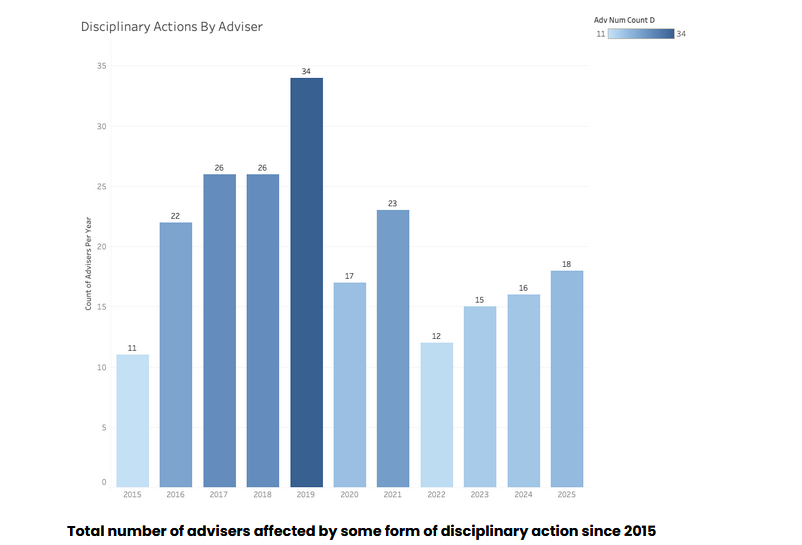

Since 2015, a total of 217 advisers have been affected by an ASIC disciplinary action, according to Wealth Data, which asks if financial adviser banning and disqualifications are on the rise.

Writing in his latest Financial Adviser Market Insights, Colin Williams says it feels at times as though barely a day goes by without seeing news that another financial adviser is banned/disqualified.

He asks whether the current stream of ASIC disciplinary actions are on the rise or whether it’s just a typical year across the financial adviser market.

In analysing disciplinary actions issued by ASIC since 2015, and comparing the years, Williams says:

- 2025 is showing a total of 18 disciplinary actions and it’s only just past the halfway point of the year. Eighteen is the highest number since 2021 which had a total of 23

- 2019 had the greatest number of disciplinary actions at 34, and the previous two years – 2017 and 2018 – were also high, both at 26

- Given 2025 is currently at 18 and continuing uncertain events in the wealth/adviser market, 2025 could well be on track to end up above the 2019 figure

Williams says it’s worth noting that in 2019, the total number of advisers on the ASIC Financial Adviser Register was significantly greater than today. “2019 started with 27,925 advisers and ended with 23,495. Currently, there are only 15,335 advisers on the FAR.”

As to how many advisers survive an ASIC disciplinary action, Williams says most of the affected advisers are no longer listed on the FAR. Of the 217 advisers that have been affected by a disciplinary action since 2015, only 15 are still ‘current’.

“Two advisers with disciplinary actions in 2025, remain ‘current’ despite recent bans. This is probably a timing delay, and they will likely soon be removed from the FAR,” he says.