Specialist provider, TPD Claim Support, reports it is achieving claims decisions between four and six times faster than current industry standards through implementing a process it has been refining since launching its service offer in 2023.

The firm’s co-founder, Trevor Battersby, says this outcome has been achieved in no small part through addressing one of the critical factors impacting claim times, namely incomplete and/or insufficient information included in the initial submission to the insurer.

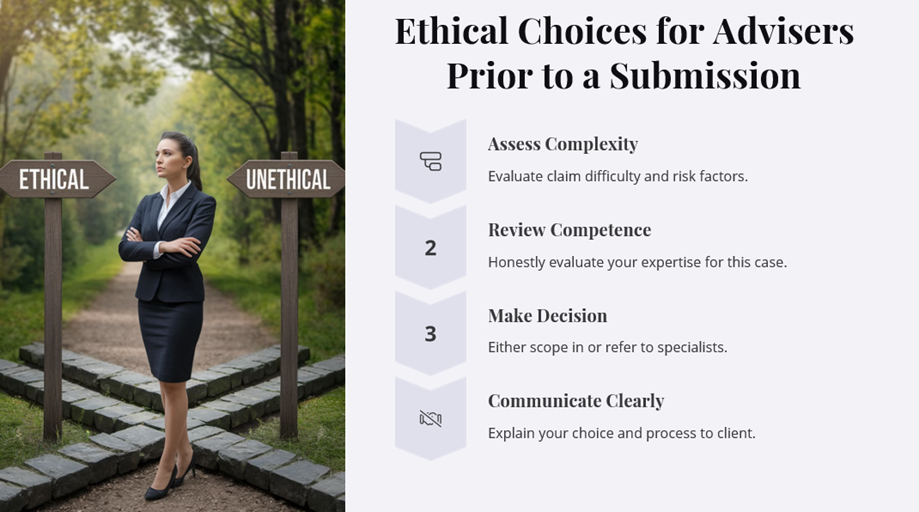

Battersby told Riskinfo he and his team have developed an 11-step process designed to optimise the efficiency of the claim process as well as its outcome for the claimant. Critically, he says his firm never submits the claim pack to the insurer until eight of the firm’s 11-step processes have been completed.

The methodology employed by the firm sees it commit an average of 20 – 25 hours on preparing the claim before it is submitted to the insurer.

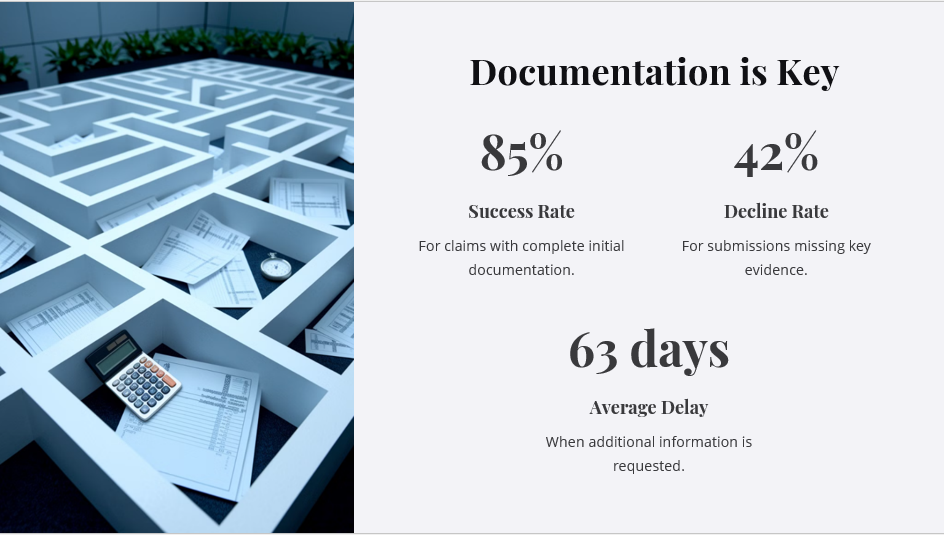

…any error or omission in the initial claim submission – on average – translates into a delay of up to 63 days for every error or omission

While this initial investment of time may appear to be excessive, Battersby references what he terms the Rule of 63, namely that any error or omission in the initial claim submission – on average – translates into a delay of up to 63 days for every error or omission.

What Battersby and his team have found – and what he is advocating – is that upfront due diligence ahead of submitting the client’s claim results in significantly quicker turnaround times and a higher claim acceptance rate.

The early steps in the process include initial meetings, discussions and fact-finding, including a 55-point check-list of items, followed by third-party authorisations and obtaining medical reports.

While mostly intuitive, the TPD Claim Support process comprises other steps ahead of submitting the initial claim to the insurer, one of which includes assessing the validity of the claim itself.

Battersby says the Rule of 63 “…is why we work really, really hard at the start and why we have very defined claims structures, systems and processes.” He adds that while the first eight steps in the process can often take at least two to four weeks to complete, it can potentially save 52 weeks in delays:

“We know the clock is ticking, that the client has no income and is still paying the premiums. So, we future forecast what is required and ensure we have complete evidence before we even submit,” says Battersby.

See also: Claims Disputes Dominated by Evidence, Delay Issues