Smaller practices continue to grapple with compliance burdens according to the findings of Investment Trends’ 2025 Adviser Business Model Report.

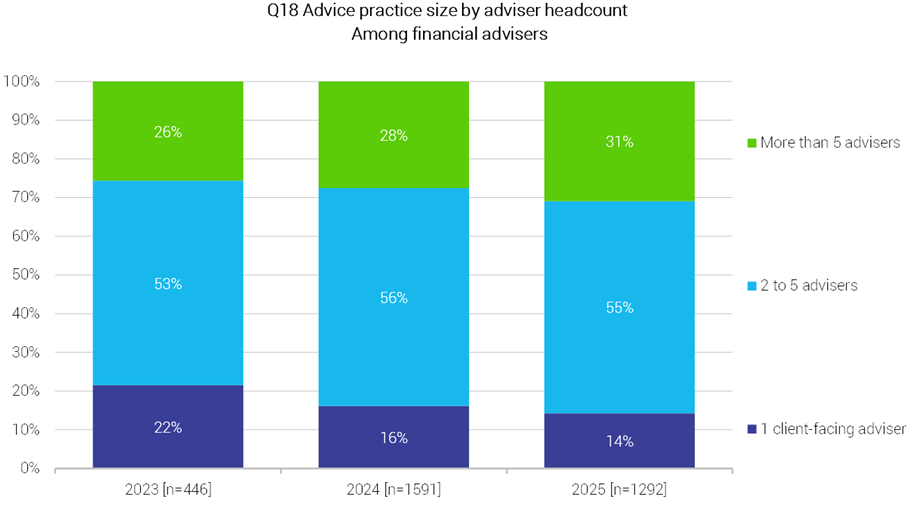

The report notes that 31% of practices now have more than five advisers, and that these larger firms hold on average $15m more in funds under advice per adviser compared to smaller practices.

However, Cameron Spittle, Director at Investment Trends, says that despite their larger footprint, efficiency remains a challenge.

“Smaller practices continue to grapple with compliance burdens and regulatory uncertainty,” he says. “While larger practices are more focused on resourcing and technology integration to scale effectively.”

The report also reveals that the shift toward larger advice practices is accelerating with firms increasing their headcount and hiring in-house specialists such as accountants and lawyers to broaden their services.

The report shows that profitability continues to improve, with more than half of financial advisers (52%) reporting a rise in practice earnings, while just 11% recorded a decline, the lowest level in a decade.

Among the most profitable practices, success is underpinned by:

- Higher ongoing fees

- Leaner cost structures

- Greater use of managed accounts to deliver scale and consistency

“Efficient advice delivery models and disciplined pricing are increasingly separating high performers from the pack,” said Spittle. “We are seeing a strong focus on operational efficiency that is driving down both operating and advice production costs.”

Ongoing advice fees are significantly higher among the top 20% of practices…

The report also highlights key trends in both advice fees and cost to serve.

“Ongoing advice fees are significantly higher among the top 20% of practices, far outpacing the average with ‘highly profitable’ advisers charging nearly double the ongoing fees of their peers.

“When combined with lean, tightly managed cost-to-serve models, these higher fees are translating into substantially stronger margins.”

The results also show that satisfaction with licensees has rebounded, with Net Promoter Scores rising from +1% in 2024 to +11% in 2025.

At the same time, advisers continue to rely heavily on licensee support.

Self-licensed firms most often outsource compliance and audit functions, while licensed advisers lean more on their licensee for paraplanning. Across both groups, demand for high-quality support remains strong, spanning technical assistance, advice enablement, and compliance.

The NPS rebound is encouraging, but it’s not the full story,” said Spittle. “Advisers are still calling for genuine support, and current outsourcing patterns reflect this. Licensees that adapt to these shifting needs will be best positioned to strengthen advocacy and retention.”