. Slightly more upfront commission as a compromise doesn't undo the damage or fix a thing.

I occasionally talk to the folks who run businesses that collect statistical information from the life insurers.

In response to my pointed questions, they's constantly reply that there is "no appetite" amongst our life insurance CEOs to go back to the government and tell them that LIF is not working and is not good for the industry. A 50% reduction in genuine new business would confirm that opinion any day.

If I was being Christian in my approach I would say I understand the CEOs position, but not today. All but one of our insurers are now shareholder-value driven. Which is interesting given that the concept of "community pooling for individual loss" is one of the last surviving bits of evidence of the socialism of the early 19th century

And the CEOs and upper management who run those life insurers have KPIs and bonuses attached to premium revenue, from any source.

For nearly 3 years, if not 5 years, now there has been clear evidence amongst most life insurers, particularly those with large books of business, or even more so those who have purchased large books of business, to regard the premiums paid by legacy policyholders as a CASH COW to replace the 50% of new business lost by a combination of LIF and the 2021 AFCA induced "nuclear option" on IP contracts

I have a 56-year-old successful businessman who is a motor mechanic, non-smoker, running an Agreed value IP contract with a 90 day waiting period and an age 65 benefit period, with BX and the TPD option.

His premium has increased by 142% over a 24 month period, but there is still no sign of a promised ASIC investigation into this outrageous behaviour.

In anyone's language that's "GOUGING". Those increased premiums go direct to a CEO bonus thats attached to revenue, particularly when that revenue has had a whack downwards in recent times because of the above-mentioned "consumer driven" measures.

Our CEOs still think they can sit this one out for a few more years, and then maybe think about it, again. Those same CEOs totally lack any evidence of courage to go to a LIF friendly government ( and ASIC) and clearly state that LIF has been a disaster.

No guts, no glory! The band keeps playing while the ship goes down.

And as we speak, those CEOs believe that Mr Jones has offered them some sort of lifeline because they can blatantly attach themselves to the demand from the industry funds to have all those "qualified advisers" wrecking financial lives. The insurers think that's a good idea, at least for the moment.

I am not holding my breath on LIF !

And my prediction is that within 5 years we will only have three life insurers, all nicely cartelled-up to stymie competition, and all employing salaried advisers, "qualified" of course. And to keep Mr Jones happy, these three insurers will be providing cheap and chearful default cover to Mr Jones's mates in the industry funds at a nice cheap price.

Heaven on a stick!

Gawd Old Risky, never a dull moment in your comments! Spectacular reading as usual. I learn something new each time and it is always seems to be one of those unknown unknowns, LOL! Cheers.

The article asks the question: "What is the likelihood that if commission caps were revised to, say, 80/20, this would somehow trigger an explosion of poor quality life insurance advice in Australia?"

Well, no, it wouldn't trigger bad advice. The main reason would be that it would not attract ANY more new or old/previous advisers into the industry. 80/20 is only breaking even now. It used to be a good remuneration when we had time to see many more clients but now only a quarter of clients are seen compared to the old days. Thank compliance and government over-reach for that.

The remuneration needed now is 100/20 and a ONE YEAR responsibility period to have any chance whatsoever of attracting ANY advisers – new or experienced to return. There is next to no chance of this level being offered after LIF hence why I maintain 95%+ of riskies will be gone by 2026/7. Simply no valid sustainable reason to be in the industry – all things considered – under the current conditions. Lord help the clients as there'll be no REAL advisers to do it.

Comments are closed.